Market Commentary: Germany – real GDP grows while energy consumption declines

Dieter Wermuth, Economist and Partner at Wermuth Asset Management

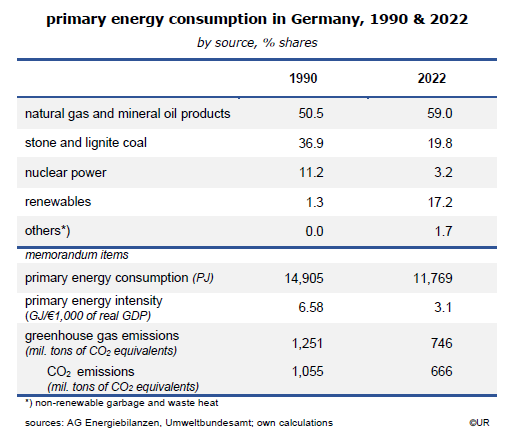

One popular assumption is wrong, especially in the case of Germany: that economic growth requires the input of more and more energy. Between 1990 and 2022, the country’s real GDP had increased by about 50 percent whereas the consumption of primary energy had fallen (not increased!!) by 21 percent. Put differently, the energy intensity of producing GDP has come down from 6.58 (GJ/€1,000 of real GDP) to 3.61 over the course of those 32 years.

The main reason for this well-established long-term trend has been the strong increase of absolute and relative energy prices. There has thus been, all the time, an incentive to be frugal about the use of energy. For economists this has been and still is a nice confirmation of one of their favorite “laws” – that the price mechanism works and can be put to work in economic policy making, for instance for the climate-friendly restructuring of demand and supply.

Another popular proposition is equally wrong: that a significant expansion of renewable power is not possible because there will soon be a lack of suitable land and space which in turn will prevent the total electrification of the economy as proposed by the present three-party-coalition government. Ulrike Herrmann uses this argument in her new best-selling book about the end of capitalism. The facts tell a different story: the share of renewables in primary energy consumption has arrived at 17.2% in 2022 and looks like being on a robust upward trend.

If I look around I see a large potential for much more electricity production from renewables. Only a small number of roofs are covered by solar panels and there are plenty of open spaces that could be used for wind turbines – and new, taller ones are significantly more efficient than existing ones. For the time being I see no reason why renewables are about to hit physical limits. At the same time the demand for energy is on a declining trend. Once again the market economy turns out to be impressively adaptable to new challenges and political requirements. The general standard of living can be, and will be improved with less and less energy input.

Another aspect which is somewhat neglected in the present discussion is Germany’s dependency on energy imports. Net imports of energy still account for almost 70% of primary energy consumption. Not least because of the progressive switch to renewables the country is becoming increasingly self-sufficient – and thus less susceptible to extortions by Russia or the OPEC countries. For an economist like myself this is not such an unequivocally good thing because I continue to be convinced of the benefits of the international division of labor. Free trade and capital flows are more effective than development aid when it comes to improve the lot of poor countries. But security considerations take priority in the present conflict with Russia. This has to be accepted. I wonder whether the trend toward autarky and the declining costs of renewables will in the end make Germany and similar countries net energy exporters. Sounds far-fetched right now.

A final note: geothermal energy – which almost plays no role today, with a share of 0.7% in primary energy consumption – has the potential to shake up the present wind-solar mix of renewables, provided the cost of CO2 emissions goes up sufficiently to make deep drilling a feasible business model. The supply of heat, ie, clean electricity from the ground is de facto limitless.

To sum up: neither Germany nor the rest of the world need more and more energy to raise the standard of living. This also helps in the fight against climate change. A general belt-tightening is not necessary. A continuing shift to less energy-intensive goods and services will do.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.