Market Commentary: China shrinks

Dieter Wermuth, Economist and Partner at Wermuth Asset Management

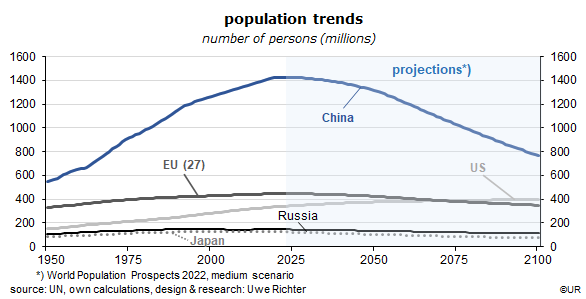

When China’s statistical office recently reported that the country’s population had declined by almost one million in 2022, compared to 2021, the first decline since Mao Tse-tung’s hunger years, it triggered a small media storm, especially in the United States. Commentators speculated that China would probably stop growing as briskly as before which in turn would make it a less dangerous political competitor. According to UN forecasts, there will be only about two times more Chinese than Americans by the end of the century; the ratio is about 4.2 to 1 today. China will supposedly experience a demographic catastrophe.

For several reasons, it is indeed almost certain that China’s population will shrink from now on: (1) the birthrate is just 1.3, similar to Western European statistics, and thus well below the replacement rate of 2.1 which is needed for medium-term stabilization; (2) because of the one-child policy which lasted more than 35 years and ended only in 2015, there is now a lack of young people, especially of women who could bear a sufficient number of children, (3) at the same time, the share of old people in the population is rising rapidly which means that working-age people have to support more and more retirees – many young families must not only look after their own child, or children, but also after their parents and even grandparents; this forces them to work 996, as they call it, from 9 in the morning to 9 in the evening, six days a week; who has the energy to raise children in such an environment? (4) in addition, the communist government is not willing to let in foreign workers to any meaningful extent, even though there are many cheap and industrious workers in nearby overpopulated countries such as the Philippines, Indochina, Indonesia, Bangladesh and Pakistan who would love to move to China if given the chance.

However, a demographic catastrophe is not inevitable. Japan or some EU countries could be role models for an ageing society – they show that a smooth transition is possible and that a rising average age of the population is actually something to appreciate. One important adjustment variable is the legal retirement age. While Germans will soon discuss more intensely about raising it to 70 years for both men and women – it will soon be 67 years – Chinese men can presently stop working at the age of 60, white collar women at 55, and blue-collar women at the age of 50. Here is obviously a large potential for reducing the burden on the young, not least because the average life expectancy of the Chinese keeps rising, as in the rest of the world.

Other policy variables are a more generous support of pre-Kindergarten facilities and an extension and improvement of the care for the elderly. Both areas are clearly ripe for major reforms – they are significantly below the standards that exist in OECD-countries. This would also lighten the burden on the young and could convince them to have more children. Given low government debt levels and an extremely high saving ratio there is certainly not a lack of money. Priorities need to be reset: less spending on yet more infrastructure, more spending on day care and retirement centers. It looks actually quite feasible and easy.

From a European perspective another plausible approach would be a reduction of the grueling work schedules of the average Chinese worker. Why not go toward a gradual reduction of the hours spent on the job, at the expense of potential additional income? The likely reply would probably be that the average monthly wage income is presently just 1,200 euro, which is hardly enough to pay for the very high cost of housing and children’s education. Since the Chinese state is comparatively rich it should be possible to solve this problem as well. How come a communist country has not enough affordable apartments?

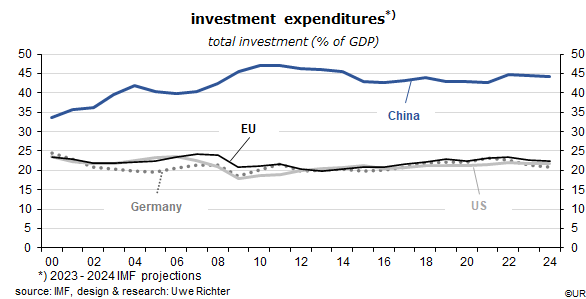

Hardly any country is financially so well off as China: the national saving rate is no less than 45½% (of nominal GDP), while the investment ratio is at 44%. Both are about two times higher than in the United States or Germany. The fact that so much money is spent on investments is one of the main reasons for the country’s rapid catching-up process which, to the best of my knowledge, has no parallel in history. Japan, Taiwan and South Korea have also done quite well in this regard, but China is simply outstanding.

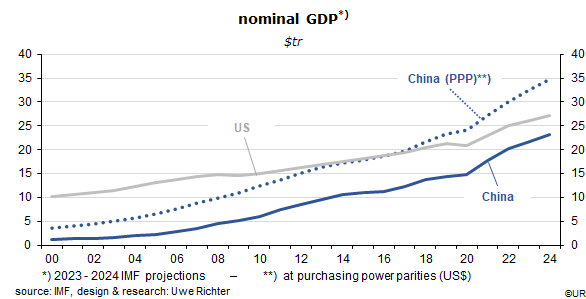

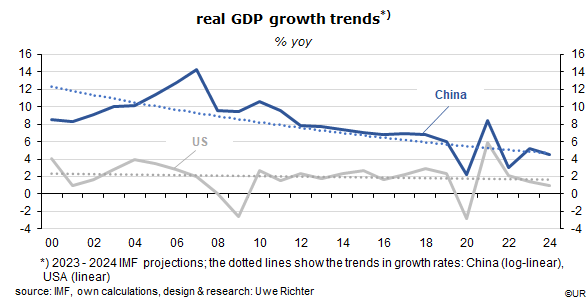

A few days ago, the Chinese government has announced its new medium-term growth target. At 5% per year for real GDP it is fairly modest compared to the growth rates of the past, but compared to the expected growth rates for the US, the EU or Japan it is incredibly high, taking into account that employment will probably continue to shrink at an average annual rate of 0.5% (it was 733.5m in 2022). This, incidentally, means that labor productivity will rise at a rate of at least 5% per year. This is another hard-to-believe success of Chinese economic policies. In the OECD region productivity growth rates in the order of 1% are seen as normal. One reason for the productivity miracle is probably the fact that so much money is spent on education, especially in mathematics, natural sciences, and engineering. The annual output of engineering graduates has recently been six times larger than in the United States. A good education is generally regarded as the best way to achieve a good standard of living and financial security.

It will probably take several decades before China’s GDP will grow as slowly as that of the United Sates, the EU or Japan. On the basis of today’s trends and under the assumptions that exchange rates stay where they are and that inflation rates do not diverge too much, it is likely that parity with US nominal GDP will be reached by 2030. Even then, China’s per capita GDP will only be about one quarter that of the US. In other words, China will quickly become the world’s largest economy and its main growth engine, provided a major war can be avoided and the huge differences of investment ratios continue to persist. Since so much money is saved and spent on physical capital, it does almost not matter that the mix of central planning and capitalism on the micro level probably leads to frequent massive misallocations of resources, ie, waste. Worryingly, a large and rising share of those funds goes to the military.

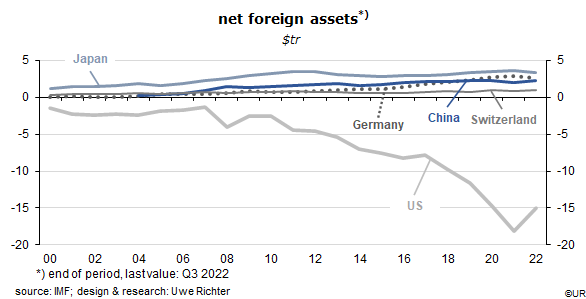

An element that is still missing in China’s ageing process but can be expected to become important over time, given the high national saving rate, is the creation of a large stock of foreign assets, along the lines of Japan, Germany, Switzerland or Norway. While these assets are now in the order of almost 2½ trillion dollars and thus not significantly smaller than those of Japan and Germany, they are still relatively small on a per capita basis.

But the ongoing surpluses in China’s balance on current account mean that for years to come the amount of net foreign assets is bound to increase further. At a time of gradually declining GDP growth rates and a further ageing of society, these assets will generate an additional source of income. In Germany, for instance, net revenues from foreign financial assets are in the order of 3.5% of nominal GDP. Similarly in Japan. China is still far behind in this process.

The bottom line is that the gradual decline of the Chinese population must not lead to a catastrophe, mainly because of rapid productivity gains and the emphasis on saving and investment. It is, on balance, a positive development, both for China and the rest of the world. The consumption of fossil fuels, minerals and land will increase more slowly and may, in the end, even decline. This is good news for the climate.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.