Market Commentary: Why Arab Sovereign Wealth Funds Should Be Welcomed in the EU

The disruptions of natural gas imports from Russia, as a retaliation for Western sanctions after the unprovoked invasion of Ukraine, have brought home the point that EU countries should never again be held to ransom in a key sector of their economies: energy supply, or become too dependent on just one foreign provider. The international division of labor has been and is an important engine of economic growth and thus of general welfare, but this is not the case in all circumstances.

A main task of governments is to guarantee internal and external safety and a reliable supply of food and energy. In a list of national priorities, it ranks ahead of free trade and cross-border capital flows. This is why proposals of Arab sovereign wealth funds to buy stakes in EU utilities and other infrastructure have recently been met with apprehension, especially in Germany. An understandable reaction – but a mistake, nevertheless.

It is pretty irrelevant who owns a country’s utilities, its wind and solar power plants, the energy storage facilities or the electricity grid, be it the state or domestic or foreign investors. Even in a serious international conflict these investments cannot be taken away: they will stay where they are. Extortion by political opponents is therefore not possible, or much less likely than in the case of Russian gas.

It is almost a gift if foreign investors, ie savers, participate in building the domestic capital stock. They are aware that they get no guarantee of a pre-defined return on investment and accept a larger risk compared to the purchase of fixed income securities, equities or other marketable assets. If one acquires illiquid ownership rights one can do very little when payments are reduced or terminated. On the other hand, European households are able to save less and consume more if foreign savers join the process – their standard of living rises.

Even so, it can sometimes be dangerous if a major portion of the domestic energy sector or the infrastructure is foreign-owned. Assume that one day major European electricity providers are controlled by the sovereign wealth funds of Saudi Arabia or Abu Dhabi. These are investors whose wealth is based on the production of fossil fuels. Conflicts of interest are a realistic possibility if European governments continue to aim for a complete phasing out of oil and gas in order to stop climate change. Such risks can be reduced or eliminated by things like preference shares, limited voting rights and the like. On balance the advantage of having capital injections from abroad is greater than the possible risks.

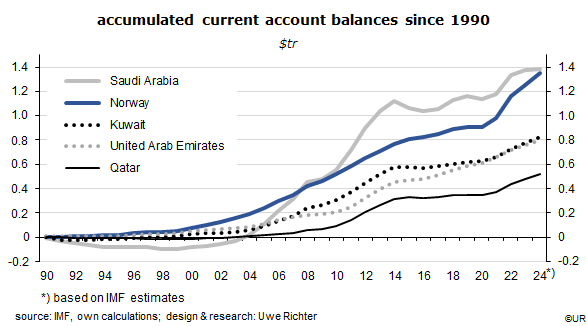

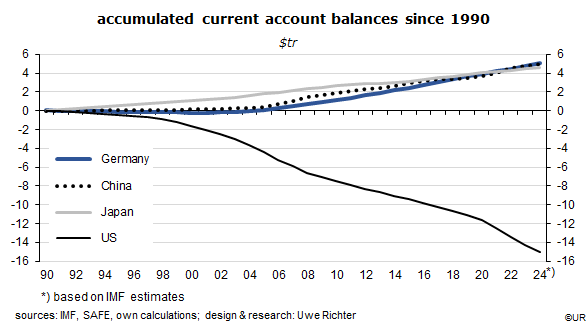

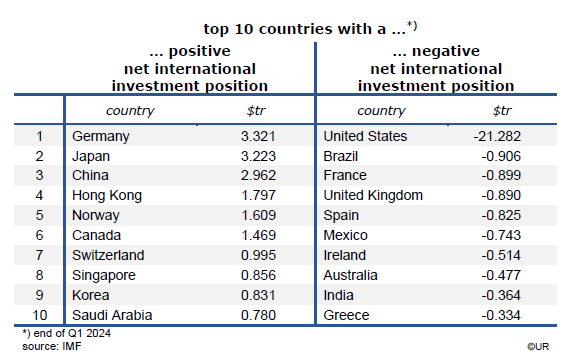

Many countries have excess savings – by definition these are just as large as the saving deficits in the rest of the world. Most net exporters of oil and gas save more than they spend (or are able to spend). In particular, this is the case for the countries around the Persian Gulf, Saudi Arabia and Norway. But other countries with structural surpluses in their balances on current account are also saving “too much”, such as Germany, Japan, China, Switzerland, Taiwan or Sweden. They are, all the time, on the lookout for foreign assets which meet their investment criteria in terms of perceived risks and expected returns.

A common feature of those surplus countries is ageing and shrinking populations. For them, foreign assets are an important supplement of their pension schemes. To rely on income from abroad can be dangerous which is why they tend to spread their assets across the world into countries which they regard as politically stable. The main beneficiaries of this strategy are the US, other English-speaking countries and the European Union – real interest rates in this part of the world are lower than they would be in the absence of such capital inflows. In addition, the capital exporters focus on segments of the economy which are profiting from the “Energiewende”, the secular shift from fossil fuels to renewables. They avoid assets which depend on oil and gas, in favor of “green” assets.

According to the Bundesbank, Germany’s foreign assets were no less than €13.1tr in June, or 3.0 times its likely nominal GDP this year. On the other hand, foreign liabilities were €9.9tr, for net foreign assets of €3.2tr, a world record. The annual returns on these net assets are probably in the order of 5% and already add significantly to national income. So it is a two-way street. Germans are investing massively in foreign countries (where returns are on average higher than at home) while foreigners seek the stability of Germany’s financial markets and democracy. Capital inflows from abroad are mostly something positive and should be appreciated, not kept out.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.