DIETER WERMUTH’S INVESTMENT OUTLOOK – November 2019

Dividends beat bond yields – by a wide margin

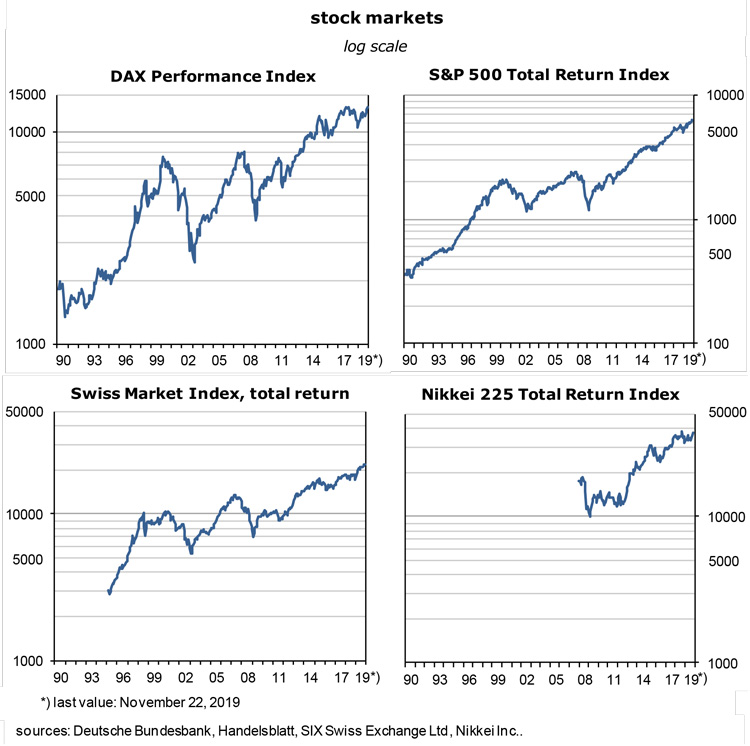

- By now, the stock market boom is ten and a half years old and thus one of the longest on record. It took off at the low point of the Great Financial Crisis. There have been some ups and downs over the years but all setbacks were seen as buying opportunities and have proved short-lived. So far, nothing has stopped the advance – not the euro crisis, not the recent slowdown of economic growth, not Donald Trump’s trade wars, nor Brexit. Stocks are not cheap, at price-to-earnings ratios of around 20 in the main markets, but as I will show, they are cheap relative to bonds. Most importantly, other than these they generate fairly large and reliable cash flows for investors.

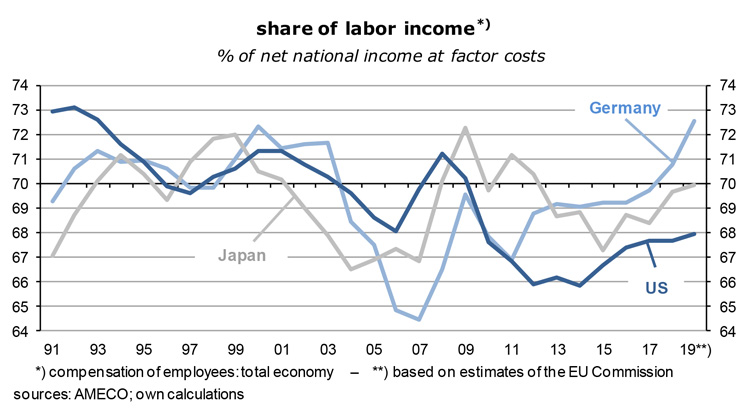

- Performance indices of the major markets in Europe, the US and developed Asia have increased about twice as fast as the GDP of the underlying economies during this long period. The owners of equity capital have seen their income increase persistently faster than that of other parts of society, labor in particular.This cannot continue indefinitely without major political disruptions.

- But at the moment, we are once again in a so-called risk-on phase where seemingly everybody is betting that the stock market is the place to be.Year-to-date, US, Japanese, Chinese and most euro area markets are up by between 20 and 30%! Outliers on the upside are Greece and Russia where indices have increased by about 40%, whereas, for various, mostly political reasons, Hongkong, South Korea, Spain, the UK, Turkey, Mexico, Brazil and Singapore bring up the rear. But even in those countries markets have gained this year. Only in Argentina, Chile and Malaysia have investors lost money.

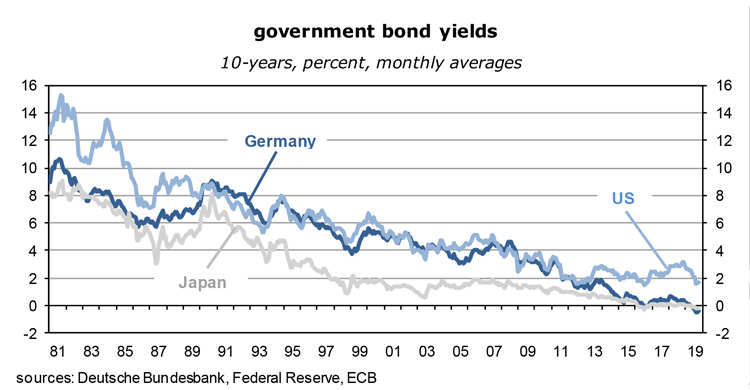

- In most of the richer mid-sized and large OECD economies, government bond yields are near zero which puts a natural limit on future capital gains. It is, of course, theoretically possible that long-term yields of high-grade debt may fall to perhaps minus 1.5% at some point – the record so far has been achieved by Swiss bonds (-1.2% for the 10-year maturity). Hard to believe that yields in countries that are not tax havens will ever fall to such a level. It probably needs a major global war for this to happen. In other words, the 40-year bond market rallies have largely run their course. Yields cannot fall much more, and capital gains will be limited. The main exception is the US where 10-year Treasuries still yield 1.77%, but there is a fair chance that they will decline further and join the crowd.

- In Japan, Switzerland and much of the euro area long-term interest rates have been around zero for half a decade by now.According to the Bloomberg Barclays Global Aggregate Negative-Yielding Debt Index, more than $12tr of traded debt is now in negative territory. At the end of last August, a record of $17tr was set. In Europe and Japan the idea is gradually taking hold that the sub-zero era may be the new normal. The current cycle seems to have staying power.

- Most fresh money will have to be invested in other asset classes. Institutional investors who must generate high returns to meet their commitments will have to give up liquidity, ie, move away from easy-to-sell assets that are either hard, or time-consuming to offload if markets turn. The share of equities in portfolios will have to rise, but alternative assets such as infrastructure and real estate are also gaining.Portfolio managers must learn to live with much less liquidity. This requires new skills.

Arbitrage opportunities in fixed-income markets

- Much of the activity in fixed income markets will reflect bets that spreads between countries and other issuers will narrow or widen, or that yield curves will change their shape. Since yields are so low, money can probably also be made by opening short positions, but this is usually not an option for institutional investors. They prefer to lend bonds rather than go short themselves. The trigger for shorting the bond market would be signs that inflation and unit labor costs were about to accelerate again. We are not there yet.

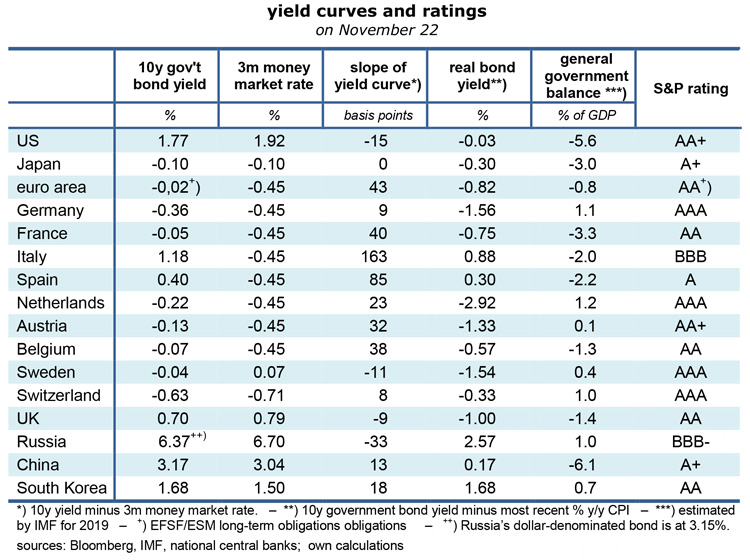

- Have a look at the following table about yield curves and ratings. Here are the main messages:

- Number one: US Treasuries are relatively cheap, both in nominal and real terms, compared to French or Japanese bonds for instance. The Fed will probably continue to cut policy rates next year and thus provide further stimulus for bonds, while the ECB cannot become significantly more expansionary – unless it dares to move to some sort of helicopter money for the citizens of the euro area. Because Europe’s central bankers are not yet really desperate, this is not a realistic near-term prospect. Moreover, free money for all would mean stronger demand for goods and services, rising inflation and policy rates – and would thus have negative effects on bond prices.

- Number two: why are US yields so high?It is probably not the government deficit. It will probably be a whopping 5.6% of GDP this year, but investors are quite relaxed about the possibility of a default – almost all of the debt is in dollars which can be created without limit if needed. In Japan, comparable deficits and the huge government debt (now at 240% of GDP) have never really mattered for bond yields. Credit ratings are more important, but the correlation with yield levels is not very tight either: the US government has a better rating than the French and Japanese issuers but must pay higher interest rates.

- The key is probably differences in capacity utilization: how close are countries to full employment of labor and capital?The US operates near its capacity limits while France and Japan have plenty of spare capacities. For market participants this means the risk of rising inflation is correspondingly higher in America. Near-term, I cannot see this risk, though: going by the recent slowdown of US employment growth, the still depressed labor force participation rate, the decline of core inflation and sentiment indicators, perhaps also in view of the negative slope of the yield curve (10y Treasuries minus 3m $LIBOR) it seems that the US economy is quickly losing momentum. Dollar bond yields have some way to fall before they will rise again. This, and the fact that American bonds are cheap in relative terms makes them fairly attractive assets.

- Number three: Positive real 10y bond yields are the exception rather than the rule.Put differently: in most countries bond owners do not participate in the ongoing (if slow) expansion of real GDP, ie, output. They pay a fine for their flight to the perceived safety of government bonds and thus indirectly subsidize assets such as equities and real estate.

- Number four: the major exception is Russia, a country outside the OECD. Inflation there is 3.8% y/y while 10y rouble-denominated bonds yield 6.37% (dollar denominated debt is at 3.15% and thus 138 basis points above Treasuries). Since the negative effects of the large currency depreciation are gradually fading away, inflation has been on a clear downtrend this year. This is a very favorable environment for fixed income securities. The yield level is high, in both nominal and real terms, and inflation moves in the right direction – down. Not to forget: Russia has its own central bank (which is not the case in euro area countries), holds a huge stock of currency reserves, sports a current account surplus on par with Germany’s and has achieved the world’s second largest government budget surplus relative to GDP, after Norway. The price the country pays for all this frugality is slow growth, just as in Germany. If it were not for the political problems in Ukraine and poor credit ratings, Russian bonds would be the place to be.

- Number five: investors who prefer bonds from countries with a better rating should have a look at South Korea,another economically super-solid country and close behind Russia in terms of real bond yields (1.68 % = 1.68% nominal minus zero inflation). It features low unemployment and surpluses in the balance on current account as well as in the government budget.

- Number six: at the other end of the scale are some of the darlings of the investor community. Dutch, German and Swedish bonds look extremely expensive in terms of real yields. Nominal yields are all negative and have little room for further declines which puts a limit on potential capital gains. If it must be euro area bonds, the recommendation would be Greece (not in the table) and Italy – in both cases the risk of default is near zero because the ECB will simply not let it happen. It has the means (and the will) to support any struggling member country of the currency union.

low risk of rising inflation and a bond market sell-out

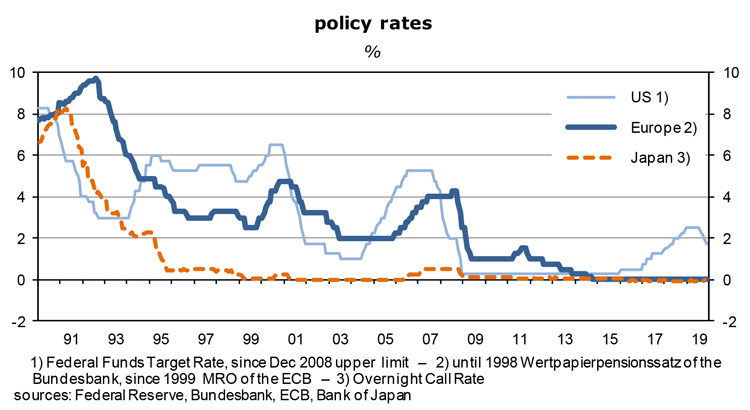

- For bond investors, the main questions are about wages, inflation and monetary policies.Low policy rates in combination with quantitative easing have strongly supported bond markets. Easy central bank policies are the major reason why bond yields are so low. Should the Fed, the ECB and the Bank of Japan start to raise rates – because inflation is sustainably on track toward the 2 percent target and beyond – a blood bath on bond market will surely follow.

- As the next graph shows, policy rates have reached the zero lower bound in Japan and Europe. They cannot fall much more. It’s somewhat different in the US where the effective Federal Funds Rate is presently at 1.56%. But it is probably also on the way down, perhaps to 1%, or lower.

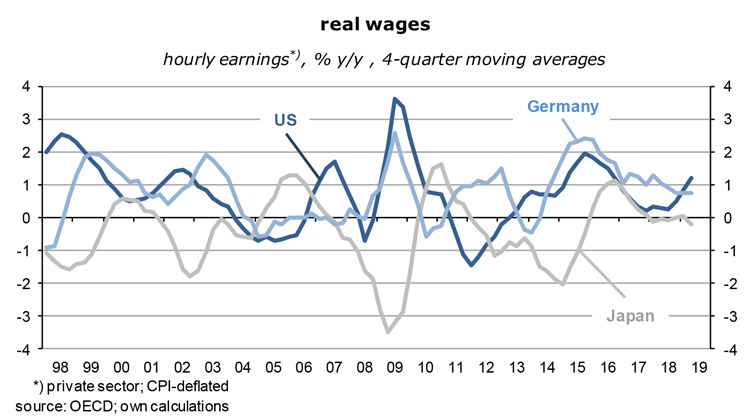

- Central banks are data-driven. Inflation rates are key, but these in turn are a function of unit labor costs and thus of wages and productivity. Export and import prices also play a role. The OECD has just released its latest Economic Outlook which shows that euro area unit labor costs have been rising quite briskly this year (up 2.4% y/y, Germany +3.5%!). Similarly in the US: +2.8%.Only Japan is lagging far behind, as usual: +0.5%. For next year and 2021 the predictions call for some deceleration. This can easily turn out to be wide off the mark because there are so many variables involved: employment, working hours per person, real GDP, agreed and effective wages and salaries.

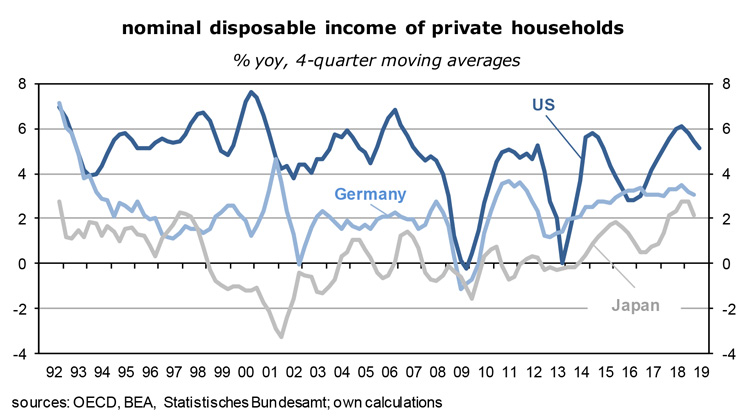

- In any case, on this basis I could argue that an acceleration of European and American consumer price inflation is not so unlikely anymore.In Germany full employment has de facto been achieved; using the methodology of the International Labor Office, it has fallen to just 3.1%. This is, incidentally, one reason why only few Germans are calling for more expansionary fiscal policies – a genuine recession must be accompanied by a noticeable increase in the number of jobseekers. As the next graph shows, the share of labor income has almost exploded since 2007, and nominal household income has recently been up about 3.4% y/y. Not bad, considering that consumer price inflation is just 1%.

- In the euro area as a whole the situation is different. Since unemployment is still at 7.5% (about 9% outside of Germany) and coming down only slowly, workers are in a weak position in wage negotiations. Italian hourly wages have increased by just 0.8% over the past year, Spain’s by 2.1%.

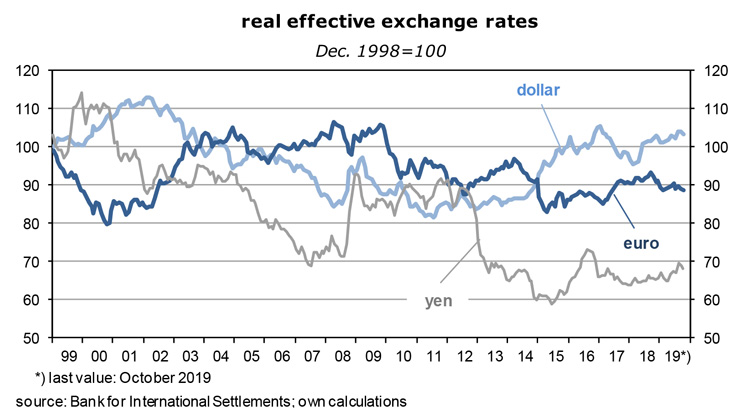

- Strangely enough, European import prices have declined by 0.8% y/y (Germany -2.6%). In the public perception the euro is a weak currency because it has declined so much against dollar and yen, but vis-à-vis the currencies of all trading partners combined it has actually appreciated which in turn has ledto lower import prices. From this side there has thus been downward pressure on inflation which has to some degree neutralized the effects of higher unit labor costs.Under the assumption that the euro will not depreciate further against the dollar – because the Fed Funds Rate will be reduced next year while the European refinancing rate will not – it is not unreasonable to expect that import prices will hold down consumer price inflation in the neighborhood of 1% for some time to come. That’s the rate where core inflation has been for more than five years.

- This means that the ECB’s forward guidance with regard to its policy rates is credible. They will not be raised next year, and bond investors must not fear a sell-out just yet. For at least four or five quarters, fixed income securities will remain a safe place for their money.

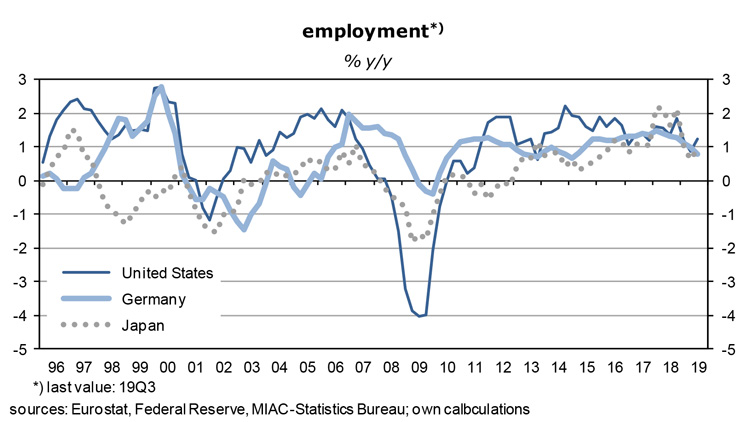

- The Fed is also in easing mode, not least because President Trump, with his re-election in mind, demands that it must do its share in stimulating the economy. He is aware that for him, as for Bill Clinton before him, “it’s the economy, stupid!”. The OECD forecasts real GDP growth will slow down to 2% in the next two years which corresponds exactly to the growth rate of potential GDP, but is less than the 2.5% average in the years since Trump’s election. Employment is not increasing so rapidly anymore.

Germany’s fiscal policies: somewhat more expansionary

- As an aside, international organizations, including the ECB, continue to urge Germany to pursue more expansionary fiscal policies.The federal government has been running budget surpluses since 2014 and the general government debt-to-GDP ratio has fallen more rapidly than expected: in the wake of annual net immigration of about 300,000 per year as well as modest real wage increases employment has increased at rates of around 1% per year since 2010 (to 45.3 million). This has boosted income and wage tax revenues and has reduced spending on unemployment and other social benefits. In addition, the business sector has been doing fine all the years since 2009, reflected in a brisk growth of corporate tax revenues.

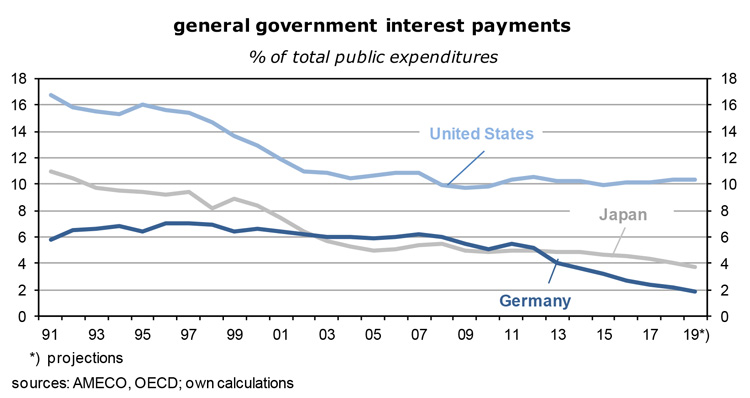

- An additional large boost for German government finances came from the steep decline of interest expenses, to less than 2% of overall public expenditures this year, after 6% in the years before 2009. German taxpayers should thank the ECB.

- This is a nice side effect of conservative fiscal policies – it has created significant room for maneuver which is increasingly used for things like minimum living pensions for everybody or more generous funding of day care centers. Automatic stabilizers are also kicking in now as real GDP growth has fallen to 0.5% in 2019, way below the growth rate of potential GDP.

- But federal government capital spending has also increased quite briskly in recent years, from €29bn in 2014 to €39bn in 2019, ie, by more than 6% per year. There is almost a consensus in the country that the emphasis must be on structural reforms and growth-enhancing spending. The capital stock must be modernized and expanded which implies that short-termism will not help much. The digital, automotive and green revolutions are not business cycle phenomena.

- Note that Germany’s smaller neighbors(Switzerland, Austria, Czechia, Denmark, Sweden, Norway, Finland, the Netherlands and Luxemburg) pursue very similar fiscal policies. Balanced budgets and creating nest eggs for times of crisis come natural there. Given that this is the world’s richest region, such a strategy cannot have been all wrong. This is why it is so difficult to convince voters in these countries that their governments should become more spendthrift.

attractive dividends

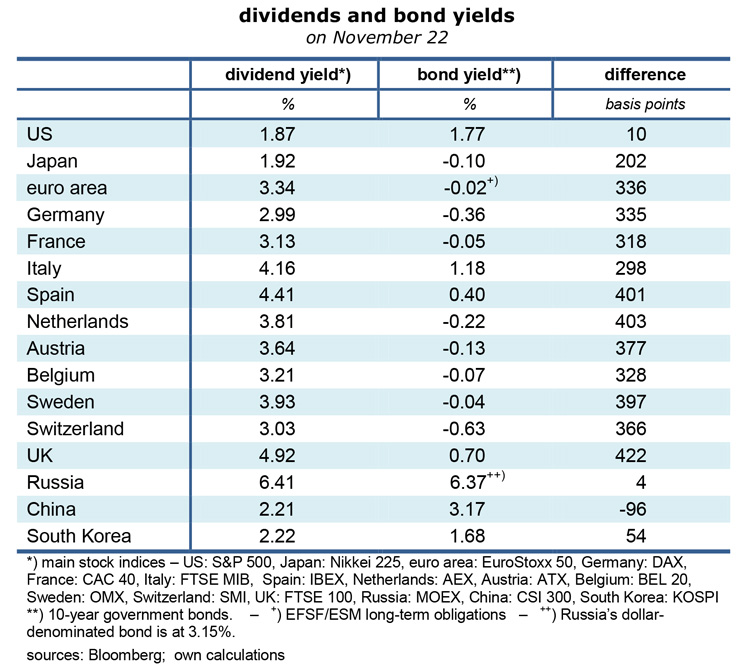

- To come back to the question of asset allocation, a top-down analysis might start with a table like the following.

- The right-hand column contains a clear message: dividend yields of western European stock markets exceed 10-year government bond yields by roughly 300 to 400 basis points. The normal risk premium of stocks compared to riskless long-term debt is in such an order of magnitude. This, of course, is a static view and tells nothing about the future and the safety of equities. I am convinced that bond yields will more or less stay where they are, given slow economic growth, subdued inflation and easy monetary policies.

- For investors, European equities are the assets of choice, but they must keep a close watch of stock market risks.I see two main ones: slower than expected economic growth outside of western Europe and a large appreciation of the trade-weighted euro.

- The region is deeply integrated into the world economy and has achieved much of its wealth from participating in the international division of labor, more so than the US or China. The International Monetary Fund predicts that the euro area will expand by somewhat more than 1% in 2020 and 2021, just as in 2019, while the world economy will grow by a little less than 3% on the basis of actual exchange rates, and close to 3½% using purchasing power parities. Global growth has slowed, and will not yet accelerate again, but all this is still very positive and no reason for panic.

- The only problem is that international organizations have been unable to predict recessions in the past, or only when they were already over. Their predictions can thus not be trusted. Investors must therefore closely watch for developments that could trigger major disruptions of the world economy, such as an escalation of the trade war, failures of major banks, a large increase of wages and inflation rates, or an unexpected tightening of monetary policies. Should the European quasi-recession morph into something more serious there might come a point where the decline of corporate earnings is so large that it may trigger profit taking and a crash. As I said before, equities are cheap relative to bonds, but they are not cheap in absolute terms. As always, the safe haven in such a scenario would be cash and high-grade short-term bonds (in spite of zero or negative interest rates).

- Volatility of exchange rates has been very low for many months. This can change anytime as we all know.Compared to the years from 2003 to 2009 the euro is rather cheap, also in comparison to the dollar, which means it is more likely that it will appreciate than depreciate. The large surplus in the euro area balance on current account, sound government finances and the coming reductions of the Fed Funds rate argue for a stronger euro while anemic growth, the ongoing dependence on the US in military matters and the negative policy rate (for ECB bank deposits) argue against. The US has so far been the main target of international capital flows.

- In other words, the euro may move strongly in either direction – or remain where it is. Predicting exchange rates has been one of my weak points. Hedging a euro exposure is, of course, fairly cheap and would not hurt.

- As the last table shows, American stocks are expensive relative to Treasuries. Compared to the situation in European markets, dividends are not very attractive. US stocks are also expensive in terms of the average price-to-earnings ratio (20.7 for the S&P 500 index) and the price-to-book ratio (no less than 3.5), a reflection of the weight of the tech giants in the index. Since America’s growth is slowing investors should revert to defensive strategies. Go for value rather than cyclical or growth stocks!!

- Russia is also not an attractive stock market on the basis of its value relative to rouble-denominated bonds. But some of the national champions have issued dollar-denominated depositary receipts which are traded in London – they offer high dollar dividends. Sberbank for instance pays 6.7%. Some of the large “dirty” companies, such as Rosneft, Gazprom or Norilsk Nickel are just as generous – but “green” investors would rather sell these.

- For risk diversification purposes investors should allocate some of their funds to Japan and South Korea,both of them financially sound and innovative countries, at the forefront of the technological developments. For me South Korea is sort of the wallflower of global stock markets, a hidden beauty. And for those who are not very risk adverse, UK stocks are also worth a look– Brexit and the coming difficult post-Brexit negotiations with the EU mean that they will be relatively cheap for quite a while – and their average dividend yield of 4.9% is not bad.

Read the full article in PDF format:

Wermuths Investment Outlook November 25, 2019