Market Commentary: High standard of living, less children, shrinking population – the case for more immigration

Last spring I had already written a piece about this topic. In the meantime, immigration has become an even more important issue in European media and politics, especially in Eastern Europe but also in Italy, Spain, the UK and even in Germany where the xenophobic AfD, the Alternative for Deutschland, has reached more than 20 percent in surveys of voting intentions. The party is still well behind the conservative Christian Democrats but has now overtaken Olaf Scholz’ governing Social Democrats. The main question in the public debate is how to reduce the rising inflow of poor people from Africa and the Near East. Almost no one dares to suggest that these people are urgently needed if we want to preserve or increase the standard of living of today’s and future generations.

One thing is very obvious. Western societies are aging rapidly which means that the young have to support more and more old people – their share in national income is therefore bound to shrink. They get poorer, in relative if not in absolute terms. This trend can be slowed by raising the average retirement age as life expectancy keeps rising, and by boosting the labor market participation rate of women, but the main tool is to encourage immigration of young people who are able and willing to work.

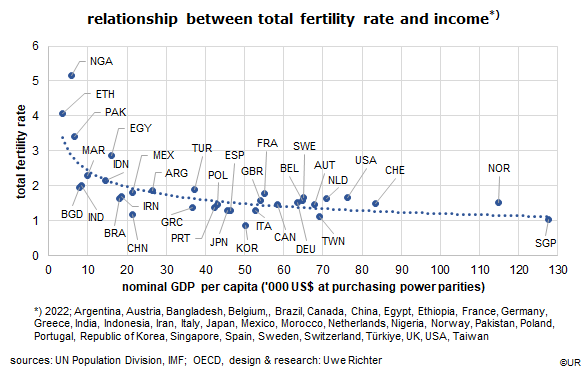

As Western societies get richer the incentive to have large families goes down. This is an important aspect that is either overlooked or not taken seriously in the public debate. One central task of economic policies is to raise the general standard of living and to provide a strong social security net, to reduce life’s existential risks. The closer a country comes to this target the less important it seems for women to give birth to more than one child, or to have a child at all. As the graph shows, this statement is empirically well supported. But we know that a country can only be stabilized demographically in the long term if the fertility rate is 2.1 or higher. In the rich part of the world, the ratio is only in the order of 1.5 which translates into a shrinking population and a mismatch between young and old, or active and non-active people. The adage that the rich get richer and the poor get children does not apply anymore in advanced Western societies, nor in Asian countries such as Japan, South Korea, Taiwan – and China. From a certain income level onwards there is a negative correlation between household income and the fertility rate. In this regard, successful economic policies cause (or are accompanied by) a shrinking population.

In other words, a high general standard of living can only be maintained in the long run if year after year a sufficient number of foreigners enter the rich countries – and are integrated into their labor markets. For Germany I would guess that, on a net basis, the required annual immigration is somewhere between 500,000 and 800,000 (the population is presently 84mn). This is far above the numbers which are proposed by policy makers – roughly by a factor of two. As we can see on the news almost every day there is certainly no lack of people who would love to come here and earn a living. This will remain the case as long as the wide income disparity between OECD countries and the so-called global South persists, ie, for many years to come.

The costs of integrating immigrants into society and labor markets are probably significantly overstated in the media and are dwarfed by, for instance, the expenditures of West Germany for the integration of the East, after reunification in 1990, or by today’s financial support of Ukraine. A small percentage of the government’s social budget would probably be sufficient while the benefits would be huge. Think of normalizing the ratio between employed and inactive people over time, or that no one needs to be afraid that one day there might not be enough workers around to support my pension.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He was a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.