Market Commentary: The trade war escalates – US massively increases tariffs on imports from China

Free trade is no longer, trade restrictions are the new normal. Yesterday, the US administration announced that tariffs on imports from China of EVs, batteries, semi-conductors, solar cells, medical products, aluminum, steel and some minerals will be raised significantly, despite strong employment and GDP growth. It’s election time. The Biden administration had already pumped billions of dollars into the production of EVs and batteries in order to reduce the country’s dependency on Chinese supply chains. The EU Commission, meanwhile, is also having a close look into the EV market, obviously considering higher trade barriers against imports from China.

One effect of such policies is the deterioration of the terms of trade and the slowdown of real income growth in both the United States and the European Union. Consumers will suffer. If China decides to retaliate – which is likely – we could be at the beginning of a new global trade war and at the end of the international division of labor, depending on the escalation of the conflict. Productivity growth will continue to slow. In the end, everybody will lose.

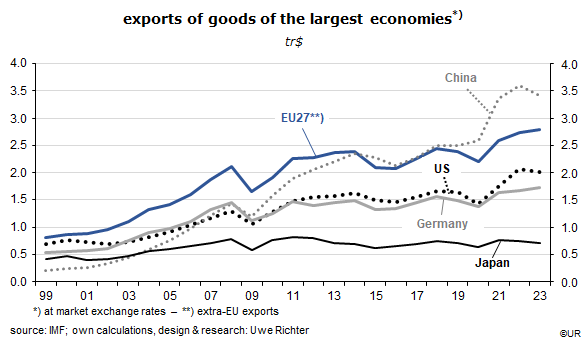

China is the new scapegoat, just as Japan had been several decades ago. Since the middle of the 2010s, it is the world’s export champion, following the EU-27 in that role.

Since the beginning of the century nominal Chinese goods exports have expanded at an average annual rate of 12.7% (at actual exchange rates), outpacing competitors by a wide margin: EU-27 5.3% (Germany 5.0%), US 4.6% and Japan 2.3%. China’s national saving rate continues to be higher than that of other countries and it invests a larger share of its output into the expansion of the capital stock. For years to come, the international competitiveness is therefore bound to improve further. China can only be stopped by an all-out trade war.

But even in such a case, China is relatively well positioned, given its huge and rapidly growing domestic market, with 1.4 billion citizens – it is less dependent on foreign events than smaller countries, including the United States. In addition, it can turn to markets in Africa, the Near East, the rest of Asia and Latin America, which are all in catch-up mode and do not mind importing cheap (and not so cheap) Chinese stuff.

In other words: China is quickly becoming the world’s major economic force. For Europeans this means they should not participate in a new trade war and rather follow the time-honored rule to “join them if you can’t beat them”. They should provide stronger incentives to invest directly in the old continent, preferably without spending taxpayer money on such a strategy. The process is already underway but is only just beginning.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.