If my country’s government decides, for climate reasons, to make the burning of oil, gas and coal more and more expensive while other countries don’t move, or drag their feet, firms will lose competitiveness and must reduce the number of jobs – as long as domestic renewable energy is not significantly cheaper and generally available. Climate policies in isolation are like own goals in soccer. From a global point of view they are not very effective if my country is relatively small.

For a country like Germany the obvious strategy is to push for a common climate strategy of the 27 EU countries, including a climate border tax which lifts the prices of imports from other regions of the world that contain, as inputs, cheap fossil fuels, and bring them up to European standards, thereby creating a level playing field in terms of energy costs. Such a duty will now be introduced in quick succession by the European Union. The instrument is called Carbon Border Adjustment Mechanism, not a very catchy name, but its acronym CBAM is also quite clumsy.

In any case, it is designed to deter European firms from moving energy intensive production to foreign countries with low environmental standards and close down domestic production. It can work because in international trade the EU is a major player: it accounts for 5.6 percent of the world’s population, 8 percent of CO2 emissions, 16.5 percent of global GDP and 15.3 percent of imports and can thus force all countries which want to export to the EU to introduce climate taxes as well. They must be comparable to European levies. If not, the exports will be subject to the CBAM – and thus generate revenues for EU countries.

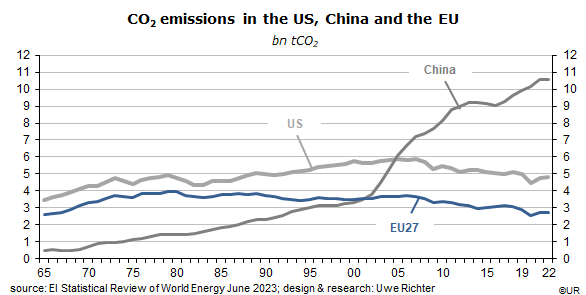

Climate taxes are necessary because global CO2 emissions continue to increase – which brings us closer to an environmental catastrophe. By a large margin, China is the world’s main culprit; on a per-capita basis the United States continues to be number one, though, except for some OPEC countries.

CBAM is, of course, the next European bureaucracy monster. It requires the calculation of the CO2 content of products with an EU origin, plus evidence of their embedded climate taxes – which is the easier part of the exercise – but the same must be done for foreign products that are to be exported into the EU. This is the only way to determine whether the CBAM should be applied, at which rate, or not at all. To fill in even more documents and pay another duty is clearly a brake on economic growth, but since both European and foreign businesses are affected equally it may be an acceptable additional burden. The quality of the global environment is the obvious beneficiary.

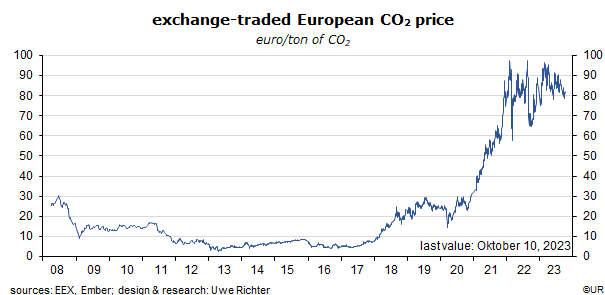

All this is an incentive for countries seeking easy access to the EU market to introduce climate taxes which are about as high as in Europe. From an allocation of resources point of view, the instrument of choice is something like the EU ETS, the European Trading System of emission certificates. In Germany, government revenues from this source will be an estimated 7.8 bn euros in 2023. Including revenues of the national emissions trading system nEHS, which covers the building sector and road traffic, should bring the total to 14 bn euros. Compared to the state’s intake of taxes and fees this is not such a big amount right now, but this will change rapidly in the near future, caused by the increasing scarcity of emission certificates and their steeply rising prices. Foreign governments have a strong incentive to follow Europe’s lead in making emissions significantly more expensive.

Germany’s Federal Office of the Environment (“Umweltbundesamt”) provides the following description of the European emissions trading system ETS: “… it is based on the cap & trade principle. The upper limit (the cap) is the maximum amount of CO2 that entities covered by the scheme may emit. Member states issue the required emission certificates to these entities – partly free of charge, partly via auctions. A certificate allows the owner to emit one ton of CO2 equivalent of greenhouse gas … The certificates can be traded freely on the market (trade). This creates a price for the emission of greenhouse gases (and) an incentive for participating entities to reduces their emissions.”

A reduction by 62% is planned between 2005 and 2030. To achieve this, the number of certificates in the EU will steadily decline while the allocation of free certificates to industry will gradually be eliminated by 2034. The cap & trade principle leaves it to the market to find the cheapest way to reduce emissions. Since the systems puts a relatively heavy burden on the poorer parts of the population (like a regressive tax), it should be combined with something like a climate bonus, paid in equal amounts to all citizens, young and old, poor and rich alike, financed from the state’s ETS revenues – those who cause few emissions would gain, those who emit a lot would not benefit on a net basis. This part of the climate deal has so far been more or less neglected in policy making.

Governments outside the EU will wonder why the EU should be able to generate revenues from charging climate border taxes, and whether it would make more sense to circumvent CBAM by introducing an ETS system of their own and thus fill their nation’s coffers. Over the years, this will have a very positive climate effect. Just as California had been the trendsetter regarding maximum exhaust emissions of passenger cars the EU will now de facto set the global standard for CO2 prices – and in this way reduce CO2 emissions worldwide.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.