Market Commentary: Initially, structural change reduces economic growth

Dieter Wermuth, Economist and Partner at Wermuth Asset Management

The discussion about Germany’s economic decline, about its status as Europe’s sick man, will not end, stimulated by the endless flow of autumn forecasts to the media, one more pessimistic than the next. At this point the average change of real GDP in 2023 is -0.4% y/y. Compared to neighboring countries which are all expected to grow by about 1% this year, and especially compared to the US and Japan which are both heading for a 2% growth rate, this is indeed a poor number. Even so, the order of magnitude is not so much different, and there are no indications that this year’s growth differentials will persist in the future. Labor markets remain strong.

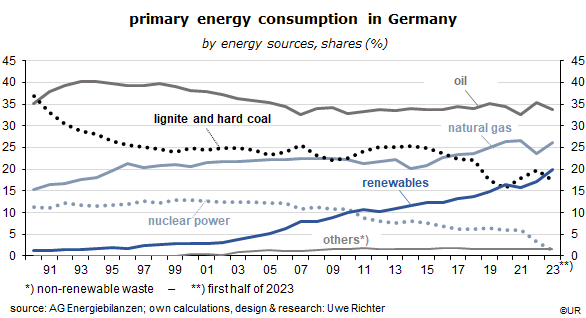

Major structural changes are under way at various fronts: from 2035 all new passenger cars must be electric, revolutionizing the country’s largest industry; all nuclear power plants have been shut down by now, coal power plants will follow by 2035 (or by 2038 the latest); electricity production will soon be almost fully based on renewables – which will require an upgraded and expanded grid; because industrial gas and electricity prices are so high, energy intensive industries are leaving the country; imports of Russian oil and gas have more or less stopped, just as German exports to Russia, previously one of the most important trading partners. On the other hand, the once-sleepy defense industry is now booming again.

All this means that a large part of the capital stock is not useful anymore and must be decommissioned. This includes the human capital stock. Skills that were needed in the fossil fuel era count for less, millions of workers have to retrain. They will initially also be less productive – a sign of this has been the 2% annualized decline of hourly productivity between Q1 and Q2 2023.

At the same time the German government has begun to reduce the budget deficits again – these had increased a lot during the Corona years. The aim is to return to a “black zero” – which may sound virtuous – but amounts to restrictive and pro-cyclical fiscal policies. Germany is once again more ambitious in this regard than most other EU countries and the rest of the G7. The main reward of such a policy is the low level of long-term interest rates on the government’s debt, with a reduction of real GDP in the near term on the cost side of the ledger.

In other words, the present weakness of the economy does not point to some fundamental problems but is largely intentional – it reflects the preferences of the population. In the end, Germany will emerge as one of the leading “green” economies, well prepared for the challenging demands and opportunities of climate change.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.