The German government plans to raise the price of CO2 emissions year after year, as an incentive for consumers and business to reduce their consumption of fossil fuels. The fees have the sole purpose to reduce the burning of coal, oil and gas and to improve the climate. Other than the value added or income tax they should not end up in the big government revenue pot and should be fully returned to citizens – this had been agreed in the December 2021 coalition contract between Social Democrats, Greens and Liberals, the so-called traffic light coalition.

Since the absolute and relative increase of the price for energy – which is an important product that has no alternative – hurts poorer households more than the better-off, there would soon be social problems, unless there is a financial compensation. Most economists argue that a climate dividend or bonus is the best instrument to achieve this. Every citizen, infant or grandmother, would be eligible for such a bonus, no matter whether they own a car or actually pay for their heating. A four-person household would get four times more than a one-person household. In this way the income distribution, distorted by rising CO2 fees, would become more equal again. In this sense the climate bonus would contribute to social peace.

This is the theory. In actual politics, government’s CO2 revenues have already been spent for subsidies for such nice and popular projects as electric cars, the insulation of houses, heat pumps and charging stations – politicians love micromanaging the economy. They don’t like to admit that the market can do these jobs just as well, if not better. In other words, the pot that could be used for the payment of climate dividends is already empty, and the German minister of finance has a point when he says that the money cannot be distributed twice. In the meantime, it is not clear whether the climate dividend will come at all.

As a result, citizens only see the higher prices for fossil fuels but not the positive effects of the subsidies. For the majority of the population real disposable incomes will decline in the wake of rising CO2 prices – they feel that their standard of living has fallen and may vote for the fascist AfD, the Alternative for Germany, which may gain more than 20% of the popular vote in the next national elections (in the fall of 2025). I wonder why politicians – who want to be reelected – have not done things differently: pay out the climate bonus first, make people happy, and raise CO2 prices and thus the prices for gasoline and heating afterwards. The financial situation of the federal government would certainly have allowed such a sequence (notwithstanding the infamous debt brake). I would guess that the Minister of Finance – whose political base are the upper strata of the income distribution – was aware that the climate dividend would be at the expense of high-income households.

According to the Federal Bureau for the Environment (Umweltbundesamt), last year‘s government revenues from CO2 fees were 18.4 bn euros, or about 215 euros per capita. This is the amount of money which would be transferred to each citizen. An unmarried student would thus get 215 euros per year from the tax authority while a four-person household could expect 860 euros.

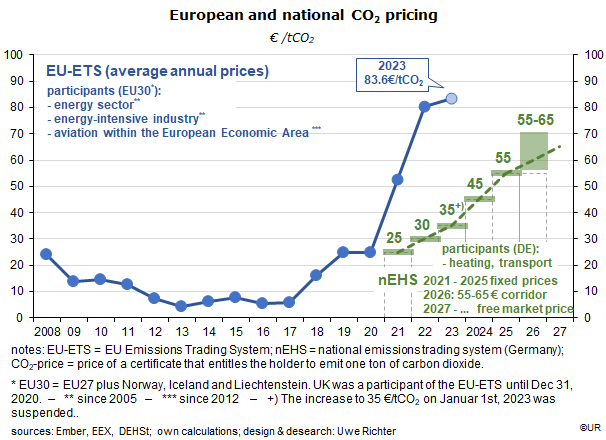

From an environmental point of view, the optimal CO2 fees are a lot higher than those used in the above calculation. If the goal is to get a full compensation for the damage, today and in the future, caused by CO2 gas emissions from the burning of coal, gas and oil to the national and global environment, the fees for emitting one ton of CO2 would have to be four times or ten times higher than their present levels – or more. Science has not yet reached a consensus: it depends on the assumptions used. In any case, the positive impact on the environment, as well as the incentive to burn fewer fossil fuels, would be stronger if emissions rights were more expensive. But this is coming.

As soon as possible, the government should announce its plans for the future of CO2 prices. This creates the necessary basis for the spending plans of households and businesses and accelerates the inevitable restructuring of the economy’s productive potential toward climate neutrality. On balance, high energy prices are something financially positive – and also a means against extremist movements.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.