Dieter Wermuth, Economist and Partner at Wermuth Asset Management

If I’m right about the underlying message of Christine Lagarde at last Thursday’s press conference the ECB is not planning to raise rates anymore. She has given up on forward guidance, not least because she does not know what’s coming. Policies will, more than before, be data dependent, and the data seems to suggest that even tighter monetary policies are not needed. In addition, the spectre of another global banking crisis has suddenly appeared on the horizon. The risk is that this may turn today’s economic stagnation in Europe into a full-scale recession.

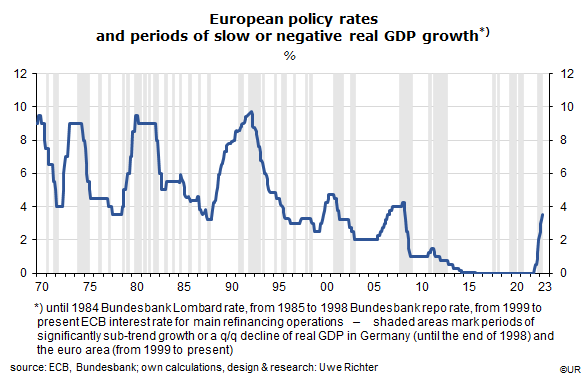

Enough is enough. Since last summer the ECB has raised its main refinancing rate in large steps from 0% to 3.5%, or by 350 basis points. Driven by the explosion of imported energy prices, general inflation was apparently getting out of hand. An energetic monetary policy response was regarded as inevitable. In a long-term perspective, interest rates are still low, but rarely have the reins been tightened so quickly and so much, after more than 13 years of very easy money, caused by the fear of deflation. US developments and policy responses were strikingly similar during those years.

So far, the effects of the policy turnaround are as desired: demand growth has slowed significantly, thus weakening the ability of business, landlords and workers to raise prices, rents and wages. European consumer price inflation is still high, though: the headline rate is 8½% y/y while core inflation is at 5½% y/y. The ECB’s 2% inflation target remains out of reach in the near future.

But a lot is already happening on the earlier stages of the value-added chain: world market prices for crude oil have fallen by around 30% over the past twelve months, those of natural gas by 70%. German import prices have come down by an annualized rate of 10.2% between last July and January, industrial producer prices by no less than 14.5%. How about wages, the most important cost component? In Germany, in real terms they were significantly lower than one year ago and have thus reduced the growth of household consumption and economic growth in general. As to nominal wages, they were up only 4.9% y/y in Q4 on an hourly basis, despite the big decline of purchasing power and a robust labor market.

I guess that European consumer price inflation rates will come down quickly from now on. The OECD has just reduced its inflation forecast for 2023 from an average 6.8% y/y last November to 6.2% now, and to 3.0% for 2024. The ECB is not needed in a process that is well established by now. It can afford to stay on the sidelines and just watch.

As mentioned at the beginning, the banking sector has become a major risk on both sides of the Atlantic. While the focus has so far been on Switzerland and the US, the two countries which used to be synonymous for safe havens until a few days ago, financial markets are so closely linked these days that major bank defaults there would immediately affect the euro area as well. It would be dangerous if the ECB were to raise policy rates in such a fragile environment.

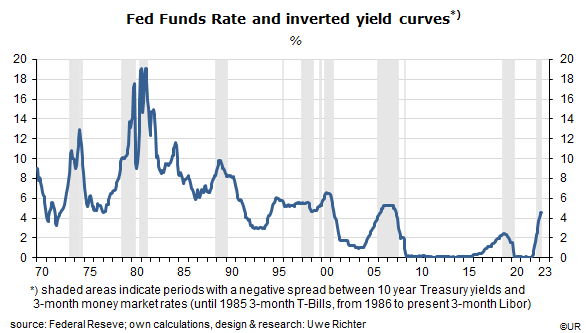

The sudden transition from a long period of ultra-easy to “normal” or even restrictive monetary policies has destroyed the business models of several mid-sized (and obviously poorly supervised) American banks. It had been very profitable for them to acquire high-yielding assets on the basis of cheap customer deposits and money market funds, without much equity, ie, a lot of leverage. There was little incentive to match the duration of the two sides of their balance sheets, for instance by issuing more (relatively expensive) fixed-rate bonds. Regulators just stood by, it seems, and certainly did not force the banks to prepare for a sudden inversion of yield curves. Realistic stress tests were either avoided or not given a high probability.

When rising policy rates drove up the cost of banks’ refinancing while the market value of assets declined in step with the simultaneous increase of longer-term rates, banks’ profits suddenly turned into losses (not all of them realized right away) – which scared depositors. For amounts beyond $250,000 they were not protected by the national deposit insurance scheme and therefore started to move their money to the large, systemically important banks such as JP Morgan or Citi. Because the big banks can simply not go under without causing a catastrophe they are regarded as safe no matter what (like Credit Suisse in Switzerland).

The risk of a major bank run was regarded as so significant by the Fed, the FDIC and the US Treasury that they had a genuine panic attack and committed at least two sins which may haunt them in the future. For one, all deposits at the troubled banks, not just those of less than $250,000 were given a full state guarantee, including at banks which are de facto broke. Secondly, banks are now permitted to borrow from the Fed on the basis of the nominal, not the much lower market value of their assets – which shifts the price risks to the Fed.

Once again we learn that it is often, or always, very dangerous when central banks switch from easy to restrictive policies. This typically happens when inflation accelerates too much after a period of good economic growth, or after a depreciation of the exchange rate. Over the past decades, banking crises, recessions and stagnations almost always occurred after policy rates were raised. An early sign that trouble was ahead came usually from the real estate sector which seems to have the built-in property of overshooting every so often. In general, banks must be regulated and supervised more strictly. And they have no natural right to earn excessive profits.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.