Poor economic growth is presently one of Germany’s main topics in public policy discussions. Since the average income is actually rather high, an acceleration of growth must not necessarily be a top priority, at least at first glance. Stagnating output would obviously be good for the environment. But if the rest of the world continues to race ahead in terms of economic performance, a shrinking share in global GDP inevitably means less influence in global issues, including the military.

A stagnating GDP also means that fights over income distribution will intensify: if one group of the population gains a bigger slice of the pie, another one will get less and feel they are treated unfairly. If, on the other hand, the economy grows by, say, 2%, one group could raise its income by 3% and the other one by 1%, a much more pleasant outcome (of course, higher inflation could also achieve this). In other words, since we do not have a world government and peace, each country will try to expand its economy.

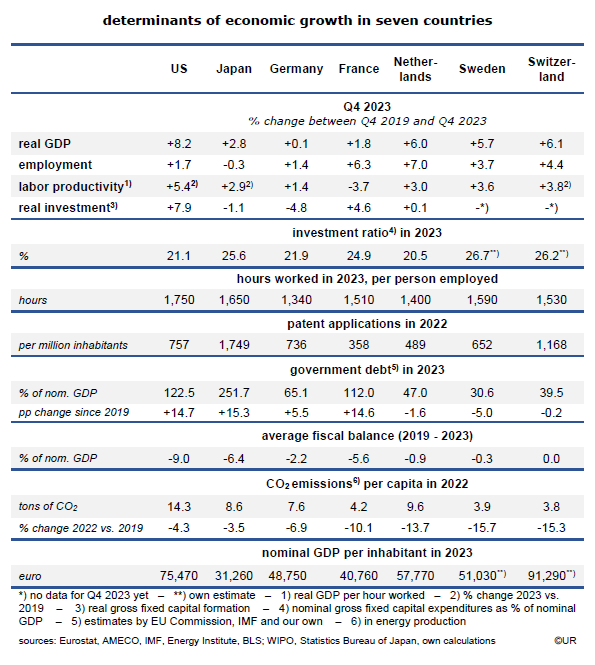

So it is quite shocking to German policy makers that real GDP has increased only by 0.1% over the 4-year period from Q4 ’19 to Q4 ’23, compared to 8.2% in the US and about 6% in neighboring countries such as the Netherlands, Sweden and Switzerland. Incidentally, the world economy as a whole grew by roughly 12% during that time. In relative terms, Germany is shrinking. To be sure, this is not a catastrophe, and better times are probably lying ahead.

The overall economic situation is still good: unemployment is at a record low of 3.1% (ILO), employment growth remains in the order of 0.5% per year, annual working hours are lower than anywhere else, real interest rates are close to zero (not least because of small government budget deficits and debt), and the international competitiveness remains very strong, given an almost structural surplus in the balance on current account of 5% of GDP. Germany is globally the largest exporter of capital and, among OECD countries, probably the largest importer of labor, recently on par with the much bigger US.

The main problem is productivity which, multiplied by labor input, determines the size and change of real GDP. Since employment has expanded by 1.4% over the four-year period while productivity (on a per hour basis) has been up 1.4%, but annual working hours were down 1.3%, so the change of real GDP was near zero. The slow growth of the German economy was thus due to slow productivity growth and the reduction of average working hours.

In any case, to get the economy going again productivity growth must speed up. That’s easier said than done. It is a long-established “law” of economics that the marginal rate of output growth declines as the capital stock gets bigger and bigger, a result of positive net investments, and it is therefore no surprise that German productivity growth is much slower than twenty or fifty years ago. But this slowdown in productivity growth is not a given – the US shows us that in spite of its large capital endowment average annual labor productivity grew by no less than 1.3% over the past four years.

So what can be done? The simple but rather abstract answer is to improve the quality and qualification of “human capital”. Germans are less innovative than they used to be, the results of the PISA studies show that things will not get better in the near term. “Education, education, education” is what is needed, with an emphasis on the early childhood and then throughout the whole working life. It requires a change in the composition of public sector spending because investments in people yield higher returns to society than almost any other kind of expenditure. Another advice is to promote spending on research and development by business and academia. It is here where the US is leading the way and probably the main reason why its productivity and overall growth are so strong.

Germany is in the middle of a profound economic transformation, away from fossil fuels and toward renewables. Nuclear and coal are phased out rapidly which in turn creates stranded assets, ie, large write-downs of power plants and other hardware based on the burning of coal, oil and gas. Like in a war, large parts of the old capital stock have been, and will be destroyed. One important effect of the transition is the strong increase of energy prices – these are needed as incentives for the reduction of energy demand (positive environmental effects!) and large investments in wind and solar installations. Almost nowhere else are energy prices as high as in Germany. They will come down in the medium term – because the marginal costs of producing alternative energy are close to zero – but right now they are a blow to the purchasing power of households and business, and thus a main cause for the four-year stagnation of the economy.

To keep government spending under tight control has not really contributed to growth. It depends on what the money is used for. Germany has a so-called debt brake in its constitution which forces the state to keep its budget to 0.35% of GDP in normal times, without distinguishing between consumption (social spending, the military) and capital expenditures (hardware, education). A reform of the debt brake is urgently needed. It should be possible to borrow money for infrastructure and education if the economic benefits are larger than the rate of interest. Given that the real long-term interest rate on new government debt is close to zero while the benefits in terms of stronger growth of productivity and general welfare are considerably higher, borrowing for these purposes is actually a no-brainer. Even fiscal hawks are now coming around to this view. There is light at the end of the tunnel.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.