Market Commentary: Germany needs (more) immigrants

As long as the difference in the standard of living between OECD countries and the rest of the world remains large there will be strong incentives for people to migrate from poor to rich countries. This process is in full swing and is a major issue in the media and in election campaigns, on both sides of the Atlantic.

For many people immigration is not seen as an opportunity but as a threat. According to voter surveys, the far-right and xenophobic Alternative für Deutschland (AfD) would get about 20% of the seats in the Bundestag, the lower house, if a national election were held next Sunday. The party would be the second strongest, behind the conservative CDU/CSU but ahead of the Greens, the Social Democrats of chancellor Olaf Scholz, the Liberals and the Left. In other rich democracies the situation is similar. Populists paint immigration as a loss-making event: at the expense of the natives, foreigners were leading a good life without contributing much, if anything, to national income.

Against this background it is good to learn that Germany’s Council of Economic Advisers has come out in favor of more immigration, as part of a new growth strategy. Their annual report which has just been published is called “Overcoming sluggish growth – Investing in the future ”. This year, the country’s economy will not be larger than in 2019, the year before Covid, and performs worse than other rich industrialized countries. In the medium to long term, the Council has identified significant growth problems, independent of today’s cyclical weakness. In the years before re-unification in 1990 trend growth of the so-called potential GDP (which determines the standard of living) had been in the order of 2.4% per year, followed by an average growth rate of 1.4% between 2000 and 2019, and by less than 1% over the past five years. If the dynamics of the factors which determine the trend growth of real GDP do not improve, it is likely that the medium-term growth rate will fall to something like 0.4%.

To improve the situation policy makers must reform both parts of the economic production function – capital and labor. On the capital side it is important to stimulate investments in hardware and software, as well as productivity. For the latter, it is important to raise spending on education and research. The ageing of the capital stock must be stopped.

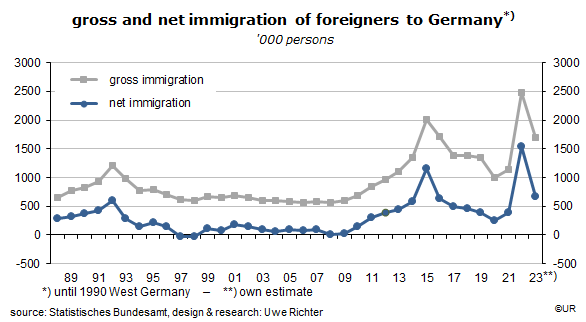

As regards labor supply, it can be raised by providing more incentives for women to join, or stay in the labor force, or for older workers to retire at a later stage. Last but not least, immigration and the integration of foreigners into the labor market should be facilitated. The Council assumes that without such policies net immigration would be 250,000 per year – which is less than needed if the aim is to raise trend growth beyond those dismal 0.4%.

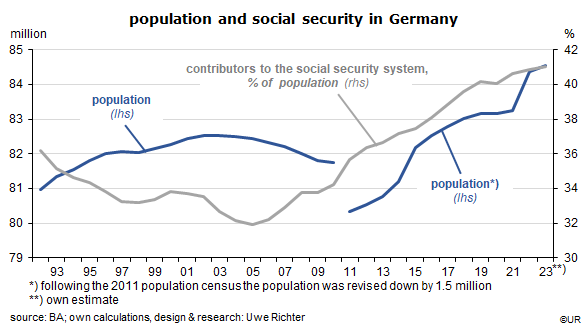

Since Germany’s fertility rate is very low the labor force would shrink year after year. Rising numbers of immigrants are the solution if the state wants to maintain, or increase, its tax and spending policies, including the social security systems. Slow growth means there is little to distribute which in turn implies more fights between young and old, workers and business, tax payers and the state, or savers and borrowers. These fights are a risk to the stability of society and the market economy. Growth is the best medicine to avoid such fights and find acceptable compromises.

Since 2012 there is no lack of foreigners who would love to come for work in Germany. On a gross basis there were 2.5 million immigrants in 2022, and more than 1.5 million on a net basis, both of them new records. This has been the main reason why both the population and the share of contributors to the social security systems have expanded briskly in recent years. The state’s finances are not only rather solid but outright excellent compared, for instance, to the other countries of the G7 group.

It is the frictional costs of integrating foreigners into society and labor markets as well as the financial problems of local communities (which are charged with taking care of the immigrants) which are responsible for the new wave of xenophobia and the success of the AfD party. Even so, it is a minority problem. The middle still holds. Immigration would not be seen as a problem if politics and the media would decide to emphasize its necessity and benefits for society. It is almost self-defeating if the traditional parties try to overtake the AfD on the right lane.

For instance, it could be pointed out that most immigrants are young and willing to do jobs that the natives don’t like. The cost of raising them from childhood to adolescence have been paid by their foreign parents rather than by German society. Put differently, Germany did not have to pay for the human capital it imports. The faster the foreigners are integrated into society and labor markets, the better. The state should provide generous support to accelerate the process because the long-term benefits of the newcomers are de facto much larger than the near-term costs of integrating them.

We have to accept that Germany is now a major recipient of immigrants, in a reversal of trends in the 17th to the 19th centuries when overpopulation drove people to emigrate to the US, Brazil and Eastern Europe. It is a new role, but lessons can be learned from the experience of countries such as France and Britain: immigrants should not be pushed into ghettos, imams and teachers of the Koran should accepts the rules of the constitution, a religion-based discrimination of women and homosexuals is not acceptable, just as anti-Semitism.

As a general rule, immigrants should be welcomed. It is quite a compliment that they have chosen Germany, with its problematic history, as their new home. They are not here as free riders but mostly as people who want to work hard and improve their life.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.