Market Commentary: Rapid decline of German inflation rates

Monday was big data day in Germany.

Third quarter real GDP came out a little better than expected, at -0.1% q/q s.a. and -0.4% y/y. It has now stagnated since the fourth quarter of 2019, just before the outbreak of Covid, or for three years and three quarters. If you define a recession as a significant and long-lasting downside deviation of real GDP from trend, this has certainly been one. Two big shocks, the shutdowns of the Corona crisis and the huge increase of energy prices that followed Russia’s invasion of Ukraine in February 2022 were the main reasons for this weakness. Overall consumer price inflation had shot up from near-zero at the end of 2020 to no less than 11.6% y/y by October 2022. Real disposable income plunged in response, while the household saving rate rocketed from about 10½% before Corona, the previous normal, to no less than 20.9% in the second quarter 2020. Consumers were scared – between Q4 2019 and Q2 2020 private consumption, the largest national accounts component of overall demand, declined at an unheard-of annualized rate of 24.3%. Household spending remains very weak to this day.

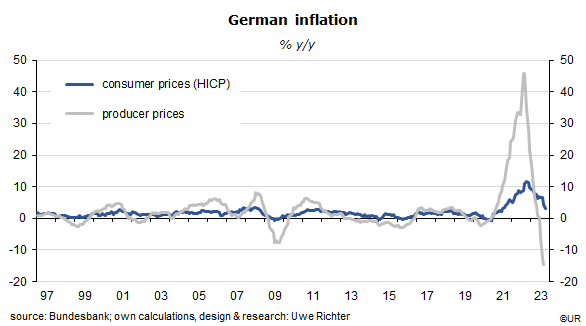

The other news was inflation. Using the seasonally adjusted Bundesbank time series, the harmonized index of consumer prices (HICP) fell by 0.2% m/m in October and rose at a six-month annualized rate of 2.1%, and by 2.8% y/y. German inflation rates are quickly approaching the 2% target of the ECB. Producer prices, which are usually a reliable leading indicator of consumer prices, were down by 14.7% y/y in September. I would guess that the situation is similar in the other countries of the euro area.

As it looks, third quarter GDP has probably been the lower cyclical turning point. Wages are finally rising much faster than consumer prices and will thus improve workers’ purchasing power. Employment growth has been robust all through the long recession – it has recently been in the order of 0.8% y/y. Household consumption will be the main driver of private consumption from now on. It will also be driven by the huge improvement of the terms of trade (+12.4% y/y in Q3). Another, surprisingly strong support comes from residential construction: in August the volume of new orders had increased by an astonishing 18.4% y/y, while the 6-month annualized rate had been even higher: +49.3%. There is a severe shortage of affordable housing, partly as a result of a new wave of immigration and the large decline of construction during the recession. This takes place despite an increase of long-term fixed mortgage rates by about three percentage points since the first quarter of 2021.

Two, perhaps three other stimulating effects can also be expected: the ECB has probably stopped raising policy rates (because of the weak economy und the fall of inflation rates); fiscal policies which had been tight in 2023, as governments tried to contain their large budget deficits run up during the recession, will be mildly expansionary in 2024; the depreciation of the euro will also help – it is vastly undervalued on a purchasing power basis which makes European goods and services rather competitive; in other words, foreign trade will be a growth engine once again. The balance on current account has increased to 6.7% of nominal GDP again.

On balance the risk is that German and euro area growth will, for a change, surprise on the upside. It is about time.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.