Dieter Wermuth, Economist and Partner at Wermuth Asset Management

For several reasons, euro area final demand for goods and services has weakened recently: (1) real short-term rates are rising strongly as the ECB will continue to raise policy rates while actual and expected inflation rates are falling; (2) consumer prices have increased by more than household revenues over the past year, reducing real disposable income, (3) banks have tightened their lending standards in order to improve the quality of their assets after these have lost in value following the increase of interest rates; (4) fiscal policies are turning less expansionary as government support for the mitigation of the Covid pandemic and the explosion of energy prices is withdrawn; (5) world trade will more or less stagnate in 2023 – other than in most of the post-war period it no longer grows almost two times faster than real global GDP; (6) since European policy rates will rise relative to those in the rest of the world, the real appreciation of the euro will continue and thus reduce the price competitiveness of the euro area.

In more detail: as of today, the ECB will probably raise its policy rates in two more 25-basis point steps this summer. The main refinancing rates will therefore rise to 4¼% and then stay there for the rest of the year, before rates will be cut again in 2024. For this to happen, though, it will be necessary that consumer price inflation is seen to be on a well-established path toward the 2% target. This is a tall order, given that euro area headline consumer price inflation is presently at 7.0% y/y, and core inflation at 5.6% (April). The ECB can afford to, and will continue to pursue its restrictive policies, not least because the labor market across the 18 countries of the currency union remains quite robust. The ECB is presently not afraid of a recession, and a recession is the most effective means for bringing down inflation.

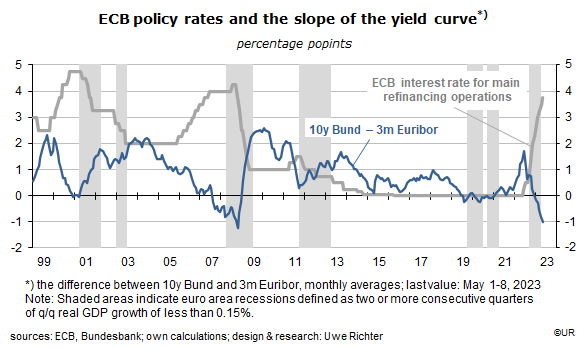

In the wake of increasingly tight monetary policies inflation expectations have come down a lot. The yield of 10-year German Bunds, for instance, has fallen to just 2.3% and is thus lower than money market rates. Market participants are obviously convinced that the ECB will reach its 2% inflation target. This is why the German (and the European) yield curve has inverted. Experience has shown that there will be a recession if the process of interest rate inversion is significant and lasts some time. After August 2023 the euro area yield curve will be just as inverted as at the end of 2008, the year of the global Great Financial Crisis.

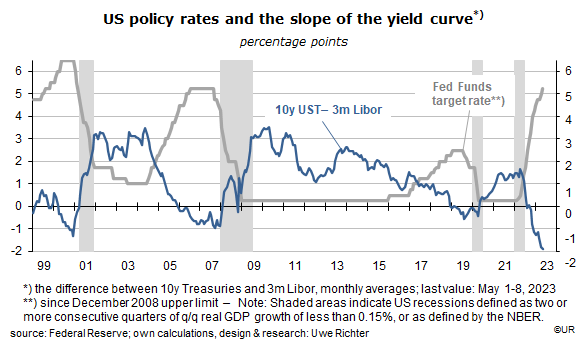

Things look similar in the US. Because the Fed has aggressively raised rates since the spring of 2022 – also facilitated by briskly rising employment numbers – the dollar yield curve has inverted even more than Europe’s, and by more than in many decades (-190 basis points, the difference between 3.44% for 10-year Treasuries and 5.34% for 3-month Libor).

In the US, a recession is therefore just as likely as in the euro area. Since policy rates, money market rates and the whole yield curve have increased so much, the market value of bank assets has dangerously declined and has forced banks to tighten lending standards, with the predictable result that the demand for bank loans have fallen steeply, especially in the real estate sector. On average, American banks do business on an equity basis of just 10 percent and run into problems if the value of their assets falls by 10 percent or more. In recent weeks we saw that some mid-sized, not systemically relevant banks had to be rescued by the state or by being taken over by larger ones. Bankruptcies and a major banking crisis had become a serious risk.

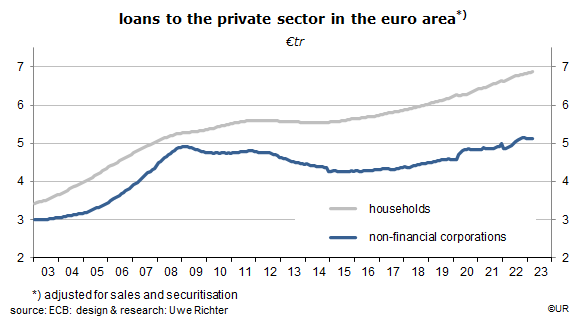

The ECB has just reported that euro area banks have also raised their lending standards in the first quarter of this years, more than at any time since 2011, because they operate on the basis of a large share of external funds, just as American banks, and tend to run into balance sheet problems in periods of rapidly rising policy rates. In combination with the restrictive effects of rising short-term rates the loan demand of non-financial business and households has therefore cooled (especially in inflation-adjusted terms) and has dampened demand in general. Real GDP growth is stalling. This is why the ECB raised its policy rates by just 25 basis points at its last meeting on May 4, rather than 50 basis points as at the meeting before.

In comparison, the negative effects of less expansionary fiscal policies, the stagnation of world trade and the appreciation of the euro exchange rate are less important for economic growth than those financial problems.

At the upstream stages of the value-added chains, there are now signs that the weakening of final demand has made it more difficult to raise prices. Crude oil, natural gas, copper and iron ore have all become much cheaper recently, even though they are still high in a longer perspective. German industrial producer prices, for instance, have fallen at an annualized rate of no less than 23% over the six months to March. That these deflationary developments have not yet arrived at the consumer level (core inflation is still 5.6% y/y) is probably due to the fact that workers are finally demanding a more significant compensation for the loss of purchasing power over the past two years. The deal of jobs for wages between business and labor has worked surprisingly well in recent years but may now be coming to an end.

I know that predictions of recessions are more frequent than actual recessions. It may be that once again some unexpected positive developments will come to the rescue. In any case, recessions which are not accompanied by a large increase of unemployment may no longer be such fearful events as in the past. Both the European and the US labor markets continue to hold up well so far.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.