Market Commentary: US and European policy rates still too low

Dieter Wermuth, Economist and Partner at Wermuth Asset Management

Since March 2022 the Federal Funds Rate, America’s policy rate, has moved from its low of 0.08% to 4.58% today, while the ECB’s deposit rate has been raised from -0.5% to 2.5%. Almost all market participants are convinced that most of the tightening is behind us and that the cyclical peak and the turning point will be reached in the second half of the year, at 5.12% in the US and 3.5% in the euro area. Bond and stock markets have turned euphoric on both sides of the Atlantic.

For at least two reasons this is premature: there is no convincing evidence of imminent recessions which would have to be fought or mitigated by rate cuts and, secondly, inflation rates are still far above central bank targets.

We know that America’s National Bureau of Economic Research (NBER) uses several indicators for dating recessions. The definition usually used by traders – two successive quarter-over-quarter declines of seasonally adjusted real GDP – is not one of them. Most important are the data on employment, real mass incomes, especially wages, spending by private households and industrial production.

The US labor market is booming. The number of employed persons (non-farm payrolls) has recently been up on a year ago by no less than 3.3%, the unemployment rate has fallen to a record low of 3.4%, and there are two job openings for each job seeker. Nothing suggests at this point that this boom will end. Without a decline of employment, a recession is almost impossible. It is the main economic indicator. Why even think about cutting policy rates?

Because wages and prices have recently been rising very slowly it is understandable that traders – who make more money in bull rather than bear markets – bet that policy rates will soon be cut. Going by forward money market rates spot rates will rise by about 30 basis points between now and late summer, from 4.9% to 5.2%, and gradually decline toward 3%. US average hourly wages have recently been 4.4% year-on-year, just as the core PCE inflation rate which is the Fed’s main yardstick. Both statistics are on a clear downtrend but are still too high in absolute terms. And it is not a foregone conclusion that inflation will stay sustainably low, given the situation on the labor market.

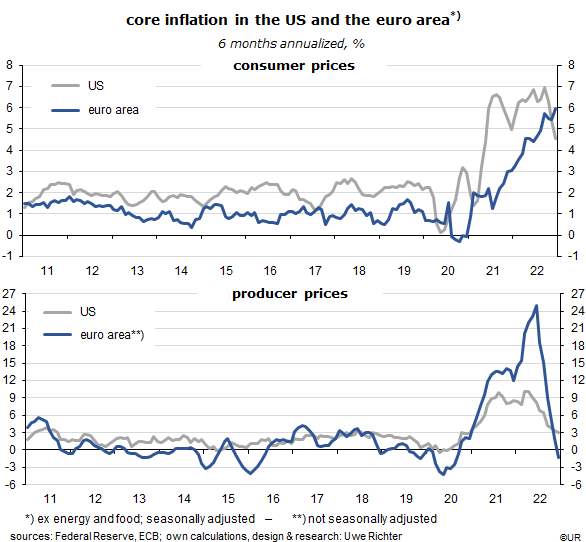

The Fed will probably raise the policy rate cautiously a few more times and then pause to take stock. The ECB, meanwhile, has indicated that the deposit rate, the main policy rate, will rise by 50 basis points in March and May, to 3.5%. European nominal hourly wages are just 2½% higher than one year ago, and core rates of import, producer and consumer are on a seemingly robust downtrend. But in year-over-year terms they are still too high for policy makers. At 8.5% y/y headline consumer prices are more than four times higher than the 2% target. In the countries of the euro area, the pressure to come to grips with inflation is much stronger than in the US. Real household incomes have declined steeply last year and are probably still falling right now. Unexpectedly high inflation causes social problems.

The ECB can point out that employment is rising strongly, at a rate of almost 2% y/y, and that the unemployment rate has never been as low as today in its 24-year existence (6.6%). Rising policy rates are also a means to boost the euro exchange rate and thus reduce imported inflation. But they come at a cost in that they have dragged up longer-term interest rates which in turn has hit the real estate sector and business investment. To preserve, or re-establish its credibility the ECB urgently needs a success on the inflation front. Luckily, there is no wage-spiral yet. To avoid a damaging impact on the capital stock, policy rates must be raised quickly and in big steps – so that they can be cut in case there is a genuine recession again sometime in the future. I guess that ECB policy makers would agree with this analysis.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.