Market Commentary: France will not go to the dogs

… even if Bruno Le Maire thinks so. For seven years he has been Economy and Finance Minister in Macron’s government and should know what he is talking about. He regards the steady gains of Marine Le Pen’s extreme right Rassemblement national (RN) over the past decades, the strengthening of the radical Left (Front populaire) and the seemingly unstoppable shrinkage of the political center as a catastrophe. Others thinks so too: according to a 2019 survey by the European Council on Foreign Relations, 69% of French voters felt that the country’s political system, as well as that of the EU as a whole, was no longer functioning. At the time, the EU average was just 38%. Seen from the outside, the French appear hysterical. The country has its problems, but they are not bigger than those of, for instance, the UK or Italy. Even in comparison to Germany and the US, France holds its own in many segments of the economy and society.

This Sunday, after the second and decisive round of the national elections, the RN and its allies may finally achieve a majority of seats in the Assemblée nationale. At last Sunday’s first voting round, parties to the left of the RN got 67% of the popular vote, though, a clear majority. This will probably happen again next Sunday. But the peculiarities of the French voting system can easily lead to a rather different distribution of seats in the lower house of parliament. Each of the 577 constituencies sends just one representative to Paris, comparable to America’s winner-takes-all system. At this point, the RN seems to be the main beneficiary.

Since Macron, the President of the Republic, will stay in office until 2027 (unless he resigns at an earlier date) while the government may be run by the RN, it is likely that France will once again be governed by a so-called cohabitation where two different political blocks share power in the executive branch. The president would remain in charge of external affairs and the armed forces, while the government, probably led by Jordan Bardella of the RN, would be responsible for passing new laws and, very importantly, for public finance. In the past, cohabitation had worked reasonably well because the representatives of the center right and the center left were usually on good talking terms and able to compromise. This is now less likely.

Macron and the RN are ideologically miles apart. The president, urbane, neo-liberal in economic policy making, elitist, increasingly unpopular among voters, “a friend of the rich” and with a much reduced number of supporters in parliament, has to deal with nationalists who demand more money for the police, who intend to take away rights and social benefits of immigrants from Africa and their children, even if they hold French citizenship, who fancy to leave the EU and NATO and would no longer support Ukraine. Several of those RN politicians are racists, anti-Semites, friends of Putin, conspiracists, islamophobic – and most of all they are afraid of the “grand remplacement” where Muslims will account for the majority of the population. Germany’s AfD politicians can relate well with such sentiments.

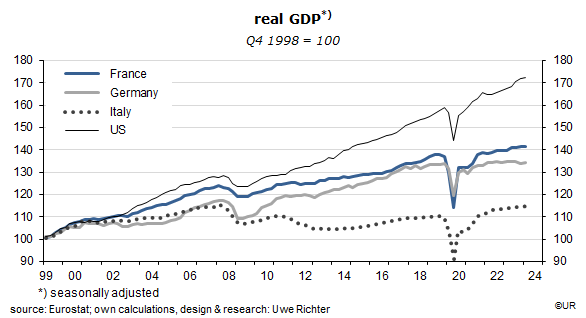

Let me now continue with a look at the positive economic features of France. Since the launch of the currency union in 1999, real GDP has grown somewhat faster than Germany’s, and much more than Italy’s. French politicians are no big fans of austerity and are usually unimpressed by orders and hectoring from Brussels. On balance, expansionary fiscal policies have been (somewhat) positive for economic growth.

The same holds for employment. Since 2019, the year before Corona, it has been increasing at higher rates than in Germany and Italy.

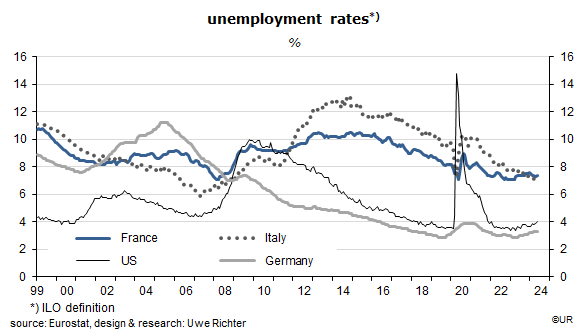

Mostly due to the robust demand for labor, the unemployment rate has come down from 10.5% in 2014 to 7.4% now. Using the time series of Eurostat this is still more than twice as high as Germany’s.

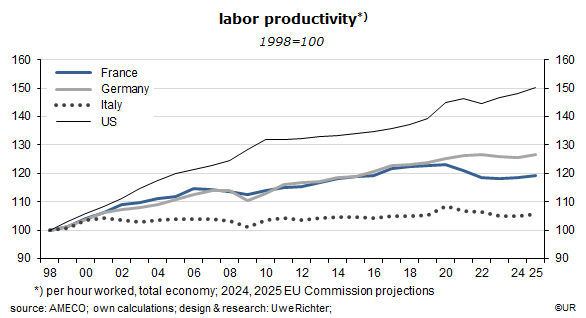

In addition, and as in many other countries, France has a youth unemployment problem and thus jeopardizes the future of the labor force and the standard of living. Another serious problem is the stagnation of labor productivity. In combination with the growth of the labor force it determines the growth rate of real GDP and is thus the main component of general welfare. People are no longer convinced that their future, and especially that of their children, will be better than their life today.

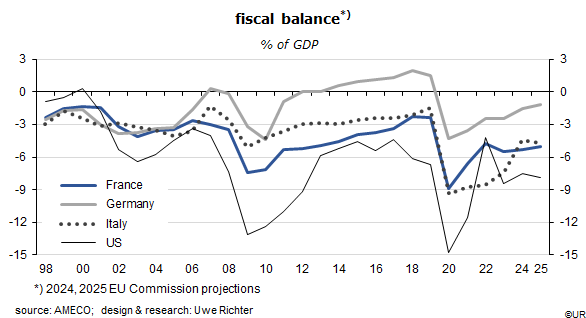

Bruno Le Maire’s main worry is probably the miserable state of public finances. Since 2002, the primary balance of the government budget (which excludes interest payments on public debt) has always been in negative territory. Most of the time the overall budget deficit was larger than in Germany, and even larger that in Italy. This year and next, the deficit will be in the order of 5 to 5 ½% of nominal GDP and thus exceeds the 3% guideline of the currency union by a wide margin. Note that the deficit is smaller than that of the US – but still much more dangerous. Why? The US has its own central bank which will always bail out the administration in a financial crisis, while the ECB is not supposed to do the same for France. The ECB has 19 other shareholders who may not like the idea. To be realistic, should France head toward bankruptcy one day, it is absolutely clear that the ECB and Brussel (the EU) will come to the rescue – but the conditions which France would have to meet would be very severe, which in turn could trigger social unrest.

If I look at the election promises of the parties, both left and right, France’s budget deficits are heading toward even higher numbers. Government debt (in % of GDP) had been about as large as Germany’s at the time of the Great Financial crisis in 2008, but since then it has almost exploded year after year and has now reached 112% (Germany 63%).

Due to the bleak outlook for government finances, S&P has reduced the rating of the country’s long-term debt to AA- a few weeks ago. For this reason, and because of the prospect of a very difficult cohabitation, the spread between 10-year French and German government bonds – which used to be between 20 and 40 basis points – has now risen to about 80 points. Meeting the interest bill requires a rising share of government spending. This means that politicians will be hard put to do what they have promised in their election campaigns.

Seen from this perspective it may be a rather good idea to let the RN run the government and get rid of the so-called cordon sanitaire which keeps them out of power. It is one thing to promise a lot and another to solve actual problems at a time of tight budgets. In some Scandinavian countries and in Italy such an approach has forced the nationalist right to moderate their policies. And, incidentally, it is dangerous to ignore the voting of large parts of the population – it leads to aggression and political apathy.

France is not heading toward dictatorship, but toward a financial crisis. For the EU, the risk has increased that it may disintegrate.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.