Market Commentary: The fight for green market shares

Dieter Wermuth, Economist and Partner at Wermuth Asset Management

In August, the US administration had passed its Inflation Reduction Act (IRA). It includes about $400bn for climate projects. Last week, partly in response, the EU Commission has presented its own €660bn Green Deal Industrial Plan which consists of green subsidies and spending by the public and private sectors; some of the money comes from unused funds of the Covid-19 emergency program. America’s $400bn are about 1.7% of GDP while the EU’s 660bn euros are the equivalent of 4.1% of its nominal GDP. In both cases, spending and tax incentives will be spread over a period of about ten years – the additional annual burden on public and private budgets is thus fairly modest and manageable, especially in view of the huge effort that is necessary to mitigate the deterioration of the environment.

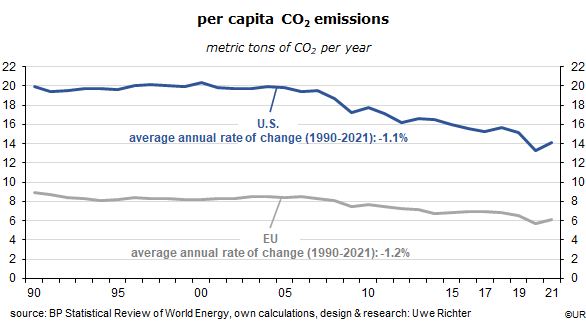

Over the course of the next decade, both plans aim to reduce CO2 emissions by about half compared to 1990, and to strengthen and improve the competitiveness of green industries. The US needs to do a lot more than Europe. While CO2 emissions there are declining at an average annual rate of 1.1% per capita since the early nineties (the EU’s rate is almost identical), in absolute terms the difference is still huge. The average American emits about 14 tons of CO2 a year, or 130 percent more than the average European (6 tons).

The relatively modest IRA will not be enough to close the gap. I also suspect that the US administration will also not reach its 2030 climate targets. I had shown last week that America’s per capita registrations of electric vehicles were just 23% of Germany’s, in spite of Tesla’s success. Another factor is the low price of fossil fuels which is an incentive to burn oil and gas. Even so, policies seem to change for the better, and climate issues have moved up on the political agenda. The main motivation for America’s change of mind seems to be the challenge posed by China in a large and very promising market. Robust industrial policies are supposedly needed to succeed in global EV and other green markets and reduce the dependence on Chinese imports. It is also an attempt to stop the country’s de-industrialization of the past decades.

Regrettably, America’s new climate policies have a protectionist bias. To some extent, the same can be said of the EU’s green project – but it is less explicit and of a smaller order of magnitude. In the US, only those products will get financial support which are manufactured there, not, however, imported green stuff. This provision is mainly directed against China, but also against the EU where politicians, business associations and the media are worried that firms will shift a significant part of their green investments to the US, with negative effects on the number of well-paid jobs and the skills basis. Especially France has rediscovered its protectionist instincts and calls for European countermeasures. There is the risk of an expensive subsidy war.

I think all this is a storm in a teapot. First of all, everybody should be glad that the US wants to do more for the climate, and also that American, not European taxpayers will foot the bill. In terms of CO2 emissions, America is the second largest evildoer (4,700 million tons annually). China is number one (10,500 million tons), but its population is four times larger. This means that, from a global perspective, US actions against climate change are significantly more effective than those of almost all other countries. We also have to accept that America’s green industry is a so-called infant industry which, in the beginning, may be protected by trade or other barriers against mature and powerful foreign competition. This is almost consensus among economists and can look back on a long tradition, not least in continental Europe.

The fact that competition in the green segment is about to intensify is not necessarily negative. It accelerates technical progress, leads to more capital spending in the sector, improves productivity and is good for almost everybody, everywhere. In the past years, the EU has benefited from an undervalued euro but has, perhaps, not fully made use of this opportunity. A stronger headwind, combined with the huge Green Deal Industrial Plan, will be a wake-up call and incentive for Europe’s green economy. The world’s climate will be a winner.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.