Market Commentary: Why Europen real wages have stagnated for so long

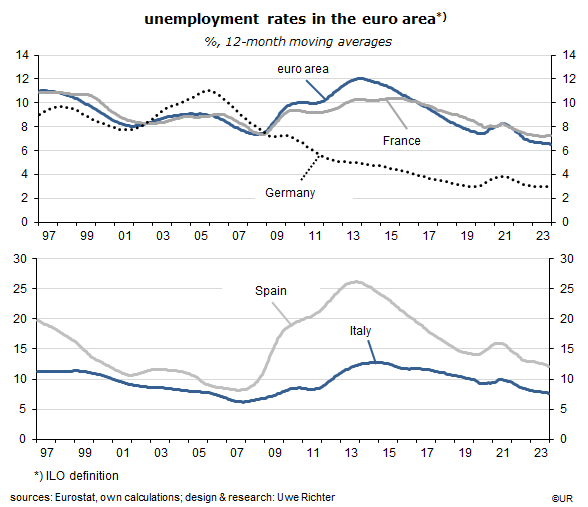

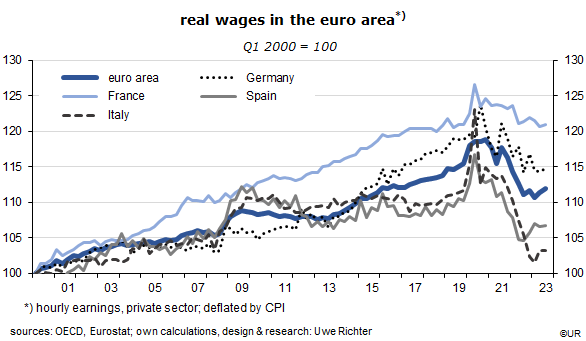

It’s a phenomenon that cannot easily be explained: labor markets in the countries of the euro area have been robust for many years – the average unemployment rate has fallen to a record low (6.4%) while employment has increased fairly steadily at an annual rate of 0.7% since the beginning of the millennium (to 168.7 million) – but real wages have barely responded to these, from the workers’ perspective, very favorable developments. In the past 23 years the average euro area rate of increase of real hourly wages has been just 0.5% per annum (Germany 0.6%, France 0.8%, Italy 0.1%, Spain 0.3%). This is next to nothing and probably one of the main reasons for the general disenchantment with politics and the rise of far-right parties. In the past, long ago, people used to be confident that their children would be better off than their parents. This confidence is gone. It urgently needs to be restored.

What happened? A positive aspect of the stagnation of real wages has been their impact on consumer price inflation, both on the demand side of the economy (“household incomes are stagnating”) and on the supply side (“wages are the main cost factor”). The harmonized index of consumer prices had increased at an average annual rate of just 2.1% and has thus almost been right on the ECB’s 2% target. Among economic policy targets price stability is not priority number one – more important are a steady and noticeable increase of living standards, a healthy environment and a fair distribution of income and wealth. Stable prices are important because they are the prerequisite for a sound currency which in turn helps to reduce tensions in society, but they are actually just an intermediate target.

The growth of wages and profits is mainly a function of productivity, the output per working hour. If it had increased more rapidly than in the past quarter century there would have been more to distribute to workers. But this has not been the case. If the aim is to accelerate the growth of real national income and the standard of living, something has to be done about productivity or, more specifically, for the two so-called factors of production: labor and capital.

It seems that the professional qualification of Europe’s labor force is no longer world-beating. To be sure, it is difficult, and even impossible to measure it. One indicator could be the results of the so-called PISA studies which evaluate the competence of 15-year old high school students in three subjects – mathematics, reading ability and science. The better the education of its children the brighter the economic future of a country, ceteris paribus. Lately, the euro area has fallen significantly behind east Asian countries. While the euro area is at a (population-weighted) score of 478, Japanese students are at 533, just as the Taiwanese; South Koreans are at 524. For comparison, the results for other large countries: USA 489, Germany 482, France 478, Italy 477, Spain 477, the Netherlands 480. Other indicators for the professional standard of the labor force are international patent registrations per capita and world market shares in key technologies. European countries are probably no longer at the top on either accounts.

In other words, if real wages and the general standard of living are to rise faster, more must be done for the qualification of workers, ie, to improve their productivity, aside, of course, promoting capital spending, the other factor of production. So far Europe‘s international competitiveness, measured in terms of the balance on current account, is still quite good, but the advantage it once had is clearly shrinking. Government spending and taxation must undergo a profound structural change, in the direction of promoting worker education, R&D, and spending on capital goods and software.

The other parameter which could boost European real wages is the terms of trade, the ratio of export to import prices. The more they rise and the higher they are the more can be distributed to the domestic (euro area) population. Increasing terms of trade mean that the real income of my country goes up, if at the expense of foreign countries. Unfortunately, the real euro exchange rate – and thus the terms of trade – has been relatively weak in recent decades. Strong competitiveness means that a country can import more for a given amount of exports – which permits a higher growth rate of real wages.

I am thus making the case for an appreciation of the real euro exchange rate. Role models have recently been the US dollar and the Swiss franc. But there is no straightforward solution to this. A significant increase of policy rates may do the trick, but it is a two-sided sword – while it may boost the exchange rate it will probably lead to an upward shift of the yield curve. It would therefore hurt capital spending and economic growth. An appreciation can be achieved almost automatically, though, in response to sound fiscal policies and a liquid capital market – this is the camino real.

Besides, it is about time that worker organizations respond pro-actively to their presently very strong negotiating power, preferably as a common European effort. They should aim for moderate long-term and at the same time cooperative wage settlements. Higher wages are not the end of capitalism.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He was a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.