Dieter Wermuth, Economist and Partner at Wermuth Asset Management

Hard to believe: as the International Energy Agency (IEA) has just reported, global subsidies of fossil fuels have reached about 1tr dollars last year, a new record. This is the equivalent of 1% of the world’s GDP, twice as much as in 2021 and almost five times more than in 2020. At the Glasgow climate conference COP26 in November 2021 it had been agreed “to phase out … inefficient fossil fuel subsidies, while providing targeted support for the poorest and most vulnerable.” The opposite has happened. The sharp increase of gas, gasoline and electricity prices in the wake of Russia’s invasion of Ukraine had led to a significant loss of purchasing power in the poorer parts of the population while energy intensive business models made less and less sense. In order to avoid a dangerous escalation of these developments, governments, including Germany’s, decided to introduce price caps and income transfers, de facto promoting the burning of fossil fuels at taxpayers’ expense.

While there is a broad consensus in rich societies that the emission of greenhouse gases must be reduced by steadily increasing absolute and relative prices of fossil fuels it became apparent that the process must not be too rapid – people will not support it if the purchasing power shrinks a lot, or if jobs get lost. Structural change and climate mitigation take a back seat when the essentials, income and jobs, are at stake. The actual situation and the near-term prospects are more relevant to a majority of the population than the threat of a climate catastrophe in the distant future. No surprise then that global CO2 emissions have reached a new record in 2022, a strong year in economic terms (about 41 bn tons). Since China, India and the other emerging markets, which account for 85% of the world’s population, continue to aim for a more energy-intensive standard of living it is a foregone conclusion that the cusp of emissions is still several years off. The Paris climate targets are at risk.

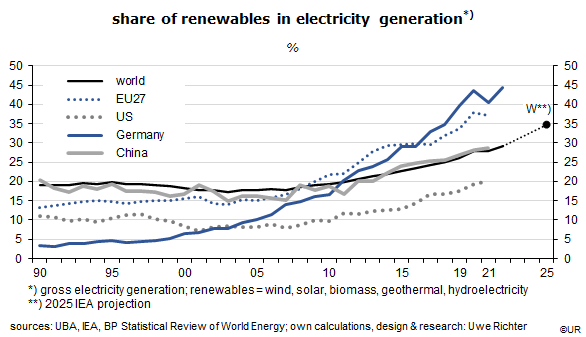

Longer term, the outlook is actually not so bleak, at least in some segments. The share of (emission-free) renewables in global gross electricity production for instance has increased from less than 20% to presently 29% over the past ten years and will probably reach about 40% by 2030, a result of technical progress, government policies and the mass production of wind and solar equipment. The trend will continue – but is not steep enough in view of what is necessary to save the climate.

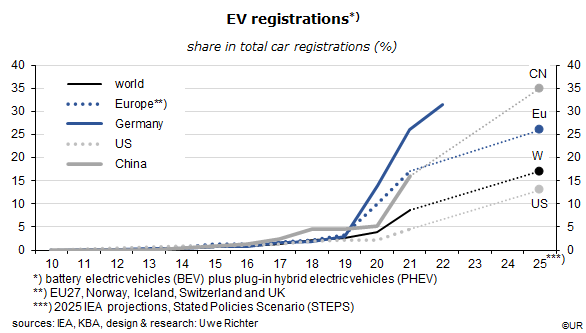

Another piece of good news is electric vehicles (EVs). In recent years, registrations have increased at high double-digit rates, and the share in global car registrations has gone from 2% in 2018 to about 11% in 2022. The IEA expects it to reach 17% in 2025, and 25% in 2030. At that point the world’s fleet of EVs would be in the order of 200 million, an increase by a factor of eleven compared to today. In Germany, by the way, the share of EVs had already been 31.4% in 2022 and had thus been a lot higher than in China, and no less than four and a half times higher than in America: the US needs a lot of catching-up.

To put these numbers into context: if one day all cars were electric and if everybody on this earth owned as many cars as people in the OECD today, the number of EVs would reach about 4 billion, or 20 times more than the expected number for 2030. This is, of course, a non-scientific extrapolation and not a realistic scenario, but it is still a pretty safe bet that the electrification of mobility has only just begun. It is a growth industry.

Even so, according to most climate scientists a catastrophe cannot be avoided if current CO2 trends persist. Progress in industry, buildings and agriculture in particular is still much too slow. As an optimist, I would argue, though, that climate mitigation efforts will accelerate a lot once the further deterioration of the environment causes large-scale existential problems in rich countries as well. It is a trademark feature of our societies that they can adapt if they really must. Let’s hope it is not too late when this point is reached.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.