Dieter Wermuth, Economist and Partner at Wermuth Asset Management

A few days ago, Professor Bernd Raffelhüschen and his research assistants at the Universität Freiburg have published a study about the future of Germany’s social security system, called “Reputable government? The generation balance (between young and old). Update 2023. Reform ideas for a fair health and nursing care insurance.” The authors claim “to have created an instrument for the projection of long-term developments of public finance and their distributional effects.”

The main response in the media has been that government debt is considerably larger than those 66 percent of nominal GDP calculated on the basis of the so-called Maastricht criteria of the European Monetary Union. The true number is a shocking 448 percent – rather than 66. Raffelhüschen calls the sum of explicit and implicit debt the sustainability gap, ie, the claims of present and future generations against the state. “Today, non-visible debt accounts for more than 85% of the state’s total debt.” Dorothea Siems of the Springer Group’s daily Die WELT draws the conclusion that “the German government’s fiscal policies are increasingly irresponsible.”

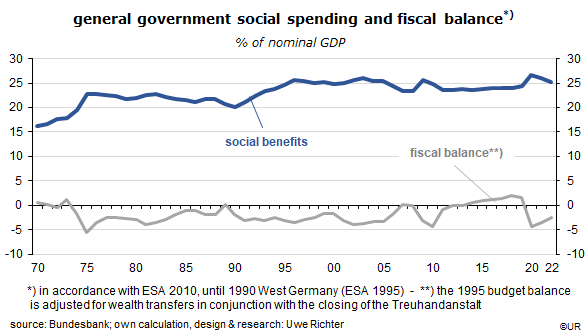

Seriously? So far, the government has no problem servicing its debt. After re-unification in 1990 social spending had jumped steeply to 25.5% of GDP (1996) but has since stabilized around this level and was 25.1% in 2022. Does not look very irresponsible.

But I find it irresponsible to define future government spending as implicit debt. As long as the state is able to reduce its debt service, ie, to cut social benefits or to increase citizens’ taxes and fees, it is extremely unlikely that it will default. In its present form the financing of the social security system is very different from genuine government debt – which is based on an explicit and usually non-revocable contract between the issuer and the buyers of the debt (bonds and similar instruments). The terms of the contract cannot be changed retroactively, except by default or restructuring.

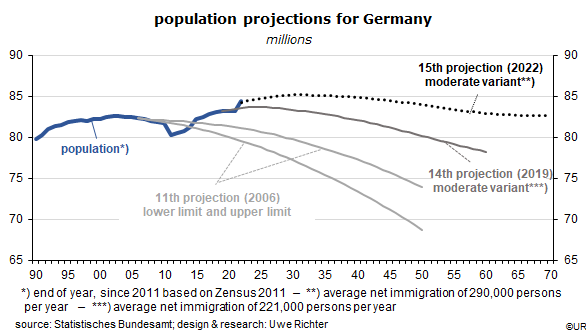

There is, of course, the risk that one day the young may not be able or willing to finance a comfortable standard of living for the old. The number of old people who need support is rising rapidly. But there is also no lack of possible solutions: adjusting the retirement age, financial and structural incentives to increase labor market participation rates of women and old people, raising productivity growth and, most importantly, targeted immigration. It should be possible to invite and integrate something like half a million immigrants per year. This would be just a little more than half a percent of the present population and reverse any trend toward population decline and a rising old-age ratio. Any problems faced by the social security system would simply disappear.

No reason to panic. For many foreigners Germany is an attractive country, rich and safe, where they would like to settle. Instead of worrying about unsustainable implicit government debt and proposing regressive countermeasures such as higher patients’ contributions to medical bills, elimination of refunds for dentistry expenses, or higher insurance premia, academic analysts, most of them civil servants themselves, should focus on how to bring about the necessary structural changes.

Two concluding remarks: the news from Freiburg – that the situation of government budgets is not only worse than expected but almost catastrophic – has been totally ignored by capital markets. The yield on long-term bonds remained unchanged at about 2½% and thus well below inflation. It is also worth noting that the analysts have used a real long-term rate of 3% to calculate the present value of future social security deficits. This is an arbitrary number which is not in synch with real government bond yields observed in recent decades. If a rate of, say, 1% rather than 3% were used, the implied deficit would rise to more than 1,000 percent of GDP. What would happen to the perceived solidity of government finances? Probably nothing. In other words: the study is actually pretty irrelevant.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.