Market Commentary: Lower inflation rates despite full employment

Dieter Wermuth, Economist and Partner at Wermuth Asset Management

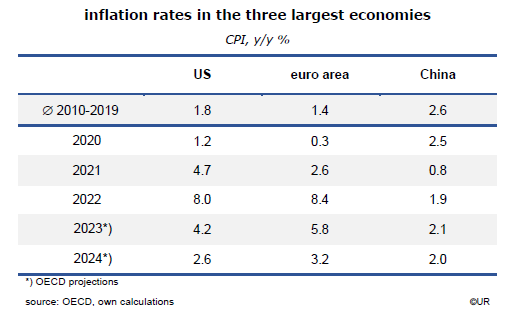

Going by the speed and size of policy rate hikes or by the decline of M3 and lending to the private non-financial sector, monetary policy in both the euro area and the US has moved from very expansionary to increasingly restrictive within less than a year. However, central banks have not yet come close to their aim of bringing down consumer price inflation to around 2%: core inflation, ie, CPI ex energy and food – which is the best available yardstick for underlying inflation pressures – is still 5.3% y/y in the US, the same as in the euro area. It remains not only high but is also disappointingly sticky. This is why the OECD in their latest Economic Outlook argue that “monetary policy needs to remain restrictive until there are clear signs that underlying inflationary pressures are durably reduced. … (this) may require higher policy rates.”

Historically, nothing reduces inflation as reliably and strongly than a full-blown recession or a significant increase of unused capacities (the output gap). When demand declines relative to potential output it is usually not easy to raise wages and prices – inflation falls. To be sure, it can also be reduced by government price controls, a large appreciation of the currency or supply shocks such a big decline of the oil price or a major technological breakthrough.

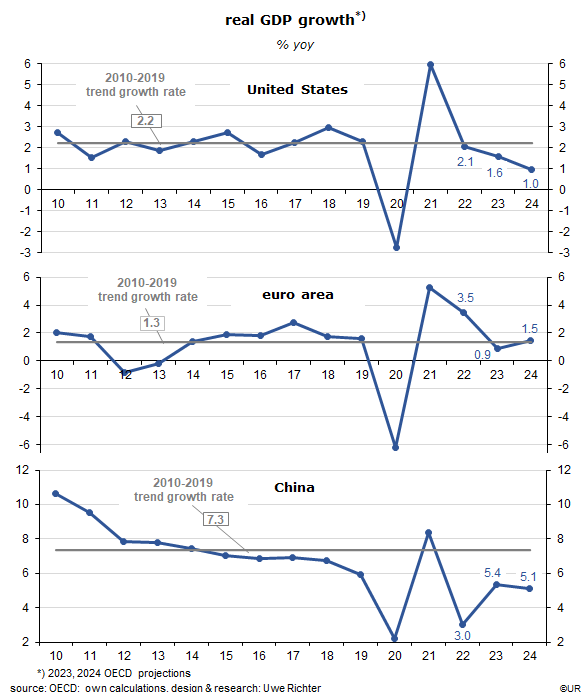

The OECD expects that the real GDP of the US will increase by 1.6 and 1.0% y/y in 2023 and 2024 – which is a lot less than the average growth rate of the pre-Corona decade (2.2%). It looks therefore plausible that unused capacities are on the rise and will bring down both headline and core inflation. Another positive effect is import prices which have been declining steeply (April -4.8% y/y), mainly because the global economy expands at a much slower rate than usually.

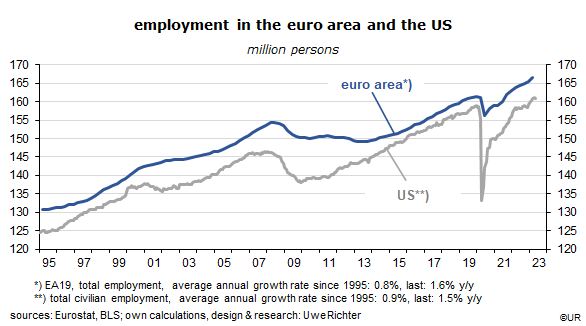

Wages are the main reason why US inflation rates do not fall more quickly. Because they had risen much less than the general price level, most households had experienced a reduction of real incomes in recent years. Since US payrolls continue to increase briskly (about 2½% y/y), workers find it relatively easy to achieve higher wages and thus catch up with inflation. Hourly wages were about 5% y/y in May. On the cost side, they are the main driver of inflation at this point – they are the most important cost component.

GDP growth got a much bigger hit in China so far. During the pre-Corona decade to 2019, average annual growth of real GDP was 7.3%, but has now declined to just 4.8% (including the OECD’s projections for 2023 and 2024). Since the world economy had lost momentum, exports are not doing as well as in the past while the bubble in the all-important construction sector has finally burst. Structural breaks such as these tend to reduce overall economic growth. One effect has been the steep increase of youth unemployment to more than 20%, another the decline of inflation rates. In April, consumer prices were almost the same as one year ago (+0.1% y/y) while producer prices were down (!!) by 3.6%. Deflation is in the air.

Real GDP of the 19-country euro area will expand only very modestly this year and next (+0.9 and +1.5%, according to the OECD). But this is close to the growth rates of the pre-Covid decade which in turn suggests that output gaps will not increase significantly and that there will be no additional deflationary effects from this side. The reduction of euro-denominated commodity prices (by 23% y/y) and the recent appreciation of the euro are more significant than GDP growth at this point. The euro’s strength reflects the fact that the gap between US and ECB policy rates is shrinking – the difference between the effective Federal Funds rate (5.08%) and the ECB deposit rate (3.25%) will be reduced by 25 basis points this Thursday, and probably by another 25 basis points on July 27, to about 140 basis points. This will support the euro exchange rate and help to lower euro area inflation.

If long-term interest rates do not move much in coming weeks, the inversion of the euro area yield curve will continue, which is bad news for the banks. Their (short-term) cost of funding gets more and more expensive while the yield of their (typically longer-term) assets stagnates. Bank profits will take a hit. An additional risk is that long-term interest rates might rise again if inflation does not come down quickly – long-term inflation expectations are low, but if actual inflation remains elevated they may be revised up, causing a sell-out in fixed-income markets. Right now, the yield of 10-year Bunds is 2.38%, very low compared to the euro area headline inflation rate of 6.1% y/y. Investors are thus surprisingly optimistic about future inflation. They are obviously convinced that the latest fall in European import and producer prices will, with the usual time lag, trickle down to consumer price inflation. Wishful thinking? If actual inflation stays high for longer, inflation expectations will probably rise which will then raise market yields and trigger a major depreciation of fixed-rate assets, especially in the real estate sector – which is already in bad shape.

For European inflation, wages are the largest risk, just as in the US. Since employment continues to be very strong (overall +1.6% in April, payrolls +2.6% y/y) hourly wage inflation has reached 4½% y/y (Germany about 6%) which is far above the ECB inflation target of 2%. European workers attempt to catch up with inflation – and their negotiating power is quite strong right now.

The bottom line is that global inflation is on the way down, but this does not mean that we are heading for another period of stagnating consumer prices and policy rates in the neighborhood of zero. Hard to believe that a severe recession may be around the corner at a time when American, European and Japanese labor markets are very robust.

But if I look at the risks I cannot exclude the possibility of another global financial crisis. At least three dangerous developments are under way: in China (crisis of the construction sector, highly indebted public sector and state-owned enterprises), in US stock markets (record-high cyclically adjusted price-earnings ratios, CAPE, in combination with a recession) and in the OECD banking sector (caused by restrictive monetary policies and high leverage ratios, the legacy of zero interest rates). Should all these risks materialize one day we could indeed be facing another global deflation. But it usually turns out that reality is not as catastrophic as in our worst dreams. Market economies are actually quite flexible. As the wise old economist Paul Samuelson used to say, “the stock market has predicted nine of the last five recessions.” In other words, relax, but take some precautions nonetheless.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.