Dieter Wermuth, Economist and Partner at Wermuth Asset Management

On August 19, the British “Economist” had asked on its title page whether Germany was “…. once again the sick man of Europe?”. To ask the question is to suggest the answer – no, it looks pretty bad. Real GDP has been stagnating since the second quarter of 2022 and seems to be heading toward recession. How come? The Economist has identified five problem areas: (1) Capital spending is lacklustre, especially by the public sector and in IT. (2) An excessive bureaucracy and the fetish of balanced government budgets are killing entrepreneurial vigor. (3) Germany is dangerously dependent on China, a country which is struggling and exposed to sanctions these days. (4) The energy transition causes heavy frictional costs and reduces economic growth in the near term. (5) The population is aging rapidly – the young have to support more and more pensioners. Firms complain about a lack of professional workers.

How serious are these problems? Not very, I would say, as long as there is no steep increase in unemployment. Using the methodology of ILO, the International Labor Organization, the unemployment rate has been stable at 3.0% – of the large industrialized countries only Japan has a lower rate (2.5%). More importantly, the number of jobs continues to rise, not as fast as before the Corona crisis but still at annualized and year-on-year rates of 0.7%. Business complains about the bad economic situation and a bleak outlook, but on balance they keep hiring. Things cannot be so bad for them. Foreign business, in particular, has begun to boom again. Over the six months to July, the volume of new orders from abroad has increased at an annualized and seasonally adjusted rate of no less than 30.8%, driven by a weak exchange rate and the robust recovery of the world economy, and in spite of a steep increase in unit labor costs.

Funding costs are a serious problem, though. They reflect the rate hikes by the ECB – which are the response to the former explosion of import and consumer prices, ie, to basically external factors. Since the spring of last year, the entire European yield curve has shifted up by about 400 basis points. Ten-year mortgage rates are presently around 3.7%, after they had fluctuated around 1% for several years before Corona. This has led to a crash of construction activity. Had it not been for the brisk housing demand caused by the growing population (fugitives!), the crash would have been worse.

Capital spending by companies is also rather interest sensitive. Exacerbating this effect is the increasingly downbeat mood, as reflected in business surveys. Here again, we should keep things in perspective: the national accounts investment ratio was still at 22.4% (of nominal GDP) in Q2, somewhat higher than in the US and somewhat lower than in Japan. The fact that it is not higher is the result of massive capital exports, not least to the United States and China where marginal returns on investment seem to be higher than domestically. In the first half of 2023, Germany’s net capital exports were 6.3% of GDP, a number comparable to those of recent decades. One effect of this is the 3.4% of GDP surplus in the balance of primary income (a part of the current account). For the country as a whole, this is effortless additional income which takes some strain off the pension contract between generations. It is the opposite of what we see in the US.

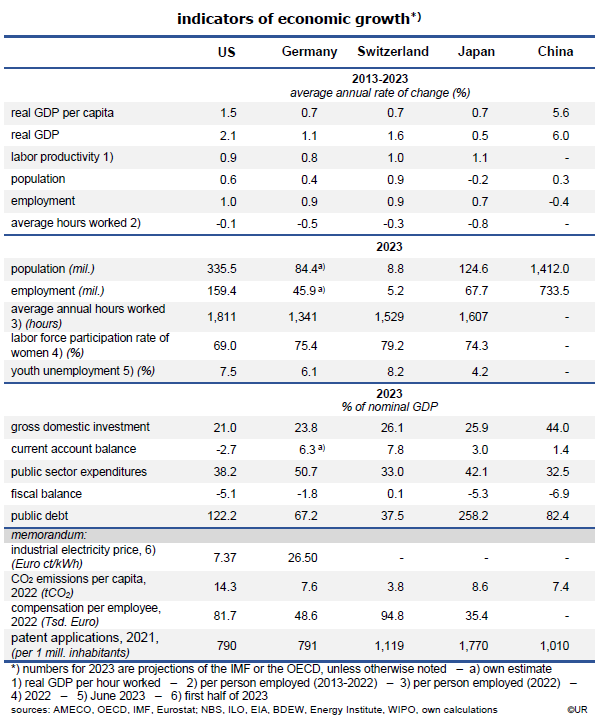

Overall, with regard to the determinants of economic growth, Germany has been playing in the same league as the US and Japan in the past decade. The growth rates of employment and productivity were about the same – on average almost 1% per year – whereas the gross investment ratio is around the mean value among industrialized countries, and thus well below China’s and Japan’s, the main competitors in world markets. In terms of patent applications (as an indicator of innovation and modernity) Germany is on par with the US but far behind Japan. On the other hand, government finances are in significantly better shape than those of the two other countries. In case there is a shortfall of demand and a risk of a major recession, Germany has a lot of dry powder to stimulate output.

Not to forget, growth is presently so weak because the rapid transition from fossil fuels to renewables causes lots of friction. A large part of the capital stock has been idled. Industrial electricity and gas prices are several times higher than in the US, and also at least twice as high as in Japan. At today’s exchange rate, one US gallon of regular gasoline costs no less than 7.99 dollars. It is a positive sign that the German economy continues to do well on world markets. It can be expected that it will remain at the forefront of an important new industry: climate technology.

There is not much hard evidence that Germany is indeed the sick man of Europe. In 1844, living in exile in Paris, the romantic poet Heinrich Heine had written a poem called “If I think of Germany at night, I cannot sleep” (my translation). In spite of all the problems, he thought that the country was in rude health even then. By the way, for me the healthiest country of them all, in economic terms, is Switzerland. It could be the role model for the rest of the world. Have a look at its numbers!

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.