Market Commentary: Rapid decline of European inflation rates

Dieter Wermuth, Economist and Partner at Wermuth Asset Management

Yesterday, we got Germany’s producer prices for March: they declined no less than 2.6% m/m – but were still up 7.5% y/y. The main and surprisingly pleasant message was that, over the past six months, they had come down at an annualized rate 22.7%, from a very high level though. Numbers have moved in the right direction, as probably in the other 19 countries of the euro area as well. The same is now happening to consumer prices, if, as usual, at a lower rate of volatility.

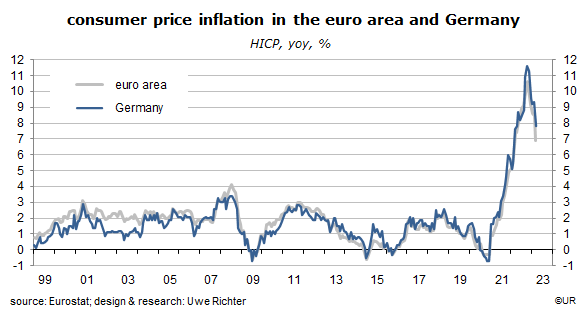

The question is whether European consumer price inflation rates will sometime soon start to fluctuate again around the 2.0% average observed between the start of the euro in early 1999 and mid-2021, ie, whether we will be back to price stability. The ECB aims for, and defines price stability not as zero inflation but, for various reasons, as 2% over the medium term. Market participants consider a return to such a rate to be likely. In its new half-yearly report the International Monetary Fund shows that professional forecasters are presently predicting average inflation rates to be close to 2% in advanced economies five years from now (p. 3f).

Bond markets are sending a similar message. Given that the euro area headline inflation is just below 7% y/y at this point it is surprising that the yield of 10-year German government bonds is a mere 2.5%. Since the trend growth rate – and thus the real longer-term interest rate – is in the order of 1.2%, the rest of 1.3 percentage points must represent average inflation expectations over the coming ten years. That 10-year US Treasuries yield 3.6% right now also suggests inflation expectations of around 2%, taking into account the fact that US trend growth is somewhat faster than Germany’s.

We are all aware that the so-called market professionals are more often than not wrong about what the future will bring. Will inflation rates really fall back soon to their previous standards? At least in theory this would be the case if the potential supply of goods and services were considerably bigger than the demand for them or, in other words, if the macro rate of capacity utilization was low – this would imply that wages and prices could not easily be raised which in turn would keep inflation down. In real life there is no generally accepted definition of an economy’s rate of capacity utilization. What is the trend growth rate of potential GDP? No one knows for sure. As to the euro area, a rate of less than 1% per annum would suggest that full employment has been achieved by now and that inflation may remain a serious problem. Today’s record low unemployment rate and the robust increase in the number of new jobs actually point in this direction. If, however, real GDP trend growth were close to 2% (based on the extrapolation of the GDP numbers from 1999 to 2008) the euro area would suffer from a huge output gap, and be faced with the risk of deflation.

The euro area is closely integrated into the world economy. It is therefore necessary to take into account the capacity utilization rate of the rest of the world as well, because this determines the trajectory of foreign trade prices – which again are an important independent variable in the consumer price equation. Since both the US and China, the two largest economies, will expand at a slower pace than in the past, the world’s GDP will grow more modestly, and the ability to raise wages and prices will be reduced accordingly.

Whether inflation rates are more likely to rise rather than fall depends to a large degree on future exchange rates. Going by the level of purchasing power parities, the euro is significantly undervalued and can be expected to appreciate in the medium term – and thus exert downward pressure on general inflation. We know, though, that exchange rates often deviate from such a benchmark, sometimes for many years. Interest differentials between economies are just as important for exchange rates because they determine the size and direction of capital flows. Since European headline inflation is much higher than US inflation (7% vs. 5%) while policy rates are almost 200 basis points lower, it is likely that the ECB will raise rates a lot more than the Fed. This will probably lead to a further appreciation of the euro which in turn pushes down inflation.

To sum up, inflation risks will decline this year and probably next year as well, if not longer – unless a major unexpected event changes the fundamentals again.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.