Dieter Wermuth, Economist and Partner at Wermuth Asset Management

Last week I had shown that there has been, contrary to people’s perceptions, a reduction of Germany’s primary energy consumption since 1991, the year after reunification (on average -0.7% per year); at the same time real GDP rose by 1.3% annually. At this stage of the country’s development economic growth seems possible without rising energy inputs. This is good news for the environment and the world’s underground reserves of coal, oil and gas. To be sure, those reserves keep shrinking but as far as Germany is concerned no longer at an accelerating pace.

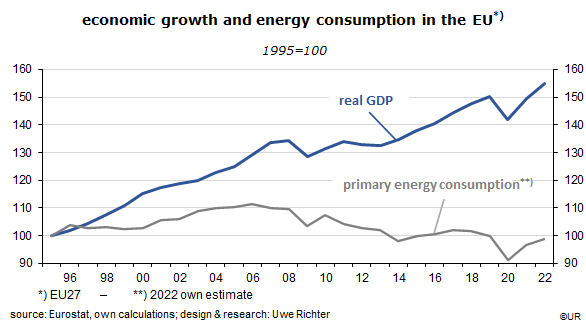

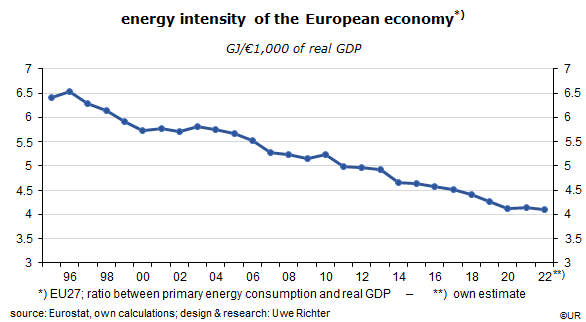

I wondered whether Germany, because of its industry-heavy structure of production, was a special case – how did it compare to the EU as a whole, with its population of 450 million? Comparable EU numbers are only available since 1995: on balance, EU energy consumption has stagnated over the 27 years through 2022 while annual real GDP growth has averaged 1.6 percent. In other words, Germany is not a special, ie, non-representative case. It is close to the EU mean.

At the global level, economic growth and energy consumption remain positively correlated, though. In the ten years to 2021, the world’s real GDP had increased at an average annual rate of 3 percent, the consumption of primary energy at a rate of 1.3 percent. Even so, the world’s so-called energy intensity, the relationship between real GDP and energy consumption, is, reassuringly, on a clear downward trend and is thus following the European model.

The growth of global energy consumption is mostly driven by developing and emerging economies – which account for 85 percent of the world’s population. These countries are still poor but are approaching rapidly the West’s standard of living. One feature of the catching-up process is the focus on basic needs, such as housing, heating, cooling, better food, driving and a modern infrastructure, products which require a lot of energy inputs.

But it is a safe bet that in ten or fifteen years a point will be reached when the world’s energy demand will decline, and not only in relative but also in absolute terms, as in Western Europe and North America – accompanied by a steady increase of per capita GDP.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.