Dieter Wermuth, Economist and Partner at Wermuth Asset Management

Since spring 2022 both fiscal and monetary reins have been increasingly tightened.

Budget deficits of European governments had grown a lot over the course of the Corona crisis as the weakness of private demand was compensated by expansive government policies. In 2020 and 2021 deficits reached no less than 7.1 and 5.3%, respectively, of aggregated nominal GDP. To make sure that this would not be regarded as the new normal, governments began to reduce the deficits once they were confident that the end of the pandemic was near. For 2023 and 2024 the ECB now expects deficits in the order of 3%. On balance, though, restrictive fiscal effects still prevail.

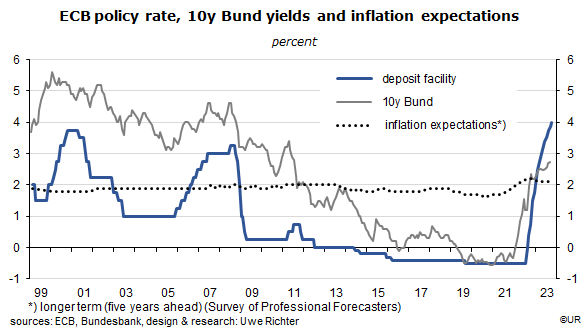

Same thing in monetary policies: when euro area inflation rates rose from almost six percent at the beginning of Russia’s invasion of Ukraine in February 2022 to over eight percent in the summer of that year the ECB argued there was no alternative to a speedy increase of policy rates; since July 2022 the deposit facility rate, which had been in negative territory for nine years, was raised from -0.5% in quick succession to 4.0% last Thursday. This is still less than Euroland’s headline consumer price inflation rate of 5.2 % y/y, but the main impact on the economy has been the sudden reversal of policies and the fact that the entire yield curve rose by between 400 and 500 basis points. Interest sensitive sectors such as the construction industry and business investment were the main victims. Monetary policies had become restrictive.

It would not be correct to blame only fiscal and monetary policies for the present weakness of the European economy. Subdued world trade, falling real household incomes and a softening labor market also played a role. A point has now been reached where a pause in the rate hiking process should be considered by the ECB. In coming months employment numbers will hardly increase anymore while headline inflation rates will fall significantly from now on. Assuming the seasonally adjusted harmonized consumer price index rises by about 0.2% a month will result in a headline rate of between 2¼% and 2½% y/y next spring. The 2%-target looks increasingly achievable.

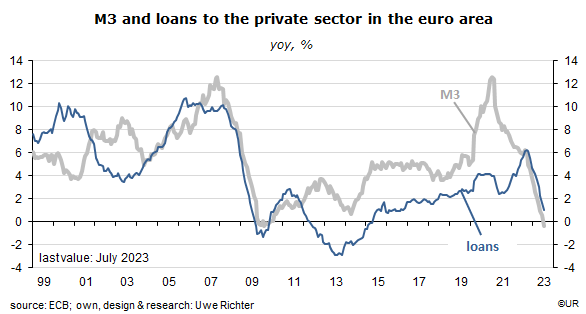

This must not be the end. Both money supply and lending to the private non-financial sector have recently declined dramatically which suggests that overall demand will continue to be weak. Output gaps will rise further which in turn limits the room for higher wages and consumer prices. Because of the new oil price explosion and the wage catching-up processes in European labor markets headline inflation rates have not fallen as quickly as I had expected, but they are heading in the right direction. Deflation may soon be an issue again.

According to Christine Lagarde there had been some board members who would have preferred a pause in the rate hiking process last Thursday. But the majority for another rate increase had still been solid. Still: “we consider that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target” – which means that interest rates have reached a plateau. No more hikes.

A final remark: the ECB has an excellent reputation among market participants, based on at least two indicators. On the one hand long-term inflation expectations have been stable around 2% for several decades now (translated: the ECB will deliver price stability, as announced), on the other hand real long-term yields of the best (ie German) bonds are at least two percentage points lower than those of US Treasuries. This may be so – but how come the euro is so weak?

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.