Market Commentary: A CO2 tax is better than the German government’s present plan

Dieter Wermuth, Economist and Partner at Wermuth Asset Management

It looks as though the government’s proposed heating law which aims at a significant reduction of the building sector’s CO2 emissions will not pass the Bundestag, the lower house of parliament in Berlin. Good news! Instead of trying to correct the weak points of the law it should be given up altogether. An entirely new approach is called for.

As the Potsdam-based climate scientist Ottmar Edenhofer and Veronika Grimm, a member of the Council of Economic Advisers, have argued a few days ago, the best solution from an economic and social point of view is to increase the price of CO2 emissions step by step over time, in this way make heating with fossil fuels less attractive which in turn will be an incentive for households and businesses to switch to alternative, climate-friendly systems such as heat pumps, distance heating or geothermal power. It is important that the government announces right from the start by how much and when the cost of CO2 emissions will be raised. Dependability and projectability are required for the major structural change that is needed.

This must be accompanied by financial transfers from the government to the poorer parts of society which are unable to pay for the necessary investments and whose real available income will be reduced by the coming high prices for gas and electricity. They need a compensation in order to maintain their standard of living. The main point is that citizens will be free to make their own choices about their preferred heating system. The project can be financed from the additional government revenues generated by selling CO2 emission rights.

A complicated and in parts unfair bureaucratic monster, as outlined in the draft law, is not needed. The state should define the basic parameters of the law and then leave it to the market, to the interplay of demand and supply, to find the best solutions. Since there won’t be, in such a model, a misallocation of resources, macro-economic productivity will increase and raise the general standard of living. For a long time, such an approach has been favored by a majority of economists, but for politicians it reduces the scope for the micro-management interventions they like. There are too many jurists in parliament, government and among lobbyists – they prefer complicated solutions!

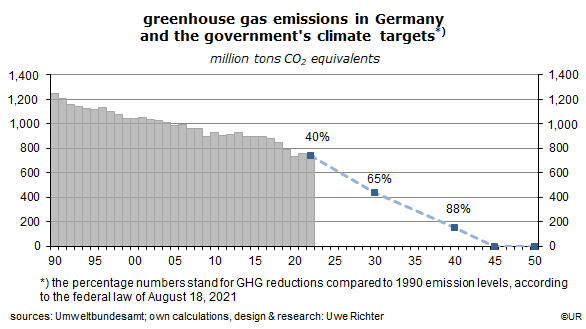

In Germany, just as probably in the rest of the EU and across the OECD as well, about 17% of all CO2 emissions are caused by buildings which is why these play a central role in the fight against climate change. Since 1990, greenhouse gas emissions have declined rather steadily by about 1.6% annually, an impressive success, caused mostly by the strong increase of fossil fuel prices. The price mechanism works.

Much remains to be done to meet the ambitious targets – net zero emissions by 2045. There is one problem: because the cost of producing electricity from renewable sources keeps falling, the demand for oil and gas is likely to fall as well which will put downward pressure on their prices – which in turn will reduce their absolute and relative prices, which in a further turn will stimulate the demand for fossil fuels and hurt the environment. In such a case, CO2 taxes would have to be raised correspondingly.

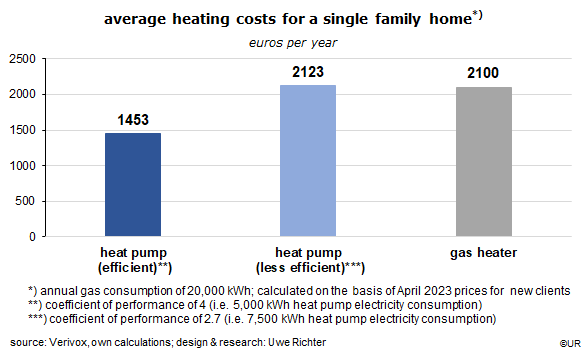

The more expensive it gets to emit CO2, the more attractive will be alternative heating systems. As an example, installing heat pumps makes sense the larger the difference between the price of CO2 emission certificates and the cost of electricity. To heat a single family home using a gas burner may cost €2,100 these days while the operating electricity costs of a similarly effective heat pump would be €1,453 per year, according to estimates by Verivox. The annual difference is €647. If €50,000 are needed to install a heat pump (probably at the high end of the likely range), savings of roughly €5,000 per year would be required for an amortization within ten years or so, which is a rather high multiple compared to the baseline scenario.

In other words, a heat pump without subsidies from the state only makes sense in this example if the annual costs for a comparable gas heating system are not €2,100 but €6,453 – which is more than three times higher than today. This would also be a huge increase and thus politically not feasible – unless there is a fair and well-communicated redistribution of the state’s CO2 revenues to households. As with the present German government plan there must obviously be a multi-year transition period.

To conclude, let me emphasize that it does not make much sense to break down the necessary CO2 reductions to the various sectors, ie, buildings, transportation, industry and agriculture. A single price for all greenhouse gas emissions, irrespective of who is responsible for them, is enough. All emissions should be treated equally. Only in a second step is it necessary to determine the size and direction of compensation payments. At that point, the focus must be on those sectors of the economy which suffer most from the inflation of CO2 prices.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.