First assessment for WAM by UN PRI: high scores

This year was the first time WAM prepares a report for the UN Principles for Responsible Investment (UN PRI, https://www.unpri.org/) and got excellent scores (results are available at the Data portal where one must login: https://dataportal.unpri.org/login?ReturnUrl=/login).

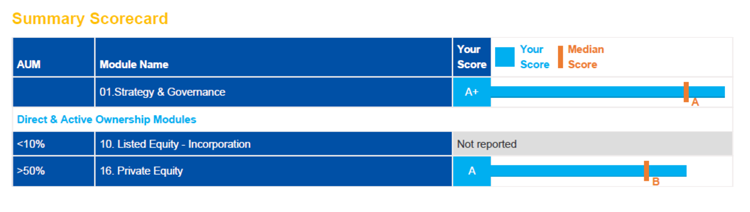

WAM got the highest possible score for the sustainability of its strategy and governance. For private equity we got an A-rating.

Marina Shestakova, Head of ESG at WAM: “We pay high attention to ESG issues in our investment process. We invest in firms with a positive and clearly measurable impact on the environment and support them to develop sustainably. We are happy that we got a positive assessment from UN PRI and are especially proud to have received the highest score for our Strategy and Governance”.

Summary scorecard: WAM

Source: PRI Assessment report 2018

UN PRI assessment framework

In line with Principle 6, PRI signatories such as WAM must “report on their activities and progress towards implementing the Principles”. This reporting should be done per asset class. Signatories are scored for each UN PRI principle, and the scores are measured against those of other investment managers that have signed the UN PRI.

The UN PRI principles

Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

Principle 6: We will each report on our activities and progress towards implementing the Principles.

About the PRI

What is the PRI? It is the world’s leading international network of responsible investors, and a partner of the UN finance initiative UNEP and the UN Global Compact. It sets the standards which investors should adhere to. Investment policies of members are regularly scrutinized with regard to their impact on environmental, social and governance (ESG) factors. Membership is voluntary and is in the order of 2,000. Signatories to the principles manage assets of about $80tr.