Dieter Wermuth, Economist and Partner at Wermuth Asset Management

How can we avoid that the earth continues to heat up? So far the answer consists mainly of technical solutions, such as subsidizing electric vehicles and heat pumps, erecting ever taller windmills on land and sea, covering open spaces with solar panels, promoting storage facilities or building high-voltage power lines. This reminds me of a remark by Einstein, that problems can never be solved by an approach which had created the problems in the first place.

At the same time, climate policies aim to reduce the emission of the climate killer CO2: taxing those emissions, forbidding, or making it more difficult, to produce and consume CO2-intensive goods and services, or providing incentives to insulate buildings.

In the following I will describe three other, more fundamental solutions to the global climate crisis. They focus on the demand for raw materials and resources in general and give the recommendation to live more modestly, to work less (Keynes), to slow and then reverse population growth, and to give up the fixation on economic growth in favor of “degrowth”.

In 1930, almost a century ago, Keynes had written an essay called “Economic Possibilities for our Grandchildren” where he described a utopian future in which the basic needs of men – of all humankind! – would be met thanks to the wonders of steady productivity gains and compound interest, provided there would be no major wars, population growth could be contained, the insights of science would be followed, and a sufficiently large proportion of income would be used to expand the capital stock.

As we know, World War II has prevented the smooth transition to Keynes’ happy future, but since 1945 there has been mostly peace in Europe, the Americas and the Pacific, and another world war has so far been avoided. Another unexpected obstacle has been the rapid increase of the world’s population, from two billion in 1929 to more than eight billion today. Keynes had also not foreseen that the exponential growth of economic output and the number of people living on this planet would bring about serious climate problems.

He expected that people would opt for more leisure time at the expense of larger paychecks once their income was so high that they would no longer worry about their basic needs such as shelter, food, health, or the education of their children. With the war for survival won, 100 years after writing this essay, ie, today, the typical work day would be just three hours, the typical work week therefore 15 hours. Work would still be necessary for some time, because the old Adam would be demanding that we do something for our income, for many more generations. Absolute leisure would be a dangerous and untested proposition. “… we have been trained too long to strive and not to enjoy.”

In peaceful Western Europe we have actually more or less achieved a standard of living which Keynes had forecast in 1930. People have on average so much money that they could reduce their working hours and thus the consumption of scarce resources. The climate would benefit.

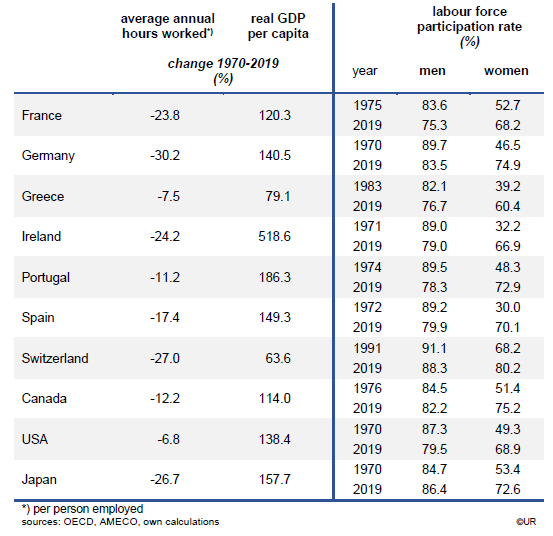

As it is, working time has indeed come down, but not as much as Keynes had expected. Old habits are not easily given up, the desire to purchase additional consumer goods and services is still strong, to buy fancier cars, bigger houses and to spend money on only marginally useful stuff. People like to impress their neighbors and friends and want to keep up with the Joneses. This is probably the main reason why the share of leisure time is only rising gradually. In Germany, annual working hours of an average worker have declined by about 30 percent over the past 50 years, and by 27 and 24 percent in Japan and France. Keynes had thought the reduction would be more in the order of 70 percent. Moreover, the numbers are not so positive as they look at first sight: to a large extent they reflect the fact that more and more women have entered the labor force – for understandable reasons many of them have a preference for part-time work and are thus pulling down the average working time.

In the United States, the richest of the larger OECD-countries, the reduction of annual working hours has actually been a surprisingly modest 7 percent. One of the reasons is probably the sub-standard quality of public and private old-age pension insurance. Many people are afraid that they will have financial problems after retirement. To take off for holiday for more than two weeks is something one should not do. Because Americans work and consume so much they are, on a per-capita-basis, the worst destroyers of the environment. This will only change once the US becomes a multiparty state with a much stronger social safety net, along Western European lines. This, sorry to say, sounds like wishful thinking at this point.

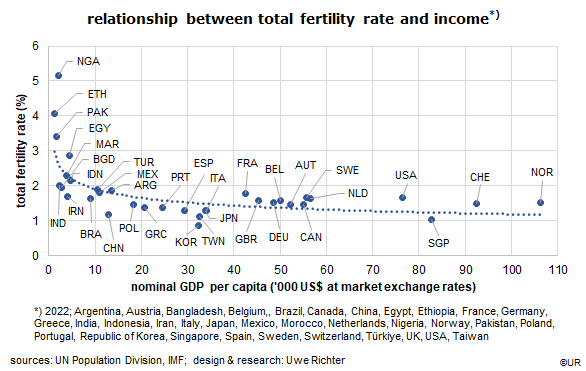

In its 1972 report on the Limits of Growth, the Club of Rome had made the plausible recommendation, among others, that women who give birth to just one child in their lifetime should be given an attractive amount of money. Less people, less demand for resources, a better environment. Even without such strategies it is likely, though, that, over the coming decades, we will see a significant slowdown of the population growth dynamics. This is mostly because the number of births is negatively correlated with per-capita income – which in all likelihood will continue to rise briskly. Many poor countries are in catching-up mode.

The world’s average fertility rate is presently at 2.31; 50 years ago it was still at 4.55. Only when it falls below 2.1, the population stabilization rate, will population growth stop. According to the latest UN Population Division forecast the peak will be reached around the year 2080, at 10.5 billion, followed by a gradual decline. In view of the accelerating deterioration of the climate this is much too slow.

Politicians must therefore try to reduce fertility rates, using incentives rather than prohibitions. China’s strategy – which was given up only recently – is certainly not a role model. The most pressing need for action is in Africa: in Nigeria and Ethiopia, the two countries with the continent’s largest populations, women still give on average birth to four or five children during their lifetime, not necessarily because this is what they really want. In India the fertility rate has fallen to 2.0, in China to 1.2. In other words, progress is possible. All cost-benefit analyses come to the conclusion that population control must be a policy priority in poor countries, not only in order to raise the standard of living there but also to reduce the demand for resources – and to stop the deterioration of the environment.

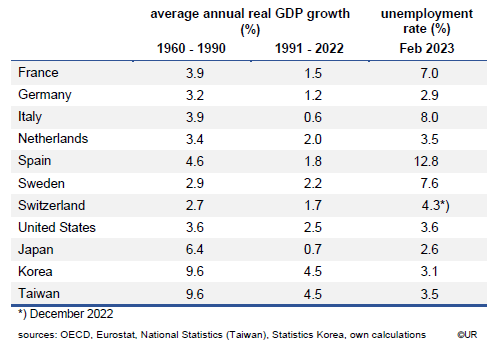

Finally some remarks about the degrowth movement. It is more or less self-evident that demand for resources will decline if the economy, ie, real GDP shrinks. But most economists, almost all business people and the population in general consider this a pipe dream: it would lead to rising unemployment and a reduction of the average standard of living. Japan has shown that this is not necessarily so: over the 30 years to 1990 its real GDP had grown at an average annual rate of 6.4%, in the 31 years that followed the growth rate has fallen to just 0.7%. It’s not yet degrowth, but it is getting close. Reports about social unrest have not been in the news, as far as I can remember. The unemployment rate is only 2.6%. Slow and even zero or negative economic growth looks feasible, I would say.

For degrowth to succeed, or to become acceptable, social cohesion and active solidarity seem to be key elements, as in Japan. In Germany, incidentally, we are also gradually moving towards zero growth. There is no strong pressure on politicians to change these dynamics. Using the methodology of Geneva’s ILO (International Labour Organisation), the unemployment rate is at an (almost) record low of 2.9%. Slow growth is compatible with low unemployment! (I wonder, though, whether Japan’s and Germany’s near zero growth rates really qualify for degrowth. Moreover, the degrowth strategy only makes sense for some rich countries, not for the world as a whole.)

When the standard of living is high, further resource-intensive growth is obviously not so important anymore. The richer a country, the less important and the lower is further economic growth. It is a well-known phenomenon called declining marginal utility. Rich countries are more willing to do something for the environment than poor ones. Degrowthers are no spinners.

The main problem is that large countries like the US, China and Russia do not want to have anything to do with such absurd ideas. They are busy growing and re-arming. What are the proponents of degrowth strategies to do in such a world? Another quote comes to mind, this time from Schiller’s Wilhelm Tell: “the very meekest cannot rest in peace, if some malicious neighbor likes it not”. To focus on shrinking economic output can be dangerous and will only become a realistic alternative once there is peace all around. A pity, really.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.