Dieter Wermuth, Economist and Partner at Wermuth Asset Management

To speculate about deflation again at this point looks premature at first glance, but not at the second. For several reasons the risk of a falling consumer price level has increased. Most importantly: the rate of capacity utilization has declined in recent years, in spite of near-full employment, because growth of real GDP in the big economies is significantly less than before the pandemic. Forecasts for this year and next suggest that growth will remain below trend which means that the output gap will grow further. In such an environment it is difficult to raise prices and wages.

As to wages, there is not yet much evidence of deflation because workers have so far been in a strong position. They have succeeded in negotiating a compensation for the high inflation rates caused by Russia’s invasion of Ukraine and the subsequent explosion of fossil fuel prices. While the wind is now changing on labor markets, fairly high wage settlements still continue to prevent a more rapid decline of consumer price inflation which in turn prompts central banks to keep the foot on the brakes, notwithstanding the deterioration of the economic situation. China is probably the main exception: youth unemployment has reached troubling dimensions.

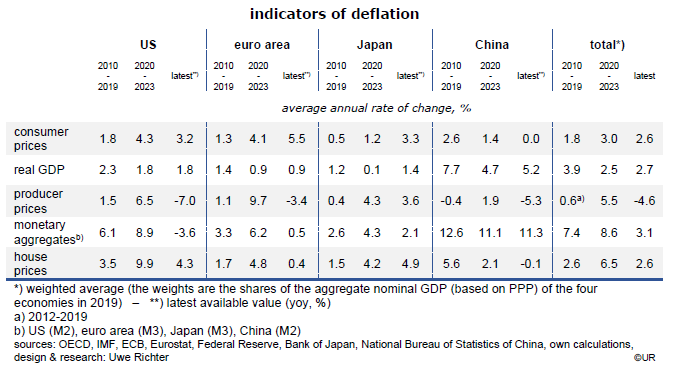

Compared to wages, output price levels are more visibly heading for deflation. Producer prices, as the most important leading indicator of consumer price inflation, are under significant downward pressure, reflecting the weakness of the housing, office and manufacturing sectors which are all, to varying degrees, in recession globally. High policy rates are leaving their traces. PPI inflation in the US, in China, the euro area and in Japan is now on average at -4.6% y/y.

A crash of important asset prices, real estate and equities in particular, could accelerate the reduction of general inflation that is under way in any case. Last week I had pointed out that US equities were dangerously overpriced on the basis of CAPE, the cyclically adjusted price-earnings ratios, and could decline a lot, especially if the economic slowdown leads to disappointing corporate earnings. The market capitalization of US companies accounts for more than half the world’s total. Office real estate assets are exposed to similar risks – in the wake of the home office revolution vacancy rates have increased, making these buildings less profitable. In China, the situation of the housing sector is extremely serious as well. In general, banks have to write down more and more of their mortgage loans and will face financial problems themselves – they could become the trigger of the next global financial crisis. As consumers’ wealth declines they become more cautious and spend less, which reinforces the deflationary effects that are already working their way through the system.

For the ECB and the Fed there are less and less obvious reasons to continue raising policy rates. Since the spring and early summer of 2022, they have hiked them between 425 and 525 basis points, more than at any time in past decades, and are now in the process of reducing the size of their balance sheets and the volume of central bank money. Money supply M3 and M2 – and thus lending – expands at about half the speed in the years before the pandemic. Enough is enough. By mid and end-September when central banks discuss their next steps, it will be obvious that deflation, not inflation is the main risk.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.