Dieter Wermuth, Economist and Partner at Wermuth Asset Management

There is a popular rule of thumb for long-term investors of securities: 60/40, 60 percent equities, 40 percent bonds – and take out no more than 2 percent annually of net asset value. In this way assets are not only preserved but can continue to gain in value over time. When stock prices have increased a lot while bond prices have fallen – as long-term interest rates have increased – financial investors have to sell equities and to buy bonds until the desired equilibrium has been reached again. For US markets this presently means to turn book profits on equities into realized profits and use revenues to buy, for instance, 10-year US Treasuries. A similar strategy makes sense for German and other European securities markets, but the need to change allocations is less pressing – if there is any at all.

Over time, equities are the better alternative and should be overweighted in securities portfolios. The so-called risk premium, the annual extra return compared to bonds of trustworthy issuers, is historically between three and six percentage points. This is the compensation for the risk that stocks may become worthless as companies’ profits decline or turn into losses, or that firms disappear. The higher the risk premium the better the protection against falling stock prices, ceteris paribus. Whether the premium should be three or six percentage points, or even more, cannot be answered once and for all. Stock prices reflect expected earnings per share as well as the expected returns of alternative assets, such as real estate, commodities, or bonds. There is no “correct” level of stock prices.

With somewhat more confidence we may determine whether the risk premium is high or low compared to what has been observed in the past. Price-earnings (P/E) ratios are usually available for equities or a stock index which allows me to calculate the so-called earnings yield, the inverse of the pe-ratio. A P/E ratio of 20 is the equivalent of an earnings yield of 5% (1/20 = 5), one of 10 translates into a yield of 10%. If the “real yield” of a long-term government bond is, for instance, 2%, the risk premium is three percentage points in the first case (5 – 2 = 3), and eight points in the second case (10 – 2 = 8). A stock with a P/E ratio of 20 is considerably more expensive than one with a ratio of 10. The difference is caused by investor expectations about future per share earnings – if the ratio is high the consensus will be that earnings will rise faster than those of the “cheaper” company. This may turn out to be correct – or not.

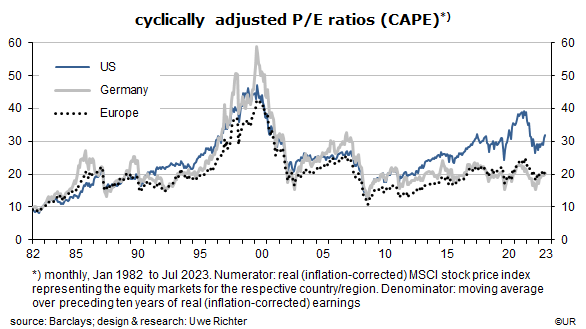

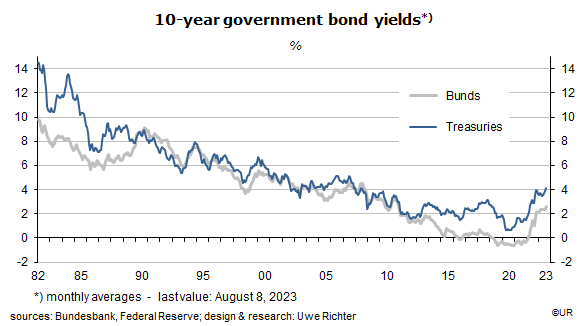

The P/E ratio for the MSCI US stock market index (more precisely: its “CAPE”, the cyclically and inflation adjusted P/E ratio) has recently been at about 32 which translates into an earnings yield of 3.1%. 10-year US Treasuries, on the other hand, are presently yielding around 4% which, taking into account long-term inflation expectations of 2 ½ percent, is the equivalent of a real “riskless” yield of 1.6% and a risk premium of just 1.5 percentage points. Whenever the risk premium was so low / the P/E ratio so high markets have corrected significantly. From today’s perspective I would add that the short-term outlook for the economy and corporate earnings is deteriorating. If investors find this sort of analysis plausible, they should change their allocations: sell stocks, buy Treasuries or other high-quality dollar bonds. Such re-allocations should take place on a regular basis in any case, like once a year or once a quarter, but, because of transaction costs, not too frequently.

As mentioned above, the need to act on the portfolio structure is less urgent in Germany and other European markets. The long-term P/E ratio of stock market indices has recently been around 20 which corresponds to an earnings yield of 5%. At the same time, the nominal yield of 10-year German government bonds is in the order of 2.5% and is thus almost the same as long-term inflation expectations – which results in real bond yield of between zero and 0.5%, and thus an equity risk premium of no less than 4½ to 5 percentage points.

To be sure, the level of CAPE has occasionally been a lot higher than today: in Germany it had reached 59 in 2000, the year of the dotcom bubble, and 32 in 2007, just before the Global Financial Crisis. In Western Europe as a whole, the ratios were similar in those two years: 43 and 26. In other words, today’s average stock prices are presently near a “normal” level while real euro-denominated government bond yields are so low that a major reshuffling between asset classes does not make much sense. This can – and probably will – change once the overvalued US stock market corrects in earnest. Because it is so much bigger and so much more liquid than stock markets on this side of the Atlantic, and because the arbitrage relationship is so strong, it calls the shots. When it comes down, Europe will come down as well. Investors can only hope that the decline will be more modest – because valuations are more reasonable.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.