Market Commentary: Sweden, the ecological wunderland

Dieter Wermuth, Economist and Partner at Wermuth Asset Management

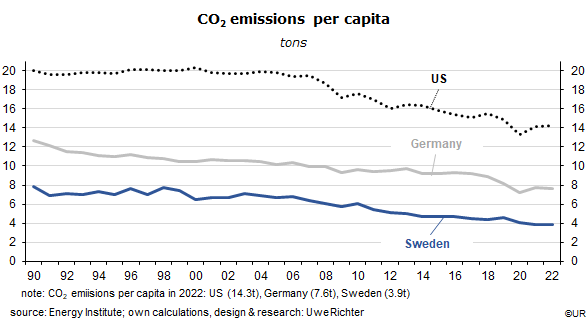

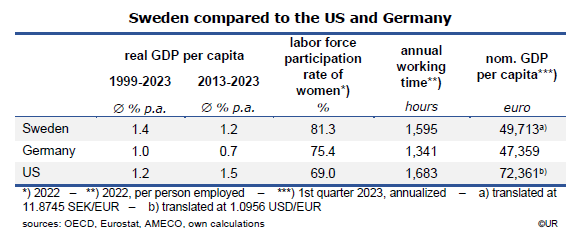

Few analysts had thought that it was possible: the Swedes did it – to reduce CO2 emissions year after year and to significantly expand real GDP, as a proxy for the general wellbeing. On a per capita basis, emissions are presently just half as large as Germany’s, and only 28 percent of US emissions. Since 1990 they have been reduced by one half while real GDP per inhabitant has been up 61 percent. Only the Scandinavian neighbors and Switzerland have achieved such an impressive combination. Climate mitigation and economic growth are simultaneously possible. By extension, may it actually be feasible that structural change towards an emissions-free economy may not only be growth-neutral but growth-accelerating? Because it pays to be an early adopter, to be ahead of other countries and gain competitiveness in climate products and services?

In a large empirical analysis two economists, from MIT and Harvard (Metcalf and Stock: The Macroeconomic Impact of Europe’s Carbon Taxes) have come to the conclusion that European CO2 taxes did not have any negative effect on growth and employment, and that in the long run those taxes did not reduce potential GDP growth and employment. Changes of relative prices, for instance as a result of new and rising carbon taxes, play no role compared to technical progress and other fundamental determinants. On the other hand, the authors have not found evidence that the introduction of carbon taxes is growth-enhancing.

Sweden had introduced a carbon tax in 1991, at about the same time as Finland, Norway and Denmark. It is based on the principle that polluters have to pay for the environmental damage they cause. It increases the incentive to save energy, to improve energy efficiency and to develop alternative, non-fossil fuel sources of energy. Over time, the tax was continuously changed and, most importantly, ambitiously increased. The tax was seen as a compliment to the existing energy tax and is levied in proportion to the carbon content of the various fossil fuels. At the start it was at 250 kronor per ton of CO2 emitted; it is now at 1,330 kronor. Using an exchange rate of 10.87 kronor per euro, it has gone up from 25 to 122 euros, almost by a factor of five, and is by now one of the more important sources of government revenues. Since the rate hiking process has been steady and predictable, households and businesses had enough time to adjust their spending, saving and investment models. It has also been good for the political acceptance of this kind of climate policy. As an aside, it is worth mentioning that the ETS price for one ton of CO2 emissions had passed the 100 euro mark for the first time in February 2023 – it is in the neighborhood of Sweden’s carbon tax.

In the beginning, those segments of industry which were not covered by the European emissions trading system ETS had to pay only a very low tax. The government, under pressure from industrial lobbying groups, was concerned about international price competitiveness and jobs. Since 2018 such firms pay the same tax rate as everyone else – a special treatment was no longer necessary.

As an indirect tax, the carbon tax has regressive effects on household incomes, just as the value-added tax: in relative terms, low-income households pay a higher tax than those with a higher income. This was the main reason why the carbon tax was an important part of the comprehensive tax reform package of the early nineties. By lowering the income tax burden on the poorer parts of the population the Swedish government successfully avoided social conflicts. There is, incidentally, no “climate dividend” in Sweden, but the general government budget is used to counterbalance undesirable income distribution effects of the carbon tax and other climate policies.

The various Swedish governments have always, and especially in the early years, emphasized that the financial burden of climate mitigation should not be carried by the little guy and that social justice must always be maintained. This is an important lesson that can be drawn from the Swedish experience. Governments which consider introducing a carbon tax must never underestimate the importance of social side effects.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.