Market Commentary: The dollar exchange rate – what goes up must come down

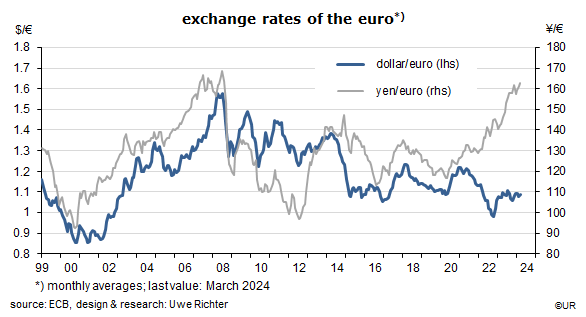

Over the past 16 ¼ years, the price of the dollar has increased from a low of 0.633 in 2008 to today’s 0.917 euros, a bilateral appreciation of about 45%. In other words, the dollar has morphed from a soft currency to the strongest one around, on par with the Swiss franc. It is now the major and undisputed reserve currency. In the 6 ½ years before it had depreciated – from peak to trough – by 45.6%. Against the yen, the swings have been equally wide.

If I look at the gold price there must be players in foreign exchange markets who may be not so certain any longer that the dollar’s strength will continue indefinitely. East Asian central banks in particular seem to allocate a rising portion of their reserves into gold, as a hedge against a fall of the dollar exchange rate. The appreciation of the dollar has been so massive that a diversification of risks looks overdue. As a result the price of an ounce of gold has gone from $1,660 to $2,290 since the last peak of the dollar in October 2022, or by more than one third. Long gone are the days of the Bretton Wood system when the official gold price was at $35 an ounce – the gold price in dollars has increased by an average annual rate of no less than 8.2% over the past half century. This more than compensated for gold’s main disadvantage: that it does not pay interest.

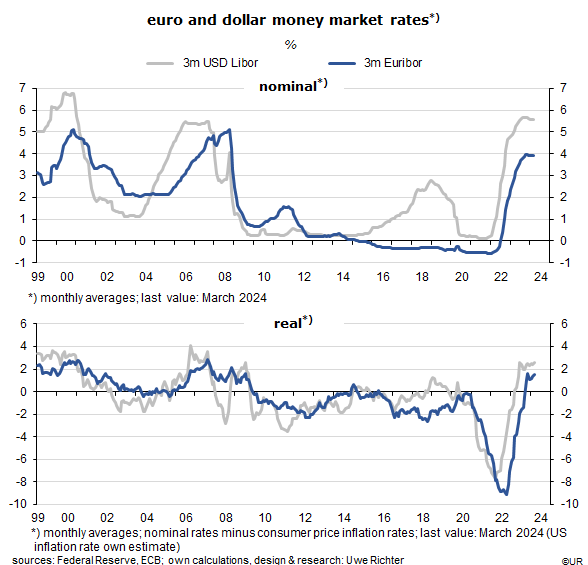

As to the future of the dollar, there are important aspects which suggest that it will remain the indispensable currency: the market value of US stock markets is as big as that of the rest of the world combined, US stock markets are not just very liquid but are also still backed up by the world’s strongest military – Russia may one day attack western Europe, but never the United States; and monetary policies are predictable and fairly conservative most of the time: the internal purchasing power of the dollar will decline only moderately and not significantly faster than that of the euro, the yuan or the yen. Last but not least, both nominal and real money market rates are high compared to other economies which in turn encourages so-called carry trades: borrow yen and euro and invest the proceeds in dollar-denominated money market instruments. This tends to boost the dollar’s exchange rate.

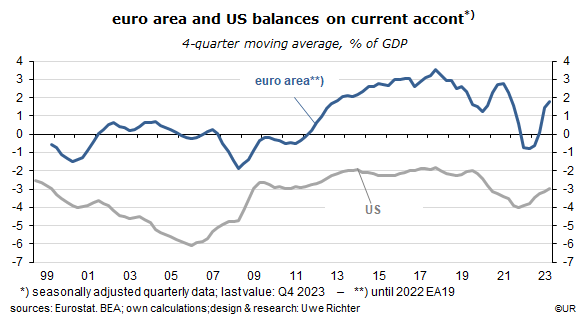

As to the risks of holding dollar assets, one is the persistent current account deficit: it is now in the order of 3% of GDP, compared to the euro area’s surplus of about 2%. That’s a huge, almost structural difference, caused by the much faster economic growth of the US and the long-term appreciation of the real dollar exchange rate. The balance on current account used to be the main determinant of FX developments. No longer, it seems. Why is this? If the euro area runs a surplus, the demand for euros is strong. But it is just as important to take account of what is happening to cross-border capital flows. Because the US has lately been growing faster than the economy of the euro area (or of Japan), despite higher interest rates, the US has sucked in foreign capital which has increased the demand for dollars, by more than the reduction of demand via the balance on current account. The focus on the latter is wrong: all determinants of the supply and demand for dollars must enter the equation. Even so, I would guess that the role of the balance on current account will make a comeback one day – it is the best indicator for the international competitiveness of an economy, and whether it lives beyond its means or not. It will support the euro in the medium term.

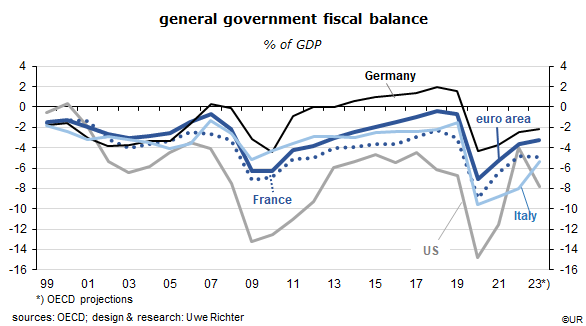

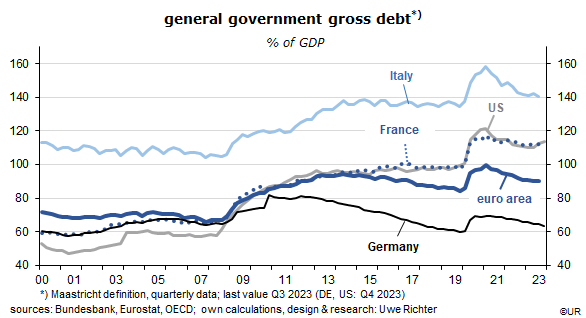

Another risk is government finances. Last year the American budget deficit was about 8% of nominal GDP, compared to the euro area’s deficit of 3.2%. For more than 20 years, the US deficit has been significantly larger than that of the euro area as a whole, and larger than the deficits of (relatively) free-spending France and Italy. The latter, once the bad boy in terms of government spending discipline, has outshone the US for most of the past quarter century. The price it paid came in the form of very slow economic growth. Admittedly, Germany’s virtuous fiscal policies have not done any good for growth either– without an increase in spending, including government spending, there will be no growth. To see how it can be done, have a look at Swiss fiscal policies.

Running large budget deficits year-after-year will inevitably lead to huge debt levels. In the US, government debt was about 115% of GDP last year, just about as high as in France and significantly above the euro area’s consolidated debt of about 90%. The long period of very low interest rates has made this sort of debt sustainable, but it has also made the government hostage to expansionary monetary policies. The risk is that interest rates will rise one day again, making debt service much more expensive, and leaving less room for other spending. Foreign holders of dollar-denominated government debt could anticipate such a development and start taking profits – which could lead to a sellout of dollar assets and a depreciation of the exchange rate. This is not a risk in the near-term, though. Jerome Powell, the head of the Fed has just stated that he expects two cuts of the federal funds rate this year. Rate hikes are not a genuine risk this year.

To be sure, though, the dollar depends on investors holding still and on the Fed maintaining its low funds rate – which obviously restricts policy makers’ room for maneuver. Black swans, ie unanticipated events could be a war between China and Taiwan, a resurgence of inflationary pressure in an environment of full employment, or a US recession. The dollar is certainly not on a one-way street anymore.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.