Anyone reading this headline will probably think that I am naïve, without a sense of today’s political realities. Maybe, but historically and even culturally Russia is part of Europe, and European countries are entitled to join the European Union. I don’t subscribe to the view that Russians, perhaps for genetical reasons, want to be governed by autocrats – because this has indeed been the case for centuries, except for the short period of the nineties, the Yeltsin years. In his novel “The Sun also Rises” Hemingway once wrote the following dialogue. “How did you go bankrupt? Bill asked. Two ways, Mike said. Gradually, and then suddenly.”

People often think that in some countries things will never change, that the state will always be able to control its citizens, and that opposition is futile. This is today’s prevailing view of the Russian situation. But the sudden, unexpected demise of long-time dictators is actually not such a rare event. Think of the Mullahs’ removal of the Persian Shah in 1979, or of the scores of coups which brought down, from one day to the next, brutal long-term strongmen in Africa, or the unexpected fall of the Berlin wall and the end of the Soviet Union. To be sure, it is almost impossible to predict whether and when history will take such a leap next time.

I suggest that Western democracies should prepare for the unthinkable, for the possibility that Russia’s dictatorial system will implode one day. The aim must be to prevent a new dictator following the old one. There may be, probably for a short period only, the opportunity to achieve a fundamental change of the political system. It could well be the democratic alternative of the European Union: freedom and a much higher standard of living for Russia and peace in the rest of Europe Why spend so much on the military if there is an attractive alternative? In 2024, Russia will probably spend €113 billion on its army, air force and navy while the EU will come close to something like €290 billion (Germany €71bn). Most of this money will not be needed if Russia and the EU decide to cooperate rather than prepare for war.

EU membership must be on the basis of the so-called Copenhagen criteria of 1993. These require the following:

– “stability of institutions guaranteeing democracy, the rule of law, human rights and respect for and protection of minorities;

– a functioning market economy and the ability to cope with competitive pressures and market forces within the EU;

– the ability to take on the obligations of membership, including the capacity to effectively implement the rules, standards and policies that make up the body of EU law (the acquis), and adherence to the aims of political, economic and monetary union.”

I am convinced that most Russians would be more than happy if they could live in a country with such rules and institutions. The advantages of EU membership (or some other sort of association) must be communicated clearly and frequently to the Russian population, via the internet or something like Radio Free Europe. People must be aware that there is an attractive alternative. This is the task of the EU’s foreign policy makers.

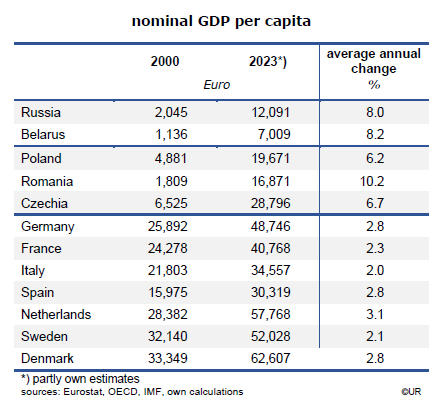

EU membership would have enormous economic advantages for Russia. Last year its nominal GDP per capita was about €12,100 while Poland, Romania and the Czech Republic were at €19,700, €16,900 and €28,800, respectively. The three countries had joined the EU in 2004 (Poland and Czechia) and 2007 (Romania). Unlike Russia, none of them is blessed with large amounts of natural resources. The reduction of military spending alone would be a big boost for national income. Note that spending on arms and soldiers does not contribute much, if any, to the growth of potential GDP and the standard of living.

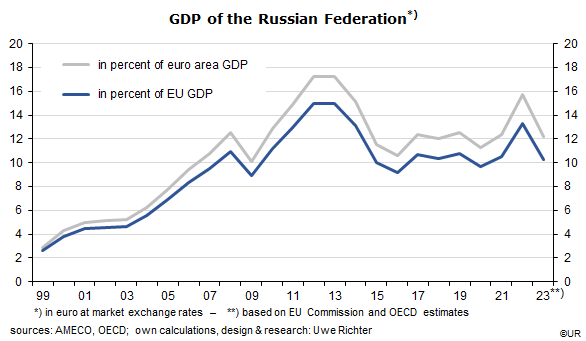

From an EU perspective, the integration of the Russian economy is a big deal, but not one that cannot be managed. Going by our calculations on the basis of OECD and EU Commission statistics, Russia’s nominal GDP was just 12 percent of the EU’s.

This is the equivalent of the aggregated communist countries which joined the EU in 2004 and later. It can be done. Moreover, an enlarged EU would be significantly less dependent on energy imports from countries outside of Europe.

In military terms, Russia is a superpower, but in economic terms it is just a teenager. But within the EU it has the potential to increase its global standing and economic weight – and the general standard of living. Germany’s nominal GDP at market exchange rates was 2.35 times larger than Russia, even though its population was just 84 million, compared to Russia’s 144 million. These numbers show the extent of Russia’s misallocation of human and other resources. No one can eat nuclear bombs.

How the integration of Russia can be accomplished has been described by twelve French and German scientist last year. They have presented a model of four concentric circles, with euro area countries at the core and less integration at the outer circles. The study was not specifically aimed at the future of Russia in Europe, but a very useful blueprint nonetheless. Have a look at my post on this topic from last October. In any case, it is once again worthwhile to think out of the box. How could a step-by-step integration look like, taking into account the specific conditions and needs of Russia?

This would clearly be a mega project. The EU constitution would have to be modernized in the process, a task which is long overdue.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.