Dieter Wermuth, Economist and Partner at Wermuth Asset Management

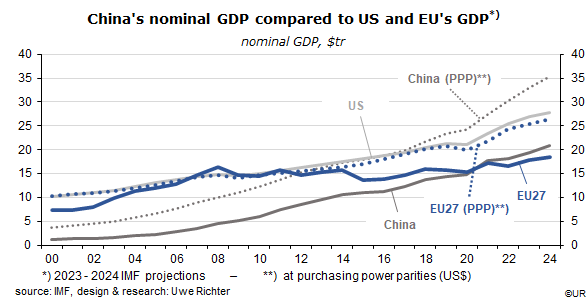

One thing is certain: according to the calculations of the International Monetary Fund, based on purchasing power parities as exchange rates, China’s nominal GDP exceeds that of the US by almost 20%. Even though its growth trend has flattened it continues to be steeper than America’s, mostly due to bigger saving and investment ratios. In other words, unless something unexpected happens, the distance between the economic power of China and the US is bound to increase further. China is also the world’s largest trading nation.

In the meantime, an escalating trade war is under way between the US and China, between the world’s hegemon of the past 100 years and its new challenger. Some political and economic analysts draw already parallels with similar conflicts in the past, for example between Athens and Sparta, between Germany and England, or Japan and Russia, where a rising power threatened an established regional or global power – which in most cases ended in war. This is the so-called Thucydides trap, which is discussed a lot both in China and the US. War is not inevitable in this new edition, though, because the participants are aware that a military confrontation would be extremely expensive and destructive for both sides – and would therefore not make sense. Not to forget, the huge nuclear arsenals of the two countries are an effective deterrent, just as in the cold war of old.

A look at some key real economic indicators shows that GDP comparisons based on purchasing power parities rather than market exchange rates convey a better impression of the effective size of an economy. Using market exchange rates, the US GDP was more than 40% bigger than China’s. This is ridiculous and just shows that the renminbi is vastly undervalued. In the following, the first number refers to China, the second one to the US: registrations of new passenger cars 21.7 vs. 10.8 million (2022); electricity production 8,534 vs. 4,406 terawatt-hours (2021); primary energy consumption 157.6 EJ vs. 93 EJ (2021); crude steel production 1,013 vs. 81 million tons (2022); number of mobile phones 1.73 vs. 0.36 billion (2021); number of employed persons 734 vs. 158 million (2022).

Seen from Europe, China is an increasingly important economic partner. In terms of goods exports from the European Union, the US remains the most important market, with a share of 19.8%, followed by China at (because of Corona at an unusually low share) 9%. For European imports, the picture is entirely different: China accounts for 20.9%, the US for merely 11.9%. As a percentage of nominal GDP, EU trade in goods and services with China is almost twice as large as US trade with China (5.9% vs. 3.0%). Germany is at a very high 7.9%.

This obviously means that the EU economy is increasingly intertwined with China and thus has a strong interest that trade develops smoothly, and that a trade war can be avoided. The dependency on Russia had been cut rapidly and without much collateral damage – but in the case of China it will not be that easy. The world market for crude oil and gas offered a lot of alternatives to supply from Russia, whereas China is a monopolist or near-monopolist in important metals markets and rare earths, and increasingly also in industrial products for renewable energy. If China were a normal democracy rather than a dictatorship, no one would care because these facts would just be the outcome of the (generally beneficial) international division of labor. Since the country’s leadership continues to announce that it would, if necessary, use force at some point in the future to bring Taiwan under its rule, European trade and other relations with China are exposed to the risk of war and thus by no means normal.

It is about time that the EU develops a common China policy, obligatory for all 27 member states, on the basis of reciprocity, covering trade, direct investments, property rights, capital controls and climate. The EU has a lot of negotiating power, given that the size of its economy is on par with that of the US.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.