Market Commentary: German and euro area wage growth remains subdued

Dieter Wermuth, Economist and Partner at Wermuth Asset Management

Last weekend, public sector labor unions and representatives of federal and local governments have finally struck a 2-year wage deal, covering about 2 ½ million employees. They largely followed the recommendations of a joint arbitration commission – which had been the only way to arrive at an amicable settlement. Once again, it was an extremely complex and intricate agreement. It makes it almost impossible to answer the simple question about the likely average year-on-year hourly wage increase in 2023 and 2024. Economists at UniCredit in Munich estimate that wages and salaries will rise by 3.3% to 6.7% over the two-year period, depending on the pay grade, while Marcel Fratzscher, the president of Berlin’s DIW economic research institute, calculates that the deal raises average wage income by 11% over two years to the end of 2024. This is certainly more than modest, given that German consumer price inflation is almost 7% y/y now, and core inflation still at 5 ½%, and will probably average 6% in 2023 and 3% in 2024. No matter who is right, both come to the conclusion that the real purchasing power of workers will decline substantially.

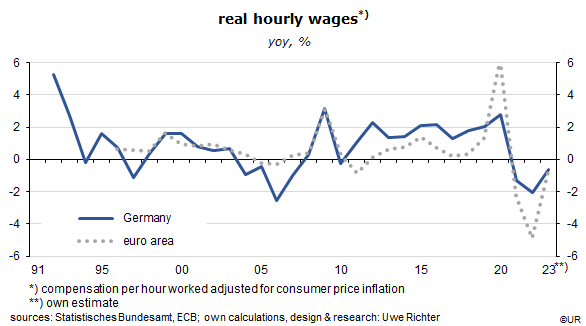

The numbers are in synch with a new Bundesbank report about the situation elsewhere in the economy: in the construction sector nominal hourly wages had fallen at an annualized seasonally adjusted rate of 0.3% over the six months to February, in spite of a brisk expansion of employment and hours worked, ie, the strong growth of demand for labor. Real wage growth in the euro area as a whole is also negative.

In other words, there is no evidence of a wage-inflation spiral driving overall inflation from the cost side. Inflation is so high because energy (and food) prices have increased so much, not because workers were able to take advantage of the tight labor market by boosting their wage income by more than general inflation. The year 2023 will also be the third year in a row of declining real wages in the rest of western Europe. To be sure, in Germany the present difficulties come after eleven years of real annual wage gains in the order of 2%. The implicit deal between labor and business (and the government) had been “lots of additional jobs in exchange for modest wage gains”.

As the world economy does not expand so fast anymore – by 2.8% in 2023, after 3.4% the year before and about 3% annually over the past decade – because China and the US are struggling, Europe will benefit from falling commodity prices, including oil and natural gas. Euro area inflation will also be pushed down by a stronger exchange rate, which in turn reflects the expectation that the ECB will raise policy rates by more than the Fed. Inflation may therefore surprise on the downside later this year. Will we then start to talk about the risk of deflation once again? There is certainly no inflation mentality these days.

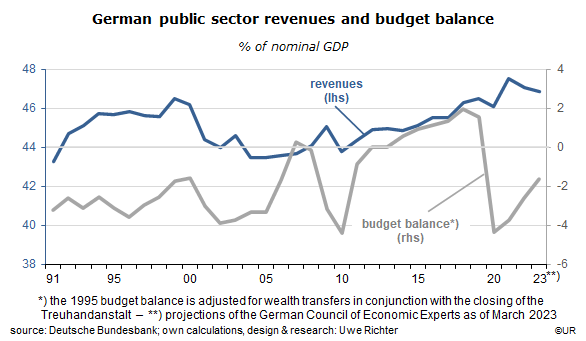

If the other branches of the German public sector arrive at wage agreements which are similar to the one we just got, spending on personnel will rise substantially. But revenues are also up strongly, given that the tax system as a whole is progressive – which boosts revenues by more than inflation.

It also helps that the government will discontinue subsidies introduced to moderate the negative income effects for households and business of the recent energy and food price explosion. On the other hand, spending on the military will rise a lot. On balance, though, the public sector budget deficit will shrink to somewhat less than 2% of GDP in 2023, and it is likely that the debt-to-GDP ratio will fall to 65% of GDP. Government finances will remain in good shape.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.