Dieter Wermuth, Economist and Partner at Wermuth Asset Management

Just as the sharp increase of energy prices last year had caused a reduction of real disposable incomes and a stagnation of overall demand, the recent fall of exchange-traded electricity and gas prices is an indicator that the burden on household incomes will become lighter from now on and thus stimulate economic activity. The process is only a few months old but will last for several quarters: inflation forecasts will be adjusted down, growth forecasts revised up from now on.

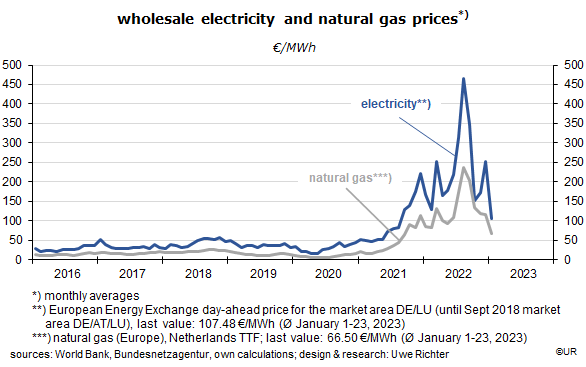

Have a look at the numbers. Since their high point in August 2022, when gas prices exceeded their year-ago level by 428%, they have declined by 72% and are now lower than before the Ukraine war. Electricity prices had increased by 463% year-on-year, followed by a reduction of 77% – but they are still about 120% higher than the average of the five years to 2021. On this metric, gas prices are up 200%. This is, incidentally, good news for the climate.

The effect of falling energy prices on the various stages of the value added chain is dramatic but has so far been neglected by the media – because on a year-on-year basis inflation remains very high. Over the three months through November 2022, German import prices have declined at an annualized rate of no less than 23.3% (+14.6% y/y); for export prices the numbers are minus 10.7% in 3month annualized terms and plus 11.6% y/y. This turnaround had immediate effects on producer prices: their annualized rate to December 2022 fell to minus 28.9% (still +21.6% y/y). Consumer prices have not been affected as much because services play a large role in the index. Even so, they have increased at an annualized 3-month rate of only 0.3% (8.5% y/y) in December.

In other words, if these trends persist, German consumer price inflation will reach less than 2% y/y next fall. The same applies for other euro area countries.

This may indeed happen because global as well as European demand and output are expected to increase by much less than in 2022 which keeps energy prices under pressure. There will be deflation in this segment of the price index. Additionally, in Germany, there are no risks of wage inflation: hourly wages have been running at a rate of just 1.9% y/y.

While market participants share this optimistic forecast and accept a yield of only 2.15% for 10-year Bunds, the ECB will have nothing of it. Klaas Knot, the hawkish governor of the Dutch central bank, has just pointed out that policy rates will be raised by 50 basis points at both the February and March meetings, followed by further increases in the summer. Moreover, from March onwards, quantitative tightening will be used to shrink central bank money. For the ECB, the normalization of monetary conditions creates urgently needed room for maneuver. No one should be able to claim that ultra-low real policy rates contribute decisively to asset price bubbles, or that the ECB is monetizing the latest wave of government borrowing.

Since European policy makers will in all likelihood continue their restrictive strategy while the Fed will soon begin to ease – as US inflation rates have been falling rapidly – it can be expected that the euro will appreciate further and in this way contribute to the decline of inflation rates. Between October 2022 and today, the euro has moved from 0.98 to almost 1.10 dollars.

Bottom line: as a result of the favorable inflation environment real incomes will rise more than expected this year. The mood and the actual economic situation of investors and consumers will improve noticeably – if only the war in Ukraine would come to a good end.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.