For years, the fight against the further heating-up of the planet has been one of the main political issues, going by the amount of government subsidies spent on improving the climate, or their role in public discussions and election campaigns, or the rapid structural change in the auto industry, away from cars with internal combustion engines, and toward electric vehicles. Even so, the journey toward higher and higher global temperatures looks almost unstoppable.

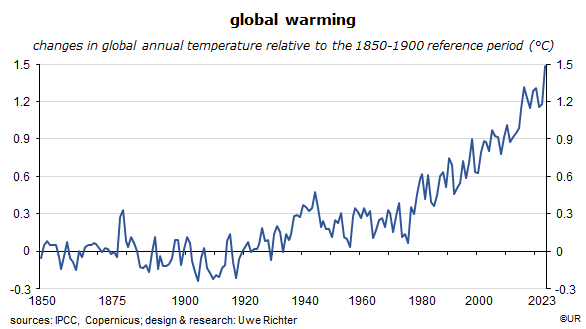

Since the late seventies the average surface temperature of the earth has increased by about 1.5 degrees Celsius compared to the 1850 to 1900 reference period, after a stagnation which had lasted several centuries. There may be progress in the rich countries of the OECD, but not for the world as a whole. If the trend of the past 50 years persists for another half century, the global temperature in 2073 will exceed that of the reference period by no less than 3 degrees. At the 2015 climate summit in Paris, a large majority of countries had voted for an upper limit of +1.5 degrees, at most +2 degrees. Good intentions, but the reality looks quite different: the world loses its equilibrium; humanity continues to destroy the earth.

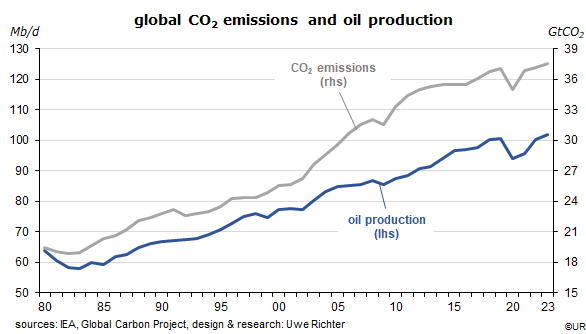

The main reason that a near-term trend reversal is unlikely is the prospect that the production of fossil fuels and, as a result, the emission of greenhouse gases will rise for many years to come. Despite the recent increase of relative and absolute oil prices the output of crude oil has grown, rather steadily, from 64 to 101 million barrels per day between 1980 and 2023 – which translates into an average annual growth rate of 1.1%. According to the International Energy Agency (IEA) output will rise by 1.2 million barrels this year, followed by 1.1 million in 2025. Almost in lockstep with these developments, global CO2 emissions have gone from 19.5 billion tons in 1980 to 37.5 billion tons last year – or by an annual average of 1.5%.

The prices of fossil fuels have been moving higher and therefore in the right direction over the past quarter century, but this had not been enough to compensate for the so-called income effects on global oil demand which have been, and will continue to pull in the other direction. 85 percent of the world population live in poor countries – these are growing at high rates and are mostly in catch-up mode. They aim to achieve the same living standards as in the “West”, not least in terms of energy-intensive mobility, heating and cooling. These efforts are broadly successful: global real GDP expands at an average rate of about 3% per year, driven by the global South. As it is, the positive price effects on oil demand and output are much weaker than the negative income effects, and will probably remain so for decades to come.

In other words, from a climate point of view, the future looks quite bleak. It will probably take several environmental catastrophes to convince people in the poor part of the world that they need to do more for alternative energies, from wind, solar and battery systems, and to restrict the consumption of fossil fuels. Otherwise their own well-being would be at stake. All around the world, the climate deteriorates so quickly that a rethinking and rerouting, and a new ordering of priorities look unavoidable. But it is not enough to trust that market forces will do the job. Governments must take the lead, knowing what will be coming, and put the environment at the center of policies. So far, there is not much evidence of this, globally speaking, and not much awareness of the risks. Rearmament and boosting GDP growth is presently more important than a healthy environment. The inevitable turnaround will be expensive.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he is also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.