Market Commentary: The Ukraine war: losers and winners

Dieter Wermuth, Economist and Partner at Wermuth Asset Management

The longer the Ukraine war lasts the stronger the effects on the world economy. The war is no zero sum game. There are losers and winners, but the loss of life, the destruction of large parts of the Ukrainian capital stock, the strong expansion of the defense sector, not just in Europe, or the big decline of the terms of trade in countries that are net importers of energy far exceed any beneficial effects. The decks of cards are reshuffled these days, but the bottom line is that the standard of living in the countries of the West will grow even more slowly than in recent years, or even shrink.

It is obvious that the Ukraine will suffer most. Large parts of the country are destroyed, real GDP has fallen by about one third compared to the pre-war years, and the population has shrunk by about 20 percent, due to flight and death.

The Russian aggressor, meanwhile, has not gained anything meaningful. Despite high world market prices of gas and oil real GDP has recently declined and is now about 10 percent below its 2019 level. There is a mass exit of young and well-educated people as Russia becomes a dictatorship where opposition and free speech are not possible anymore. Men who cannot flee or do not understand what is happening are drafted into the military and used as cannon fodder in a futile war. Demographically, Russia is in a catastrophic state.

The West’s sanctions will gradually begin to work. The EU has just passed its tenth package. So far, Russia is still able to buy the (high tech) goods it needs for its missiles, airplanes, and computer centers by placing orders with Turkish firms. Turkey is a member of NATO and thus an ally of the West. As a result, Turkish exports to Russia have been up by about 110% y/y in December. Such loopholes will probably not exist for much longer.

For some time to come, Russia cannot expect direct investments by foreign firms anymore. The risks are simply too high. Note that the large amount of Russian private and public assets held abroad, the result of cumulative surpluses in the balance of current account, can easily be confiscated if the conflict escalates further. These assets cannot be shifted at the stroke of the pen to China, India, or Dubai, ie, out of the reach of Washington and Brussels. And: does Putin really want to become a vassal of China?

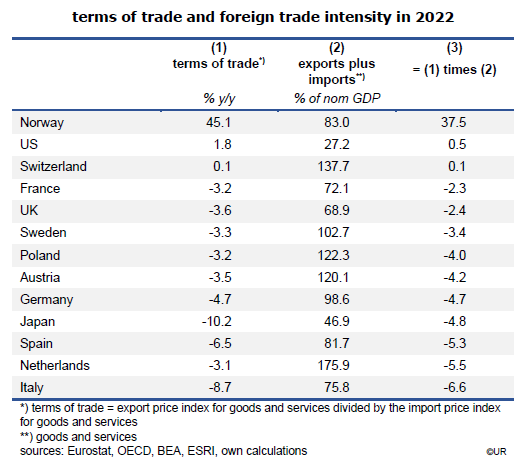

According to our calculations, Norway is, among the democracies of the West, the largest beneficiary of the Ukraine war, a result of the steep increase of oil and gas prices until last fall and the large share of exports and imports in its GDP. On a per-capita basis Norway is by far the world’s richest country. Another beneficiary of the war is the United States whose terms of trade have gained 1.8% last year compared to the 2021 average, but since both the energy and the international trade sectors are small relative to the rest of the economy, real incomes have increased much less than those of Norway.

In the other OECD countries the terms of trade have declined a lot in 2022. Because they all have a large international sector, the negative effect on real incomes has been significant which in turn reduces the room for large wage gains. A full compensation for inflation may not be possible, at least on average. Household consumption is therefore under pressure. In recent months, the terms of trade of countries which are net importers of energy have rebounded somewhat, as oil and gas prices have fallen, but they remain significantly below their 2019 levels (about one tenth).

The war and high energy prices act as a turbo engine for the global energy transition. Even the greatest skeptic must now acknowledge that renewables are the future, just as all strategies that aim to reduce energy consumption. Structural changes are gaining speed, creating new industries, business models and jobs. To be sure, another beneficiary of the Ukraine war is the defense industry – the longer the war drags on the better for their business. Other (potential) beneficiaries of the war are industries that rely heavily on imports from countries run by authoritarians or dictators, especially from China. As Russia has shown, such dependences may be dangerous and must be reduced. Attempts are under way in the OECD to re-establish the competitiveness of the solar and wind industries, among others. Buzzwords are resilience, independence, and de-globalization. Industrial policies have become respectable again.

On the political front it looks a s though the war will have positive effects, certainly from a European perspective. It is now increasingly likely that a democratic Ukraine will soon join both NATO and the EU and thus strengthen Europe’s geopolitical role. Under normal circumstances Ukraine’s economy will grow briskly for many years once peace is achieved and thus stimulate the other European economies as well. Go east, young man. A daydream?

Another positive is the plans of Sweden and Finland to give up their political neutrality and join NATO. This lowers the risk that Russia may one day decide to attack Moldova and the Baltic states in an attempt to create a new Russian empire. Stronger European cooperation and cohesion are a surprising and highly welcome side effect of the war.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.