Globally, CO2 emissions continue to increaseDieter Wermuth, Economist and Partner at Wermuth Asset Management

Despite all the efforts and success stories in rich OECD countries, the emission of CO2 keeps growing year after year in the rest of the world, mostly as a result of the catching-up process in the poorer countries. When people are better off, they start to buy cars, heating systems and air conditioners, to rent and buy larger apartments and houses, and to fly to places around the globe. In this way they increase the consumption of fossil fuels and contribute to the further heating-up of the world’s atmosphere. To prevent this, the prices for oil, gas and coal must rise significantly. The alternative, to reduce demand via slower or negative GDP growth, would be an effective strategy, but so far it is near-impossible to get everybody on board for such an extreme austerity policy.

As long as the catching-up process is in full swing, ever larger amounts of fossil fuels will be extracted and burnt. While the annual GDP growth rates in the poorer part of the world are on average about twice as high as in the OECD area (2012 – 2022: 4.1% vs. 1.9%), the -standard of living is still very low. On the basis of nominal GDP per capita, it is just 30% of the OECD average. It will take a long time to close the gap and to reach a point where the global demand for crude, natural gas and coal will begin to shrink. This is bad news for the climate.

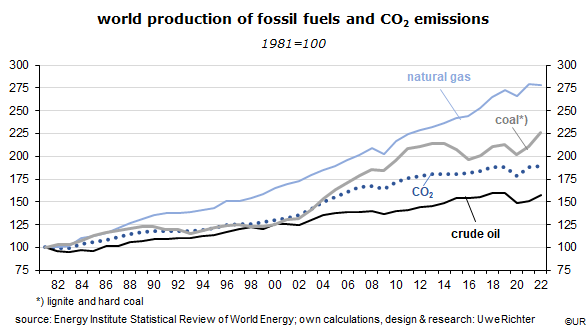

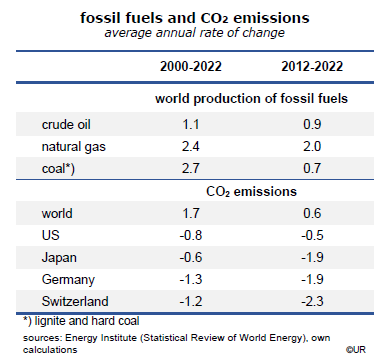

Even so, there are at least two pleasant developments: number one, from a certain standard of living onwards, the demand for fossil fuels begins to shrink; this has happened in all OECD countries; number two: the growth rates of global CO2 emissions have declined significantly in recent years; this looks like a stable trend as the awareness of climate risks continues to increase. I would guess that, if nothing unforeseen happens, in about 20 years a tipping point will be reached, after which global CO2 emissions will decline for good. Many analysts would add: too late!

In Germany, a heated climate debate is under way, triggered by a provocative FAZ (Frankfurter Allgemeine Zeitung) opinion piece by Hans-Werner Sinn, the former head of the Munich-based Ifo-Institut. He has his doubts that green policies will do any good for the climate – they could actually be counterproductive. His main point is that „ global CO2 emissions will rise in response to the coming European ban of cars with internal combustion engines …. people who drive an ICE car make a positive contribution to the fight against climate change, because they take away fossil fuel from people on other continents, while those who drive an electric vehicle contribute to the acceleration of climate change” – because the (intermittent) production of electricity from wind and sun and its prohibitively expensive storage require back-up power plants which use lignite coal, an extremely bad pollutant.

Somehow Sinn assumes that OPEC and other oil producing countries will try to maintain output levels. Means: if Europeans, with their obsession about green energy, reduce their demand for oil, its price will fall, and the rest of the world will use more. Therefore: nothing gained for the climate. Only if the world’s large economies joined forces in what Sinn calls a climate club could they achieve a meaningful reduction of oil demand and CO2 emissions, for instance by agreeing on a common emissions trading system based on a steady reduction of available permits. In this way they could push down oil prices so much that oil production would have to be curtailed or stopped. The club would have so much market power that it could effectively fight free riders who might buy – and burn – cheap oil for their own advantage. Unfortunately, for the time being, a climate club is not a realistic strategy. Important countries such as the US, Russia and Canada are major players on both the demand and supply side of the equation and would have almost no incentive to apply for membership.

So is it fair to call Germany’s policies a flop? Going by the robust labor market and the huge – and rising – surplus in the balance of trade, they have no visibly negative effects on the economy so far. Moreover, those high energy prices (perhaps the world’s highest) are accelerating structural change in a direction where all others will have to go eventually. This creates a competitive advantage. From an allocation of resources point of view it is true that bans on ICE cars and gas boilers are not efficient strategies, but they were probably the only ones that could be sold to the public. And they will help to accomplish the policy target – to further reduce CO2 emissions.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.