Dieter Wermuth, Economist and Partner at Wermuth Asset Management

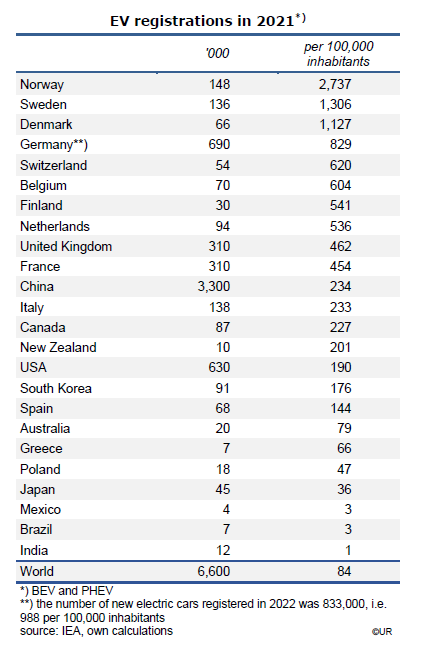

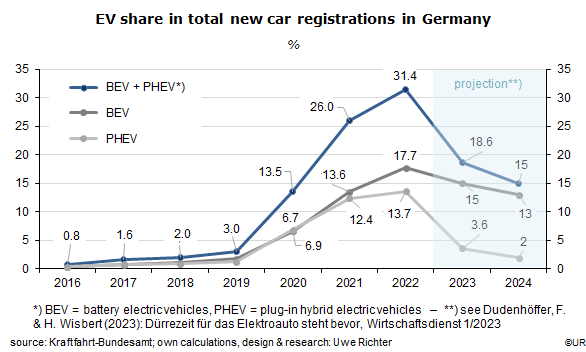

In the January edition of Wirtschaftsdienst, an economic policy magazine, Ferdinand Dudenhöffer and his colleague Helena Wisbert of the Duisburg CAR (Center Automotive Research) institute predict a sharp reduction of EV registrations this year and next. For the time being, the boom has ended. But I am convinced that it is just a dent in a steeply rising trend and that the rapid expansion of the market will continue from about mid-2024. For environmental reasons, the German government, as well as many others, are determined to gradually stop the sale of cars with internal combustion engines (ICE-cars). From 2035 onwards, such cars can no longer be sold in the European Union. Clients will then have no choice – they have to switch to EVs. The Scandinavian countries are showing us where we are heading.

The CAR authors list three main reasons for the coming slowdown of the EV market: 1. starting this January, subsidies for electric cars will be reduced significantly, or even be eliminated altogether, which raises their prices by 11 to 33 percent between 2022 and 2024, depending on the model. Small, and thus the most affordable cars will suffer most. Their existing disadvantage will increase. For hybrids, the end of subsidies will be their death bell. 2. household electricity prices are now about 60 euro cents per kilowatt-hour, and 70 cents at public charging stations and are thus twice as high as before the energy crisis. Driving an EV is no longer unbeatably cheap. 3. the production costs of batteries, the main cost component, will rise significantly because raw materials such as lithium-hydroxide, cobalt, nickel, manganese and phosphor have become very expensive.

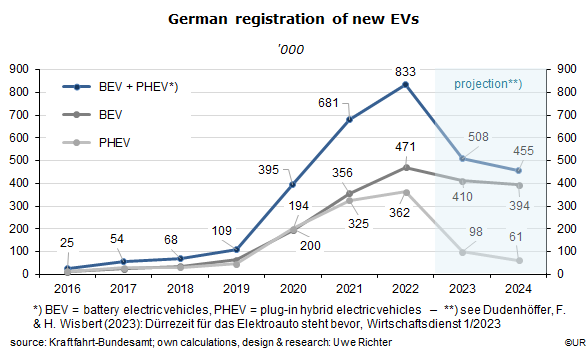

Whereas 833,000 new EVs had been registered in 2022, an increase by a factor of 7 ½ since 2019, the number will fall to 455,000 in 2024, or be no less than 45 percent, according to the forecast of Dudenhöffer and Wisbert. Of these, only 61,000 will be hybrids.

The most important actor by far on the EV market is China. Since the country has acknowledged that it cannot realistically compete against the producers of cars with internal combustion engines – and because the environment is in a terrible state – the government has moved full speed into the production of electric vehicles. Globally, more than half of all new EVs are now registered in China. If European, American, Japanese and South Korean car makers want to survive they have to study the plans of the Chinese planners. They have obviously realized that the future belongs to cars powered by electric batteries. In the meantime, capital spending in this segment is huge.

The reduction of German subsidies is certainly a major reason why EV sales will do poorly this year and next. But markets in other countries, including those without subsidies, are also facing headwinds these days: international supply chains are not functioning smoothly anymore. EV producers are often simply not able to deliver. Catchwords are the port of Shanghai and the war in Ukraine.

While battery prices have indeed increased somewhat recently, the long-term downtrend is unbroken. According to a study on Bloomberg, In terms of 2020 prices, the cost of a capacity of 1 kWh was $600 in 2014. In 2024, it will have fallen to $94, and to $59 by 2030. These are the wonders of mass production and technological progress. In addition, producers such as Tesla are increasingly switching to batteries on a lithium-iron-phosphate basis which do not require cobalt and nickel. The race is on to reduce the dependence on expensive rare earths – and thus also on China. Overall, the share of battery costs in the total cost of an EV will decline further and will be no longer the decisive factor. Take the Fiat 500: in Germany, it costs about €35,000 to buy one – of this, only €6,000 are accounted for by its 42 kWh battery.

As to the cost of operating an EV, assume the owner of a car with an internal combustion engine drives 14,000 kilometers per year, burns 8 liters of gasoline per 100 kilometers and pays €1.90 per liter. This adds up to €2,128 a year. An EV, on the other hand, will need €1,512 for the same distance, assuming an average electricity price of 60 eurocents which translates into monthly savings of about €51. Some Germans will be able to profit from the recently introduced electricity price brake of 40 cents per kWh – it reduces the annual cost to €1,008 and leads to an increase of the monthly cost advantage to €93.

Moreover, insurance costs and car-related taxes are lower for EVs while prices for used cars are higher than for ICE-cars. It is also highly likely that electricity prices will fall in the long run. The marginal costs of energy from renewable sources is almost zero while the output and share of renewables in total electricity production is increasing steadily.

I do not think that spending money on expanding EV production capacities will turn out to be an expensive misallocation of resources. It is just the other way around: firms which invest too little cannot survive.

*) I want to thank Robert Seiler of Mobility House for his valuable support.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.