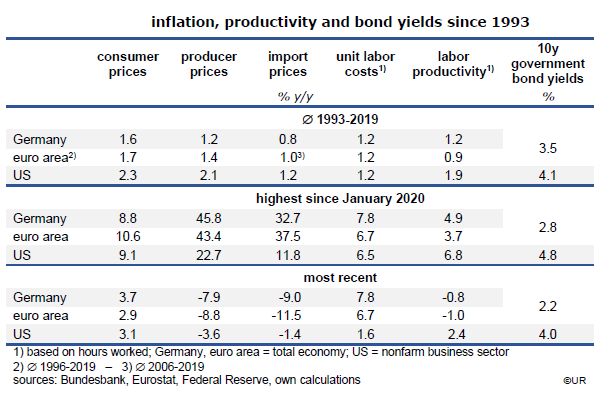

If financial investors accept, for the next ten years, a yield of just 2.2% on their holdings of German government bonds, while ECB policy rates – which determine money market rates – are above 4%, they must obviously expect a large decline of inflation rates and a change of direction of monetary policies, perhaps a refinancing rate of less than 1%, as in the decade before Covid and the Ukraine war. At this point, they accept that long interest rates are almost 200 basis points lower than short-term rates.

The situation is similar in the US, if less extreme. The yield of 10-year Treasuries is 4.0% – while the Federal Funds rate, which determines interest rates at the short end of the yield curve – is at 5.3%. Expectations are that inflation will come down further and that the Fed will cut the policy rate later this year, but deflation will not be a risk once again. As in past decades, both inflation and policy rates will be almost structurally higher than in the euro area. American policy makers are less dogmatic than their European, especially German colleagues, about reaching an inflation target. Austerity is not their thing – full employment is more important. This may be the reason why labor productivity, as an indicator for the improvement of general welfare, has, for a long time, been rising much faster than in Europe.

Another reason for those relatively low long-term interest rates could be investors’ fear that prices of equities, real estate or raw materials are presently dangerously high. They may want to hedge against crashes in those asset classes. Both German Bunds and US Treasuries will remain liquid in turbulent times – government debtors will meet their obligations when other capital market participants are unable to. Not to forget, bonds will do well in case of a long and deep recession when prices of other assets collapse. Seen from this perspective, relatively low long-term interest rates are like an insurance premium. Bonds protect against some negative effects of a deep recession. Investors who want to diversify their risks cannot bypass German and American government bonds.

Whether inflation rates will indeed come down significantly, as implied by the implicit forecast of capital markets is another matter. Even though brokers, bankers and asset managers have strong incentives to get things right, their track record is at best mediocre. In the euro area, very weak overall demand and steeply declining producer and import prices suggest that consumer price inflation will fall to something between 1 and 2% year-on-year in a few months. On the downside, unit labor costs, the most important cost component, have recently increased strongly. European labor markets continue to be robust, and workers have finally decided to do some catching-up, after several years of wage restraint. Since firms find it difficult to pass on those rising labor costs to their clients the chances of a new wage-price spiral remain low. Overall, Europe can look forward to lower inflation rates. An example: over the six months to December 2023 German consumer prices have increased at an annualized rate of just 1.1% – the underlying inflation rate is very low already.

The ECB will therefore begin to cut policy rates in the second or third quarter of this year – the yield curve will gradually flatten, and long rates will exceed short rates sometime next year. This will boost bonds. Since yields are already so low their prices will rise only moderately though. Markets have already raced ahead in anticipation of the coming monetary policy reversal.

The likely scenario of dollar money and bond markets will be similar. Because of the brisk growth of demand and output, core inflation is still rather high – at about 4% it is far above the Fed target of 2%. “Higher for longer” is today’s narrative of the central bank. Even so, weakening overall demand makes it likely that US policy rates will also be reduced over the course of the year. Given that levels are so much higher than Germany’s, bond yields will fall more. In other words, dollar bond markets look like a better bet than euro government bond markets.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.