Dieter Wermuth, Economist and Partner at Wermuth Asset Management

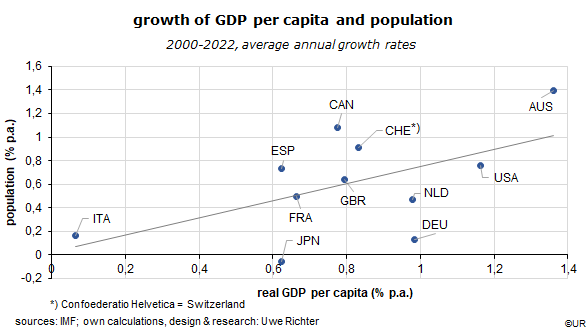

My thesis, that a growing population does usually not just lead to an increase of a country’s real GDP but also to a more rapid increase of per capita output, is not easy to prove empirically. In recent decades there has been a strong correlation (R2 = 0.32) between the two, based on a sample of large and rich OECD countries, but the direction of causality is not clear: it could be that population growth is high when economic growth is high, or the opposite – that per capita income growth is high in areas where immigration is strong. I had in mind the US of the nineteenth century, when waves of European immigrants, with their diverse professional backgrounds and their determination to succeed materially, led to a productivity miracle which made the country incredibly rich and, in the end, the world’s dominant economy. Expanding markets intensify the division of labor and thus boost productivity.

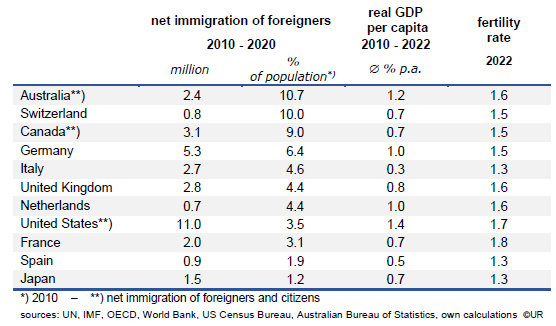

The data cannot be used to prove the opposite theory either – that immigration and strong population growth reduce a country’s standard of living. On balance, the overwhelming evidence from my rich-country sample is that it has a positive impact. In the US, for instance, the population had increased at an average annual rate of 0.76% between 2000 and 2022 while real per capita GDP growth was 1.16%. Germany’s numbers were 0.13% and 0.98%. At the other end of the scale were Italy (0.16% / 0.07%), Japan (-0.06% / 0.62%) and Spain (0.73% / 0.62%).

The analysis suggests that from an economic point of view it does not make sense to keep out immigrants. It is therefore surprising that the recent success of Europe’s extreme right is mainly the result of anti-immigration and anti-multiculturalism polemics, especially against Islam, in addition to their opposition to same-sex marriages and everything woke, their denial of climate change and their support of Putin. Several such parties have directly or indirectly entered government by now (Finland, Denmark, Sweden, Poland, Italy and Hungary). After Sunday’s national elections in Spain, post-Franco Vox hopes to join the conservative PP in a new right-wing coalition government. In German surveys of voting intentions, the AfD (the Alternative für Deutschland) is now ahead of the Social Democrats and thus the second-largest party. The new leadership of the Christian Union, Angela Merkel’s party, is in response about to jump on the xenophobic bandwagon.

The EU Commission, not to be outdone, has just signed a deal with Tunisia which provides massive financial aid in exchange for stopping African refugees to take off for Italy and Greece, ie, to emigrate to the EU. Similar negotiations are under way with Algeria and Morocco, two other countries on the southern shores of the Mediterranean. The idea is to prevent Africans to apply for asylum in the first place (because it would normally have to be granted). Britain pursues the same policies. Uncontrolled immigration is mostly regarded as dangerous for Europe’s stability and should not be allowed, no matter what. Where have Europe’s humanitarian principles gone?

That immigration is something positive for rapidly aging countries is a macroeconomic and thus a rather abstract concept for people who feel they have been left behind. In their search for a scapegoat for their miserable situation they have identified foreign-looking immigrants – who supposedly exploit Europe’s generous welfare system without contributing much, if anything, to its finances, leaving less for needy natives. Xenophobia is mostly a social problem but it also shows how difficult it is to convince the public that a friendly welcome and the integration of immigrants is actually a win-win situation.

Immigration pressures will persist as long as Europe remains so much richer and safer than the countries of the global South. On the other hand, the population of European countries would shrink a lot without the influx from abroad – because fertility rates are far below the stabilization rate of 2.1 children per woman. France is presently at 1.8, Germany at 1.5 and Italy at 1.3. A turnaround is not likely. For comparison, sub-Saharan countries such as Ethiopia, Kenya or Nigeria have fertility rates in the order of 3 to 5!

In Europe, workers will have to support more and more pensioners while Africa is increasingly overpopulated. The demographic imbalance in Europe is just as dangerous for social peace as a more liberal immigration policy. Raising the fences at the borders is not a viable long-term solution. A pragmatic and humanitarian approach is needed. But nothing of that sort is in sight. The EU Commission prefers to bust its head in the sand. For the time being, the xenophobes have the upper hand and force Brussels to discard the EU’s founding principles. Where is the courageous politician who will develop and popularize a more positive immigration narrative?

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.