Market Commentary:  Energy price explosion will accelerate Germany’s structural changes

The energy transition, called Energiewende in German, had lately lost some momentum. Since the formation of a new federal government in Berlin late last year – which includes the Social Democrats under Olaf Scholz, the Greens and the Liberals – and especially after the Russian invasion of Ukraine, things have changed dramatically. Prices of fossil fuels are up steeply, gas and oil imports from Russia will be reduced to zero by the end of 2022, to be replaced by alternative energy sources from the EU, rearmament has become a, if not the main political priority, concerns about budget deficits and public sector debt are no longer a restraint on government spending, and the green revolution will get another major boost. All this is good news for the environment.

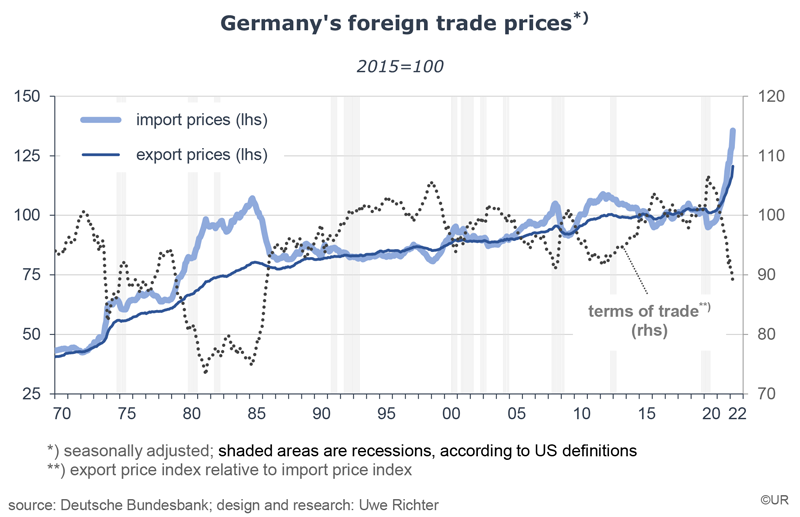

For the German economy, the huge increase of import prices is the main indicator of things to come. Between March 2021 and March 2022, imports have become 31% more expensive, and have increased by 43% from their earlier low in April 2020. For about 40 years, the prices of imported goods had been more or less stable – and now this!

Since global inflation, with few exceptions (Japan, China, Switzerland), has picked up strongly over the past two years, Germany’s export prices have also increased considerably, but by far less than import prices. They rose by 16% and 19%, respectively. From a welfare point of view, a country should try to raise export prices (revenues) by more than the increase in import prices (costs), as long as this does not cause labor market problems. This improves margins, profits and the real income of the population. The opposite has lately been happening in Germany. The relationship between export and import price indices is called “terms of trade”. If these decline, a country must provide more exports for the purchase of a given volume of imports – the relative price of imports goes up, living standards take a hit.

In the year to March 2022, the terms of trade have declined by 11.5% which is the equivalent of a reduction of Germany’s annual real income by about €30 billion, or 0.82% of real GDP – and by €360 per person. The relative prices of German products have declined by almost as much as during the 1973 and 1980 oil crises, the only two comparable precedents.

On the other hand, the labor market has taken these changes in its stride. No sign of a serious crisis there! A war, or a pandemic, or the risk of a deep recession typically lead to expansionary fiscal policies and an increase of the demand for labor. The state fills part, or all of the gap in private sector demand. In March, employment was up by no less than 1.6% y/y, significantly faster than trend. The total number of jobs reached a new all-time high (45.5 million). Incomes are rising more slowly, but there are plenty of jobs. According to the ILO, the unemployment rate has fallen to 3.1% (US: 3.6%).

Another, rather underappreciated effect of the recent fuel price explosion is on the environment. On the one hand, those high prices reduce the demand for oil and gas, similar to the effects of a large increase in CO2 taxes which is the favorite tool of climate analysts and activists. Buyers of energy switch to renewables whose relative prices have come down. Greenhouse gas emissions go down. On the other hand, investments into renewables become more attractive: as a result of economies of scale and ongoing technical progress the cost of producing electricity continues to fall while market prices for electricity (from any sources) have almost doubled over the past year.

The main problem of renewables is that they are intermittent – the supply of electricity from that source is not yet 100% steady and reliable. Large storage facilities (and, initially, conventional back-up power plants) are needed to address this issue. One obvious solution is to establish a network of bi-directional charging stations on the basis of Germany’s 40 million passenger cars and the fact that they are parked most of the time. This would create large-scale storage and thus the missing link of the Energiewende. A significant reduction of CO2 emissions and independence from Russian fossil fuel imports could be achieved much faster than expected.

All this has positive effects on the climate and the German and EU economies, but it would hurt Russia, wouldn’t it? Not necessarily. Russia clearly suffers from what is called a “commodity curse”. Countries whose income is mainly generated by the production and sale of commodities have several features in common: corruption, capital flight, autocratic constitutions, repression of free media, outsized business cycles and unfair distributions of income and wealth. Quite a list. Political instability and high risk premia that result from this inevitably hurt investment and long-term growth. If Russia is forced, in response to the expectation of declining fossil fuel prices, sanctions and capital controls, to broaden its economic base, ie, diversify into non-commodity related sectors, it could become, over time, a more “normal” European country. Wishful thinking?

Read the full article in PDF format here: English. / Deutsch.