Dieter Wermuth, Economist and Partner at Wermuth Asset Management

A ghost is going around in Germany, called de-industrialization. It’s the topic of countless studies and articles, and those who are not aware of the actual numbers could easily come to the conclusion that the country’s economic decline is under way and irreversible. The impression is reinforced by forecasts that real GDP will shrink this year, compared to 2022 – among the larger countries only Argentina will do worse. According to the IMF’s new World Economic Outlook the Russian, British and US recessions, near-certainties until a few months ago, have now been called off.

In reality all these worries about decline are just a lot of ado about nothing, nothing to worry about. Other countries would be happy to have Germany’s “problems”.

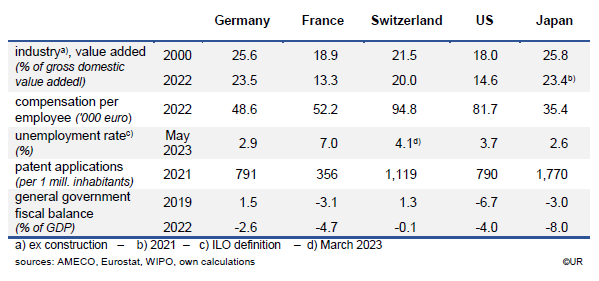

The first and most obvious point is that in all rich countries the share of industry in value added is on a downward trend. Most advanced in this respect is France where the share has declined by no less than 5.6 percentage points, to 13.3% between 2000 and 2022, followed by the 3.4 percentage point reduction in the US (to 14.6%). Germany, with a decline from 25.6% to 23.5% continues to play in a very different league and is almost identical to Japan in this respect. Together with China, both remain the biggest players and competitors in international trade.

In the OECD area the demand for services is rising faster than income and takes longer to approach saturation points than the demand for goods. Think of medicine, old age care, education, research and development, public social services, hotels and restaurants, entertainment, sports, asset management, business services of all kinds, legal and tax consulting, or a better environment. Most people cannot get enough of these, compared to physical stuff such as food, cars or housing.

In other words, there is no reason to fear that de-industrialization will lead directly to rising unemployment and economic decline. This may be a realistic prospect for France where unemployment is still 7.0%, but other countries such as the US and Switzerland, with their world-beating service providers, are characterized by significantly higher per-capita incomes than those of traditional industrial countries. In 2022 and at actual exchange rates, Swiss and US labor income per worker was 95,000 and 82,000 euros, respectively, compared Germany’s and Japan’s 49,000 and 35,000 euros. Only France seems to be struggling to achieve a successful transition from industry to services. In general, de-industrialization is something desirable going forward, not a ghost to be afraid of. I may sound cynical, but I am not.

The inevitable structural change requires active and creative policies. To enter into an international war of subsidies for the most promising technologies looks like a waste of resources from this perspective. I may stretch my point, but if American or Chinese taxpayers want to spend money on giant battery factories, they are free to do so. We can then buy cheap batteries from them and can appreciate the opportunity that someone else has paid for this sort of industrial policy and that we have saved our money for projects with a high marginal utility for our society, such as early-childhood education, first-class universities and institutes of technology, a good infrastructure, a healthy environment or a reliable military. Rare is the case where the state has correctly identified successful future industries and products.

Since Germany, with its high national saving rate, remains one of the largest net exporters of capital, it can acquire shares in those subsidized foreign firms and continue to make significant capital investments abroad. Not everything must be produced at home. The international division of labor is something good – as long as it is organized on a fair basis and does not lead to a concentration of risks.

The numbers presented above show that high wages do not necessarily cause high unemployment. There is no problem if wages are matched by productivity, ie, by a large capital stock and well-qualified workers. The quality of human capital is the main determinant of general welfare going forward. Cheap energy, a weak exchange rate, low real interest rates and wages are less important in the long haul. Even less important are comprehensive industrial policies. But it helps a lot to promote competition, to fight monopolies and dumping strategies and to keep borders open for goods, services, capital, and immigrants. Social implications should always be kept in mind, though, because without solidarity a society will find it near-impossible to improve productivity and the welfare for all.

On balance, the inevitable de-industrialization should be seen as a chance for creating a higher standard of living. We should try to make the best of it.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.