Market Commentary: Bitcoin – on the whole, a loss-making instrument

Dieter Wermuth, Economist and Partner at Wermuth Asset Management

A few weeks ago the eighth edition of Charles Kindleberger’s classic “Manias, Panics and Crashes” has been published; the first edition was in 1978. After Kindleberger had died in 2003, at the age of 92, Robert Z. Aliber and Robert N. McCauley have updated the following editions; they have also written several new chapters. Robert McCauley is the author of the preface and the chapter on crypto currencies which he regards as a mania and “the most speculative asset ever invented by the human mind,” “worse than a Ponzi.” Regrettably, he does not offer a convincing proof of this thesis and tends to rely on anecdotal evidence. As it was, the 75% crash of the bitcoin price following its all-time high of November 2021 had no significant negative effects on the world’s financial markets and economies.

Other economists such as Willem Buiter, Andrés Velasco or P. Papsdorf, J. Schaaf und U. Bindseil of the European Central Bank have put the main emphasis on the fact that crypto is no viable alternative to regular money but rather an asset without substance, a system for insiders to get rich quick, a universe where money launderers, tax evaders and other dubious characters try to cover their tracks as well as a major climate killer, a result of the huge energy consumption of the datacenters that are crypto’s operational heart. Since the risks are not easy to grasp but potentially of a systemic nature, I wonder whether it will be enough to just step up regulatory efforts, or to forbid the participation of banks and other financial institutions – or to get rid of these markets altogether (if this is still an option).

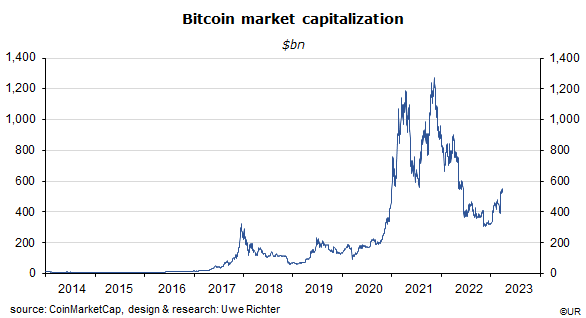

Since January 2009, when Bitcoin – still the main crypto currency – went live, its price has increased from less than a dollar to about 68,000 dollars in November 2021, its all-time high. Over the course of almost 13 years, the average annual rate of growth had thus been an astounding 185%. Nothing stimulates a bull market more than the sight of friends and neighbors becoming rich overnight – the temptation to join the party is hard to resist. Back in November 2021 Bitcoin’s market capitalization reached 1.27 trillion dollars. For comparison, according to the International Monetary Fund the global nominal GDP was $97tr in 2021 while the World Federation of Exchanges put the market value of all publicly traded stocks at $124tr. When Lehman Brothers went belly-up in 2008, a smaller amount of money had triggered the largest financial crisis and the deepest recession of the post-World War period.

As mentioned above, the subsequent crash of Bitcoin’s price – by 75% at the end of 2022 – has not caused large damages, except for those who had bought the crypto currency with borrowed money. Most market participants seem to have been aware that they were investing in an extremely speculative asset and had thus limited their exposure to an amount of money which they could afford to lose. There was no dangerous chain reaction and no increase of the number of defaults in the wider economy, including the banking sector.

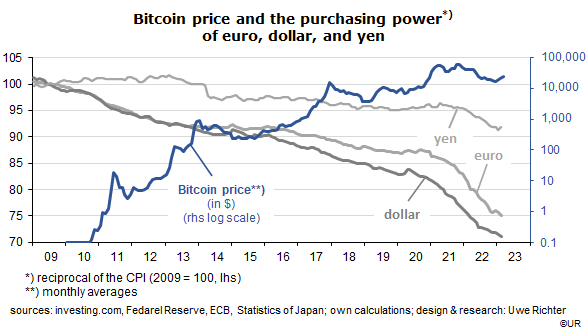

Bitcoin had been brought to market with the narrative that it would be a better, more stable currency than traditional money: because its supply is limited it could not lose value over the long term. And it did not need a central bank. No one could therefore force it to print additional money to pay for rising government deficits – a process which invariably leads to a loss of purchasing power and a lower value of the currency. This story has been a deception.

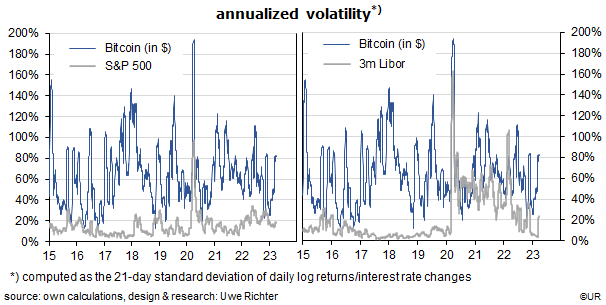

Money has three essential functions: as a means of payment, a unit of account and store of value. It is not yet possible to use my Bitcoin credit card to pay for stuff in a supermarket, perhaps never will. Nor does the tax and revenue office allow me to pay my taxes by debiting my internet Bitcoin account. My entire income is denominated in euro. In addition, transfers from one Bitcoin account to another are significantly slower and more expensive than what we are used to in our daily financial euro or dollar transactions, for now at least. A further disadvantage of Bitcoins is their wide price fluctuations, the large and sudden changes of the currency’s purchasing power. In a bad year, the ECB or the Fed may have to put up with a 10 percent loss of purchasing power (an annual inflation rate of 10%), this may happen to Bitcoin in a single day.

Bitcoin is least useful as a store of value. It is de facto a perpetuity without any coupon (interest payments) and without a promise to redeem the purchase price or the nominal value. This is the reason why it is impossible to calculate something like a “fair” price. Bitcoins have a price because there are market participants who believe that tomorrow they will be worth more than today. They are a purely speculative “asset”. Each price is an equilibrium price, so to speak – and it can be all over the place. If actors begin to believe that Bitcoin’s price will not rise anymore, this would be its death knell. It would simply disappear.

A look at Bitcoin’s price volatility shows impressively how quickly price expectations tend to change direction. Daily fluctuations are a lot wider than those of gold, equity indices, money market instruments or the main exchange rates. To call Bitcoin a stable currency is simply not true.

As on any market, there are winners and losers among those who “invest” and trade in Bitcoin. Winners are, first of all, the “miners” (producers) and early buyers of the cryptocurrency who built their positions long before November 2021. Many of them have become dollar billionaires. Losers, on the other hand, are typically those who entered at a later stage: they had been dazzled by the otherworldly price gains. Their purchases had helped the others get rich. In this narrow sense the Bitcoin market is a zero-sum game.

From a macro perspective Bitcoin activities are a negative-sum game, though, a major waste of resources. No one has yet shown that cryptos have contributed to an acceleration of productivity growth and general welfare. But there were, and still are, significant costs. To list the most important ones: the socially undesirable redistribution of wealth in favor of the crypto insiders; the high income of those who deal in a fundamentally useless asset, at banks and asset managers; the costs to society by facilitating money laundering and tax evasion; plus the costs of running the extremely expensive and climate-damaging IT-systems. Without crypto, the economy would be better off – there would be more money for consumption and investment.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.