Dieter Wermuth, Economist and Partner at Wermuth Asset Management

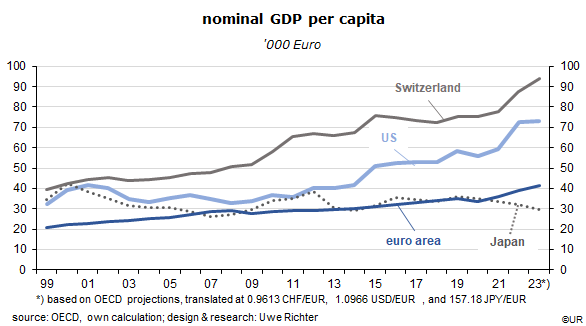

If I compare the development of European income and output to Swiss and US numbers in recent decades I could easily get depressed, especially if I use nominal GDP per capita at actual exchange rates as a yardstick for the standard of living. I am aware that the euro area is doing quite well relative to the US if I use other indicators, such as the income distribution, the quality of the environment, the labor market participation rate of women, life expectancy or crime statistics, but average GDP is simply the easiest and most comprehensive number that informs me about the financial situation of the population.

In 2008, US per capita GDP was 14 percent higher than that of the euro area, now, 15 years later, the difference has increased to 77 percent. The US performance vis-à-vis Japan has been even more remarkable. How have Americans done it? Before I am overtaken by admiration I have a look at Switzerland where things have been even better than in the US, in spite of a lack of natural resources and a relatively small population – which is a disadvantage in terms of economies of scale and productivity. Swiss GDP per capita exceeds euroland’s by no less than 128 percent.

Differences in growth rates can have different causes, and they are not carved in stone. The environment may change, not least because of targeted growth policies. In the following I will focus on just two policy areas: differences in fiscal and monetary policies.

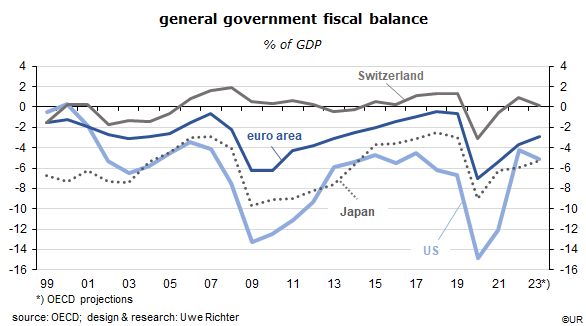

It is obvious that the US administration has pursued significantly more expansionary fiscal policies than the governments of the euro area during the three recessions since 1999, the year the euro was introduced. To simplify the analysis, I use changes in government budget balances as proxies for the direction and size of fiscal effects. If I were more rigorous – and patient – I would compare actual with cyclically adjusted deficits. By how much do recorded deficits exceed “neutral” deficits? For this I would have to calculate the trend values of potential GDP. I find this too complicated right now, and I also bet it would not change the message in any meaningful way.

Just two examples: during the 2007/2009 recession the US government budget deficit had grown by 9.8 percentage points (to 13.2 percent of GDP) while the aggregated deficit of euro area governments rose by 5.6 percentage points (to 6.3 percent of GDP). Over the course of the Corona crisis the US fiscal deficit rose from 6.7 to 14.9 percent of GDP, or by 8.2 percentage points whereas the European deficit rose by 6.4 points to 7.1 percent of GDP. In other words, in the US, the decline of private demand was much more energetically compensated by the government than in the euro area. One of America’s main economic principles is to avoid recessions – the subsequent recovery will take care of the budget deficits. Since the US, as a result, usually bounces back more quickly than European economies, its average growth rate is higher. It could be that the euro area cannot really compete in this regard because there is no common fiscal policy and no minister of finance. Let me point out, though, that Switzerland has conducted rather restrained anti-cyclical policies and has still succeeded impressively, avoiding recessions and unemployment and achieving healthy growth. Steady does it (sometimes).

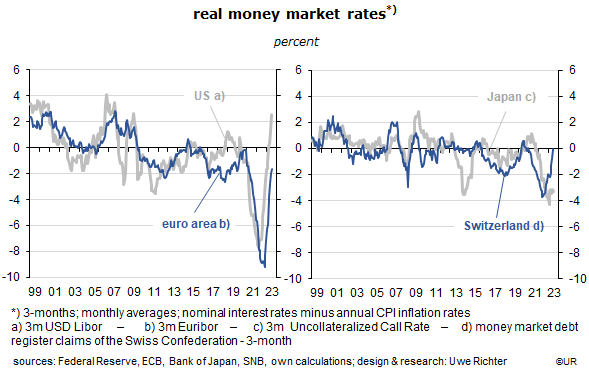

As to monetary policies, it is not easy to detect significant differences between Fed and ECB strategies. After 2018, the Fed has reacted more promptly to signals that a crisis was coming, but the scale of the initial monetary easing and, later, of monetary tightening does not differ in any meaningful way.

In the meantime, there are multiple signs that European demand for goods and services is weakening quickly and that inflation will probably come down on its own toward the ECB target of 2 percent. The central bank has indicated that policy rates will be raised again in September unless a rapid further improvement of inflation numbers suggests otherwise. Before inflicting too much austerity on the economy the best strategy seems to me to wait and see. Seldom have interest rates been raised so quickly and by so much as over the past year.

I cannot answer the question whether the ECB has boosted medium-term GDP growth in one form or other. Different from the Fed it does not have a dual mandate and must not worry too much about target no. 2, full employment. Even so it has recently been less successful than the Fed in its fight for price stability. It could be that inflation is not so much responding to differences in monetary policies but mostly to high energy prices – the US is a net exporter of energy while the euro area is a net importer.

Finally, exchange rates! In international comparisons they play a major role in determining the value of a country’s nominal GDP. Since 2014, the euro has depreciated by 21 percent against the dollar, and by 26 percent against the Swiss franc. In addition, the euro is not really a reserve currency as long as governments are not guaranteeing each other’s debt. The euro area is not yet a nation, and may never be, and therefore does not fully benefit from the fact that the aggregated budget deficit of the region is much smaller than that of the US, or that the current account surplus will be almost 2 percent of GDP this year, compared to the US deficit of 3 percent. Usually, these balances are among the main determinants of exchange rates. The US has once again a so-called twin deficit, but FX markets couldn’t care less.

Other than the Swiss franc, the euro has not the status of a safe haven currency. It is still to some extent a work in progress.

Going by purchasing power parities, the euro is undervalued against dollar and franc by about 25 and 37 percent, respectively.

In this context, it is a little strange that for some time long-term (10y) yields of euro area government bonds have been about 150 basis points lower than those on US Treasuries, in spite of Europe’s higher inflation rates and its weak exchange rate. Does this reflect the expectation of investors that the euro will gain on average one and a half percent in value annually against the dollar over the next ten years?

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.