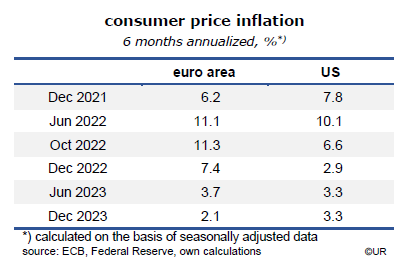

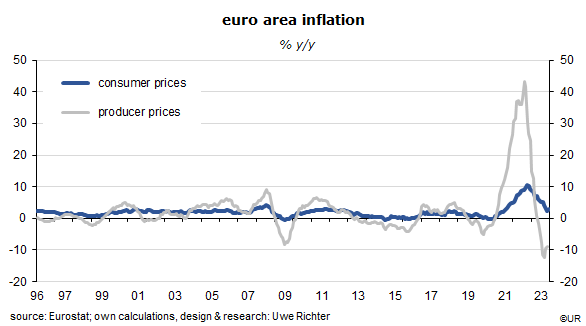

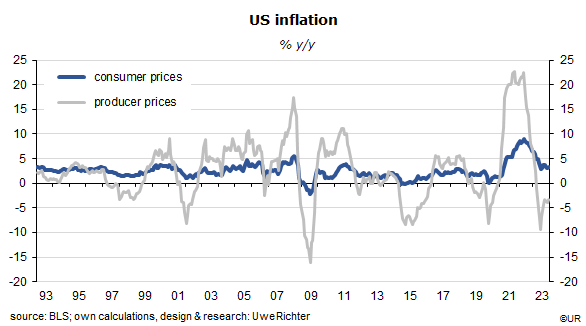

Most people in the United States and the euro area are convinced that inflation is still very high. This is not so. Consumer prices have increased a lot since the beginning of 2021, with annualized rates peaking at 10% in the US and almost 12% in Europe. But things have improved markedly since the end of 2022, and it doesn’t require much intellectual effort to predict with some confidence that European consumer price inflation will have the number one in front of the digital point by the end of spring. The ECB will thus be back on target.

Two weeks ago, I had shown that German inflation rates are presently on a steep decline. In the US, where the economy is still doing quite well, the decline is less pronounced. To be sure, price levels are still quite high in both economies, but they are rising not so fast anymore – this is why inflation rates are coming down.

Bond markets agree. Shortly before Christmas, yields of German 10-year Bunds had fallen to just a little over 1.9% (US Treasuries to 3.9%). Investors obviously expected that average annual inflation would be close to zero over the coming ten years. Zero!! In the meantime, yields have climbed somewhat again, to 2.3% and, in America, to 4.1%, but they remain very low. The history of Japan shows that near-zero inflation (and government bond yields) are not necessarily accompanied by a long-lasting recession and rising unemployment.

In retrospect, the price explosion in 2021 and 2022 looks like a one-time event. Most importantly, it has not triggered a wage-price spiral because it was almost exclusively caused by problems on the supply side, such as the Covid pandemic and Russia’s invasion of Ukraine which drove up prices of gas and oil and, because they play such a prominent role in consumer spending. Neither in Europe nor in the United States were there any signs of excessive demand growth. Both economies were in good shape, but they were by no means overheated.

So we are now back on a path to normality. Between 1996 and 2019, European consumer prices had increased at an average annual rate of 1.7%, without much volatility around that trend. Monetary policies were on target.

One reason for the fast decline of inflation rates must have been the strong increase of policy rates – since July 2022 the ECB had quickly raised the deposit rate, one of its policy rates, from -0.5% to 4%, where it is still today. This was much faster than the change in inflation expectations over this period. Another indicator of the de facto pro-cyclical shift in monetary policy are the growth rates of money supply M3: on a year-on-year basis, they were at 5.3% in July 2019, at 9.5% in July 2020 and by no less than 12% in January 2021. This was the turning point – the most recent reading is -1%. Sometime in the third quarter, European policy rates will be lowered again in response to excellent inflation rates at the time. Even so, real, ie, inflation adjusted ECB rates will still be high.

The outlook for European inflation is also positive for another reason: the economy continues to expand only slowly which means that the output gap will remain large. This leads to intense competition which in turn prevents business from raising their prices as much as they would like. Between Q4 of 2019 and Q4 2023 the real GDP of the euro area expanded by an average annual rate of just 0.8%, which was probably less than the growth rate of the productive potential of its economy.

For financial investors such an environment suggests that nominal bond yields must not necessarily rise much more, even though they are low by historical standards. They will fall again!

As to the United States, consumer core and headline inflation have most recently been a little less than 4% and 3.4% y/y, while the 6-month annualized rates were at 3¼%. They look sticky. Given that the labor market remains in good shape and that GDP growth continues to beat expectations, I would not bet on significant near-term progress on the inflation front. The market has a different view, though. According to Fed Funds futures, the Fed will still cut its Funds rate six times this year, by a total of 150 basis points. Since August 2023 it has been effectively at 5.3%. US monetary policy is thus expected to become expansionary once again. Over the three decades to 2019 the average annual consumer price inflation rate had been 2.2% (and thus 0.5 percentage points higher that European inflation). The Fed’s 2% target will not be reached any time soon.

The reason the US central bank will probably cut rates quite aggressively is owed to recent leading indicators which suggest that real GDP growth will slow down considerably, to 1.3% y/y in 2024, after a strong 2.3% in 2023. At some point, any boom will end. In the past, the American economy has usually outperformed the predictions of doomsday sayers. Maybe history repeats itself once more.

From the perspective of financial investors, dollar bonds may be not such a bad choice after all. The pros are high nominal yields, the likely decline of money market rates and the gradual reduction of inflation, caused by weaker growth. On the basis of fundamental determinants I expect them to be outperformed by European bonds, though.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.