Dieter Wermuth, Economist and Partner at Wermuth Asset Management

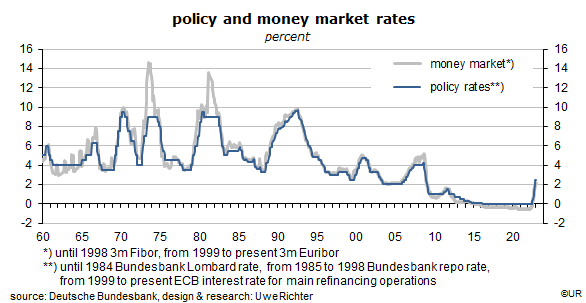

One thing I am certain of: European money market rates will not fall again by more than 1,450 basis points as from 1981 to the end of 2021. Similarly for ECB policy rates: over the coming decades they will not fall as much as between mid-1992 and spring 2016 – from 9 ½% to zero. For almost six and a half years, to the end of July 2022, they had then be kept at the zero bound.

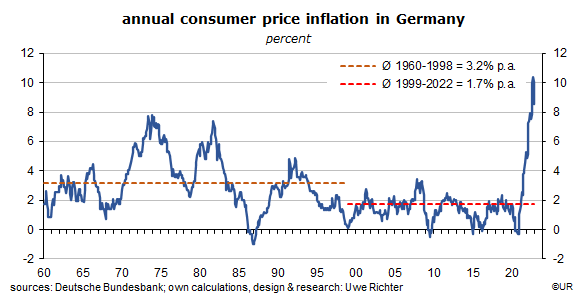

During those long decades German inflation rates had come from almost 8% to less than 0%, with large ups and downs around the downward trend. This had been the main reason for the secular decline of short-term interest rates. The disinflationary period lasted until the end of 2020, then, over the course of just a few quarters, consumer price inflation rates rose from -0.5% to more than 10%; they fell to 8 ½% y/y in December. Inflation of this magnitude had last been seen in 1951, shortly after the Second World War.

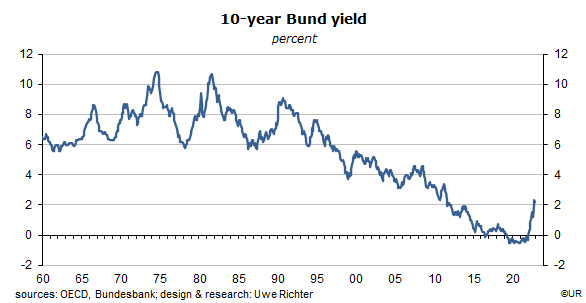

Since inflation was on a long-term downtrend, with deflation a serious risk at the end of the process, both the Bundesbank and its successor, the ECB felt the need to reduce policy rates – which in turn gave a strong support to bond markets. Between 1981 and the end of 2021 prices of 10y Bunds increased by 110%, an annual average of 1.9%. At least at the beginning, investors had also benefited from high current yields. The managers of bond portfolios became rich thanks to an excellent performance in real, and especially in nominal terms that lasted four decades. They couldn’t do wrong, it seemed.

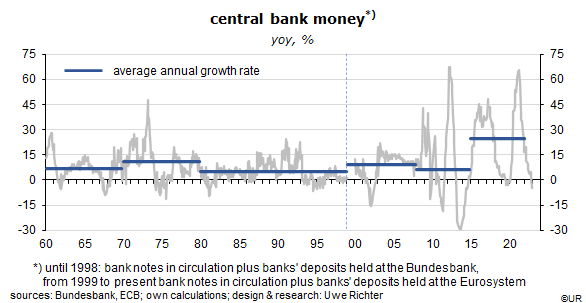

The other reason for the lasting and unprecedented performance of bond markets had been the banks’ more than generous supply with central bank money, the sum of cash and bank deposits at the central bank. It became increasingly easy – and cheap – to raise funds for capital market investments. It is hardly an exaggeration to say that those who dared to borrow from banks or capital markets had money thrown after them. The Eurosystem became a money printing machine which moved an ever growing share of government debt onto the books of national central banks.

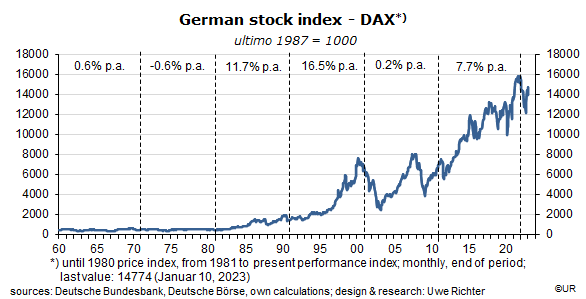

Falling bond yields meant ever more attractive earnings yields of equities – risk premia rose, and stock prices followed. There was in the wake of the 2007/2009 Great Financial Crisis a large setback, but stocks became quickly the investment vehicle of choice again. Markets were dominated by the fear of missing out (FOMO) and reached valuations which appear, in retrospect, as wholly irrational. From 1980 to the end of 2021 the average annual performance of the DAX (a performance index) was no less than 8.9%. For comparison: Germany’s average annual consumer price inflation rate had been just 1.9% in this period.

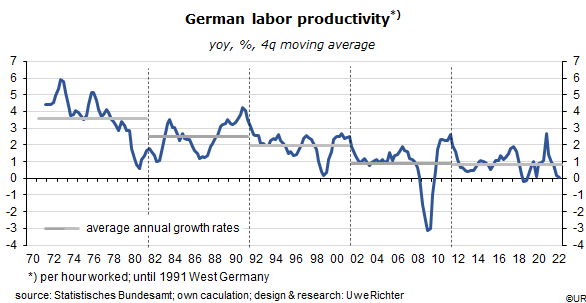

The great correction began around the end of 2021. At the time, inflation adjusted yields of 10-year government bonds were -5.6% on the basis of year-on-year inflation rates prevailing at the time, or about -3% on the basis of (low) medium-term inflation expectations. “Normal” nominal yields would be around plus 3%, though: 1% for the trend growth rate of (labor) productivity plus 2% for the ECB inflation target.

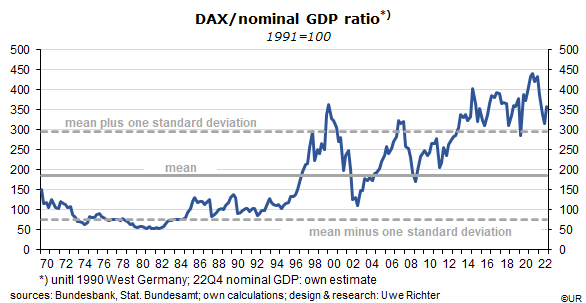

Not only bonds, but equities as well were hugely overvalued at the end of 2021. If I take the ratio of the stock market index DAX to Germany’s nominal GDP as a proxy for the price-to-earnings of the stock market as a whole (which does not exist as a time series), I must conclude that it has never been as high, at least since 1929, higher than it had been before the popping of the Dotcom bubble in March 2000.

The question is whether something like normality has been reached after last year’s correction of bond and stock prices. As to bonds, progress has been significant: the yield of 10-year Bunds is now 2.2% and thus not far from the 3% “equilibrium”. But it all depends on whether the ECB will indeed be able to move actual inflation towards 2% in the medium term. According to analysts’ recent forecasts it will take until 2025 for actual (not expected) inflation to reach 2%.

A cautionary note is in order at this point: inflation rates have come down very quickly over the past three or four months, implying that the 2% target could be reached much earlier than generally expected. Over the three months to November 2022, German import prices have fallen at an annualized (seasonally adjusted) rate of 23.3%, industrial producer prices at a rate of 20.9%. Fallen!! Applying this approach to consumer prices yields a December inflation rate of just 0.4%. The weak world economy, the stagnation of domestic value added and the recovery of the euro exchange rate all play a role. Add to this that the all-important hourly wages for the economy as a whole were just +1.9% y/y in Q3 (more recent data are not yet available). Bond yields could therefore go down again. On the other hand, October hourly wages in the construction industry were 4.6% y/y, pointing in the other direction.

Also keep in mind that the central banks of the Eurosystem, the main buyers of government debt, intend to withdraw their support by shrinking their balance sheets again – which would drive up yields.

Equities are still very expensive, especially after the rebound in the second half of last year. This recovery occurred even though the outlook for economic growth and profits has lately been revised down. Higher bond yields are another strong headwind. If I just look at the DAX/GDP ratio I have no problem to predict that the German stock market could fall by about one third from here.

The ECB, for its part, will keep its foot on the brake and seems to plan raising policy rates by another 150 basis points between now and June or July. Since the euro area labor market remains surprisingly robust (given the stagnation of real GDP) it will not suffer much from a more restrictive monetary policy. In addition, the ECB intends to follow actual rather than expected inflation data – and these are still unacceptably high on a year-over-year basis. This is what matters for the foreseeable future.

To conclude I would say that capital markets are, or will soon be, on the way to a situation determined by the real economy. Since labor productivity grows by just under 1% annually, average returns from investments in capital markets will be quite modest from here on.

Two clearly distinct periods lie behind us: the time of rising inflation and interest rates in the seventies, followed from 1981 to the end of 2021 by falling inflation rates and the risk of deflation, accompanied by an expansionary monetary policy and overvalued bond and stock markets. We have now entered, probably for the next couple of decades, an era of more moderate valuations and returns, perhaps also with less volatility. Reality is catching up with financial investors.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.