Market Commentary: European elections: immigration as the main issue

Overall, the political center has held its ground somewhat better than many had feared at the recent elections to the European parliament, in stark contrast to the ecologists who suffered big setbacks. Other than five years ago, environmental issues were less of a priority for voters because people feel overwhelmed by the rapidity of structural change, especially by high energy prices and the coming end of cars with internal combustion engines. Since the economy and real household incomes have now stagnated for a long time, it has been difficult to sell the green transition compared to half a decade ago when the outlook was more positive. For a large part of the population, structural change without growth and social fairness looked like a project of the elites and therefore no longer attractive.

This time external and internal security as well as immigration had been the main topics, ie, the Russian invasion of the Ukraine and the danger that the „flood“ of mostly Muslim newcomers was a risk for the natives – they were seen as a burden to the social networks, without contributing to their finances. Right-of-center parties were rewarded not least by promising more xenophobic policies. Even so, the extreme right has been the main winner of the elections. They shamelessly used the slogan “Ausländer raus!” (let’s get rid of foreigners) which had been a taboo in the past. In Italy they are heading the government, and in France they are close.

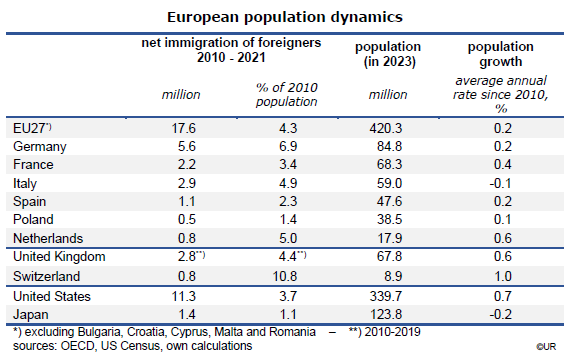

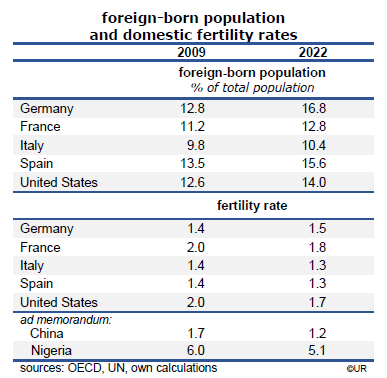

In all of this it is surprising that in all European countries there is a lack of workers in important sections of the economy – which can only be resolved by more immigration. Foreigners are generally less choosy about the kind of jobs they are willing to accept. Think of construction work, health and old age care, truck and taxi driving, house cleaning, fruit picking or various crafts. In a rapidly ageing society, which irrationally refuses to raise the legal retirement age in lockstep with rising life expectancy, foreign workers are badly needed.

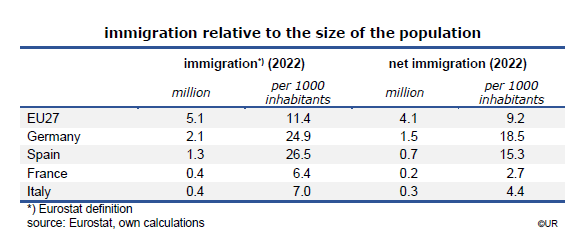

It is also surprising that the shift to the extreme right has been most pronounced in countries which severely restrict immigration, as in France, Italy and Poland. Admittedly, the causality could be running in the opposite direction: because these countries are so xenophobic, only relatively small numbers of foreigners actually try to immigrate.

Incidentally, Germany is the European country which has admitted more immigrants than others, relative to the size of the population, behind Sweden, Austria and Portugal, a sign that hostility toward foreigners is not yet a mainstream phenomenon. The extreme right party AfD, the Alternative for Deutschland, got 15.9% of the vote, whereas the French Rassemblement National and Reconquête together were at 36.9%, the Italian Fratelli of Georgia Meloni and the Lega got 37.8%, Belgium’s Flemish parties 28.5% and the Dutch xenophobic parties 23.2% (not to mention that Donald Trump can expect almost 50% of the popular vote in November’s presidential elections).

I am surprised that politicians do so well using anti-immigration strategies. The “old” establishment of the center has decided to piggyback on the fears and prejudices of the “left-behind” segments of the population rather than explain to them the obvious advantages of immigration and make sure that integration into society speeds up. Why are they so faint-hearted? Foreigners are used as scapegoats for the persistent stagnation of the standard of living. For a sustainable increase of general welfare it is necessary to promote employment and boost economic growth, including a positive attitude toward immigration.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.