Market Commentary: 4-day work week – a good option for many people

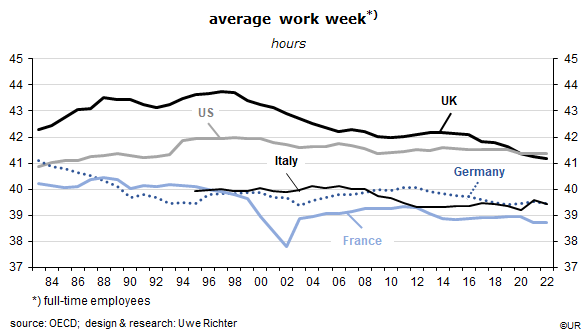

The topic is once again part of the annual wage negotiations in Germany. If the average income is high, historically and in international comparison, the utility of an additional euro in wages is not so large and the value of leisure rises. In microeconomics this is one of the fundamental laws because it reflects real life attitudes. Keynes once said „Three-hour shifts or a fifteen-hour week may put off the problem [… we have been trained too long to strive and not to enjoy …] for a great while. For three hours is quite enough to satisfy the old Adam [… everybody will need to do some work if he is to be contented …] in most of us.” As it is, average working hours have actually declined much less than Keynes had expected in 1930. Productivity growth was mostly used for monetary gains, not so much for more leisure time. Working less rather than earning more money has turned out to be a less important target.

Things have begun to move again. In more and more rich countries we see attempts to move from a 5-day to a 4-day work week, so far without trying to reduce the length of the work week and the take-home pay, as Keynes had once predicted. In most cases the issue is to reallocate the “normal” 38-hour work week to four days and increase the working time on those days from 7.6 now to 9.5 hours, have a 3-day weekend, without giving up any income.

For companies the wage bill would thus remain unchanged, but since productivity would probably grow faster – because of fewer sick days and a healthier work force – profits and stock prices would increase which in turn would reduce the cost of capital and boost capital investments. A 4-day work week would also probably make it easier to hire staff. Surveys suggest that most people prefer to work four rather than five days. On the other hand, factories and offices would be empty for a longer time each week which drives up the cost per unit of output. I think this is a manageable issue – it just requires some creative time management. Managers study this in business school.

I guess that a 4-day work week would be especially attractive for women and thus not only increase the labor supply but also average productivity and thus the standard of living. On average, the professional qualification of women in today’s service economy is higher than that of men. The so-called gender gap would shrink, and more women could become financially independent. That is a good thing in its own. A 4-day work week would also make it easier for immigrants to learn the language of their host country and to integrate more rapidly into society. This reduces tensions between them and the natives – which is something desirable as well.

Last but not least, there would be less commuting, ie, driving. This would lead to large reduction of gasoline consumption and CO2 emissions, and help to improve the environment.

For small businesses and retailers as well as for independent professionals such as doctors, lawyers, tax consultants, real estate agents or sports coaches, a four-day work week is problematic because they would probably have to offer their services in much the same way as today.

To conclude, our societies are still not yet ready to adopt Keynes‘ model. In negotiations with their employers, workers would need to give up some of the potential financial gains in favor of more leisure time. Not much is happening in this respect. Even so, it makes me optimistic that the issue of a 4-day work week has arrived in public discourse and that working time reforms are discussed in earnest, at least in the rich countries.

###

About Wermuth Asset Management

Wermuth Asset Management (WAM) is a Family Office which also acts as a BAFIN-regulated investment consultant.

The company specializes in climate impact investments across all asset classes, with a focus on EU “exponential organizations” as defined by Singularity University, i.e., companies which solve a major problem of humanity profitably and can grow exponentially. Through private equity, listed assets, infrastructure and real assets, the company invests through its own funds and third-party funds. WAM adheres to the UN Principles of Responsible Investing (UNPRI) and UN Compact and is a member of the Institutional Investor Group on Climate Change (IIGCC), the Global Impact Investing Network (GIIN) and the Divest-Invest Movement.

Jochen Wermuth founded WAM in 1999. He is a German climate impact investor who served on the steering committee of “Europeans for Divest Invest”. As of June 2017, he was also a member of the investment strategy committee for the EUR 24 billion German Sovereign Wealth Fund (KENFO).

Legal Disclaimer

The information contained in this document is for informational purposes only and does not constitute investment advice. The opinions and valuations contained in this document are subject to change and reflect the viewpoint of Wermuth Asset Management in the current economic environment. No liability is assumed for the accuracy and completeness of the information. Past performance is not a reliable indication of current or future developments. The financial instruments mentioned are for illustrative purposes only and should not be construed as a direct offer or investment recommendation or advice. The securities listed have been selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the issues presented and do not necessarily form part of any portfolio or constitute recommendations by the portfolio managers. There is no guarantee that forecasts will occur.

Read the full article in PDF format here: English.